Prices

March 25, 2022

Raw Materials Prices: Surges in Iron Ore, Coking Coal, Pig Iron, Scrap, Zinc

Written by Brett Linton

The war in Ukraine has disrupted commodity markets across the globe. Prices for all seven of the steelmaking raw materials tracked in this SMU analysis increased over the last 30 days. Through late-March, pig iron prices surged 60% compared to one month prior, coking coal prices jumped 45%, scrap prices increased 26-32%, zinc and iron ore prices were up 10% and aluminum prices rose 9%.

Table 1 summarizes the price changes of the seven materials considered in this analysis. It reports the percentage change from one month prior, three months prior, and one year prior for each material.

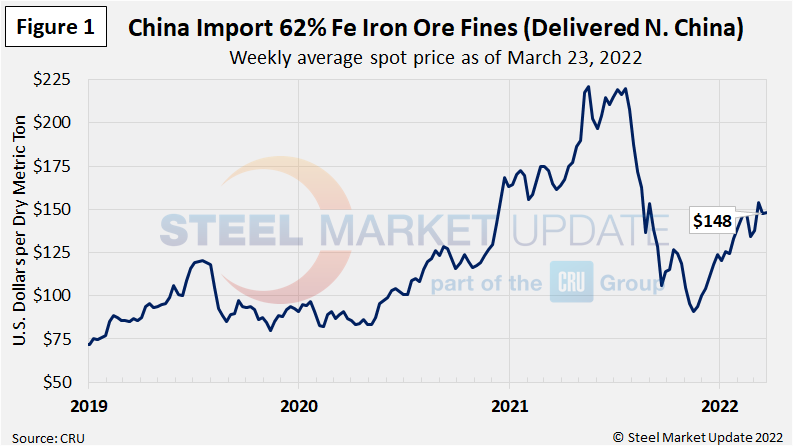

Iron Ore

After rising to record levels last summer, the Chinese import price of 62% Fe content iron ore fines declined through November, reaching an 18-month low. Prices have since risen and continue to trek upward; Figure 1 shows the price of 62% Fe delivered North China at $148 per dry metric ton as of March 23. Iron ore prices have increased 10% in the last 30 days, up 26% compared to three months ago, yet down 8% from the price this time last year.

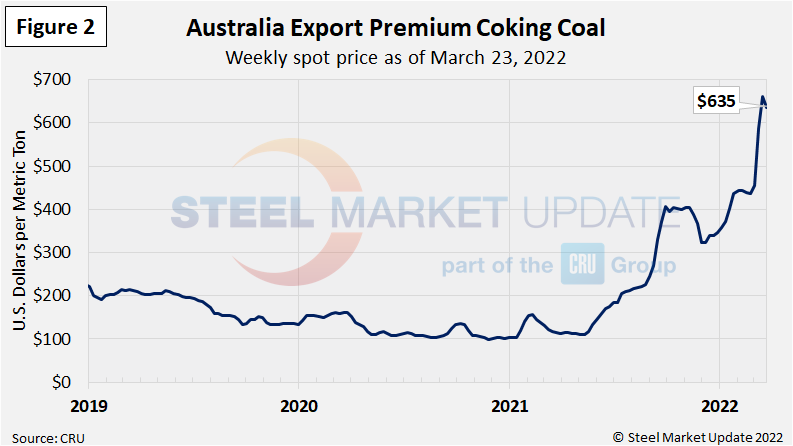

Coking Coal

The price of premium hard coking coal FOB east coast of Australia surged to $635/dmt as of March 23, second to the $660/dmt record price seen the week prior (Figure 2). Prices have increased 45% in the last 30 days, up 86% compared to three months prior, and up 458% from prices one year ago. In 2021, coking coal prices rose to a record-high of $405/dmt in October/November. Prior to that, the previous record for coking coal prices was $400 per ton in July 2008.

Pig Iron

Most of the pig iron imported to the U.S. currently comes from Russia, Ukraine and Brazil. This report summarizes prices out of Brazil and averages the FOB value from the north and south ports. Pig iron prices had been relatively stable for the last few months, but surged 60% in March to $825 per metric ton. Prior to this month, pig iron prices had remained historically high for over a year. Recall that pig iron prices had reached a multi-year low of $275 per metric ton in May 2020 (Figure 3).

