Market Data

March 25, 2022

CRU: How Long Will the Impact of the War Last?

Written by Alex Tuckett

By CRU Principal Economist Alex Tuckett, from CRU’s Global Economic Outlook, March 21

Russia’s invasion of Ukraine has sent shockwaves through the world economy. What does war mean for the world economy? We outlined three scenarios in terms of severity of impact from the war itself, but most crucially from sanctions and the response to those sanctions.

The Western response in terms of sanctions has been hard-hitting. What’s more, private sector companies in the West have avoided purchases of Russian commodities, as well as breaking other economic links.

Although Russia has not yet retaliated by restricting supplies of commodities, the continued threat of this – together with the sanctions themselves – has kept commodity prices high and volatile. In terms of impact, it appears that something similar to Scenario C – our high-impact case – is playing out.