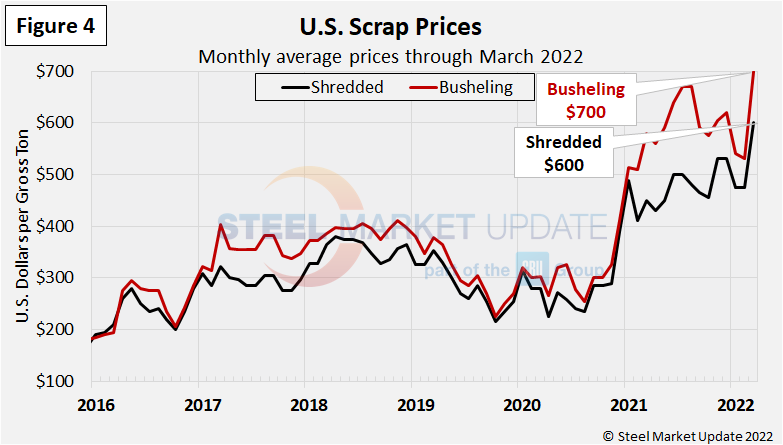

Scrap

Hot rolled steel prices fluctuate up and down with the price the mills must pay for their raw materials. Changes in the relationship between scrap and iron ore prices offer insights into the competitiveness of integrated mills, whose primary feedstock is iron ore, versus the minimills, whose primary feedstock is scrap. Figure 4 shows the spread between shredded and busheling scrap, priced in dollars per gross ton in the Great Lakes region.

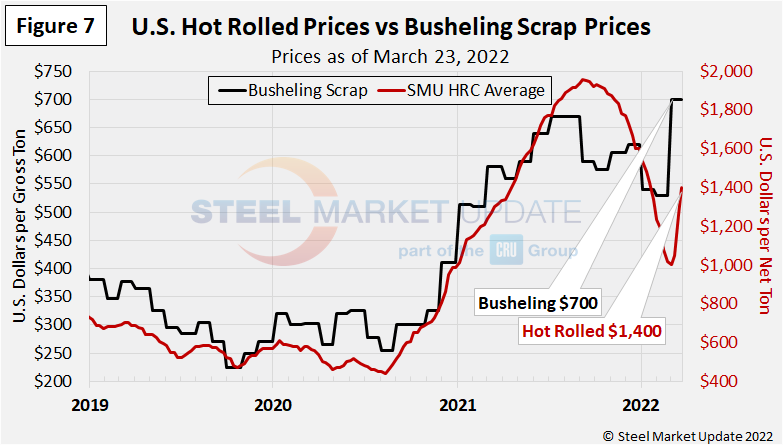

Scrap prices rose to record-high levels in March; shredded scrap prices increased 26% to $600 per gross ton, and busheling scrap prices were up 32% to $700 per gross ton (recall busheling’s record high of $670 seen back in July/August). Prior to 2021, the previous record for scrap prices over the last decade was $510 per ton for busheling in December 2011 and $473 per ton for shredded in February 2012.

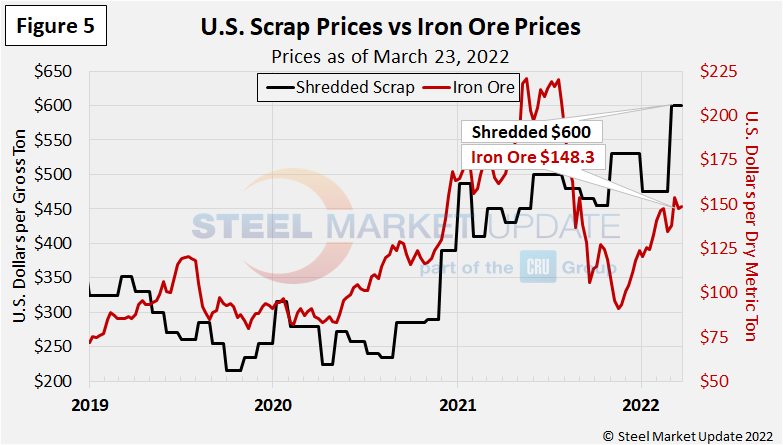

Figure 5 shows the prices of mill raw materials over the past four years. Iron ore prices are 33% below the May 2021 peak of $221 per dry metric ton, while shredded scrap prices have risen 33% in that same time.

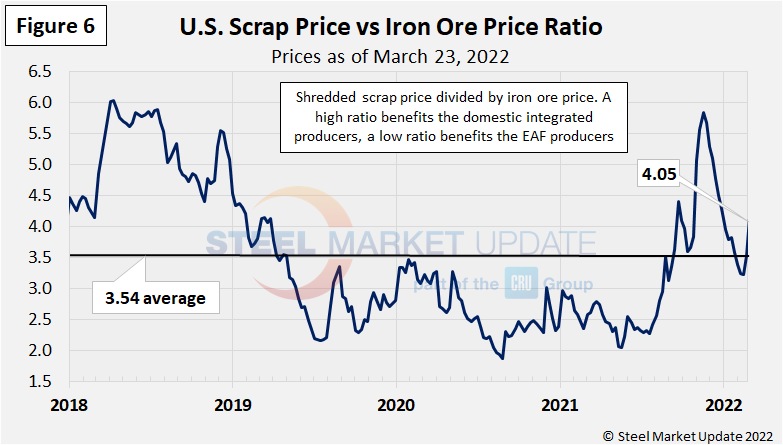

To compare the two, Steel Market Update divides the shredded scrap price by the iron ore price to calculate a ratio (Figure 6). A high ratio favors the integrated/BF producers, a lower ratio favors the minimill/EAF producers. At the current 4.05 ratio shown below, the brief cost advantage held by integrated producers in late-2021 could be coming back. Four months ago we saw a ratio of 5.84, the highest seen since mid-2018. The scrap to iron ore ratio reached a record low of 1.86 in August 2020 (within SMU’s limited 12-year data history).

Figure 7 shows how the price of hot rolled steel generally tracks with the price of busheling scrap. Bush rose $170 per gross ton over the past month, up $30 from the July/August peak, and up $120 from one year ago. The SMU hot rolled price average increased this week for the third consecutive time with the March 22 average up $140 week over week to $1,400 per ton. This is an increase of $380 per ton compared to the prior month, down $555 from the early-September peak, and up $70 from one year ago.

Zinc and Aluminum

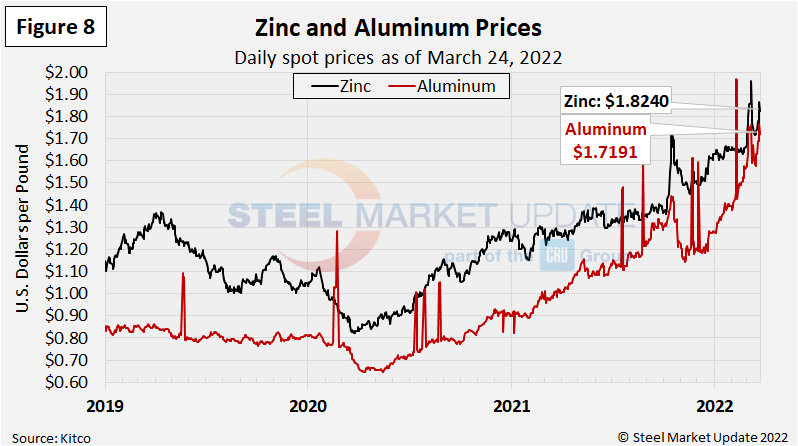

Zinc, used to make galvanized and other products, continues to increase in price in line with other raw materials, albeit at a lesser rate. The LME cash price was $1.82 per pound as of March 24, up 13% from three months prior and up 44% from the same time last year (Figure 8). The LME cash price for zinc reached a single-day record of $1.96 per pound on March 8, with the runner up occuring March 22 at $1.87 per pound.

Aluminum prices, which factor into the price of Galvalume, have been trending upwards since May 2020. Aluminum prices reached a record high of $1.76 per pound as of March 23, now the highest price seen in our 10-year history (note that aluminum spot prices often have large swings and return to typical levels within a few days, as seen in the graphic below; we do not consider those surges in our overall high/low comparisons). The latest LME cash price of aluminum is $1.72 per pound as of March 24, up 35% compared to three months ago and up 70% from one year prior.

By Brett Linton, Brett@SteelMarketUpdate.com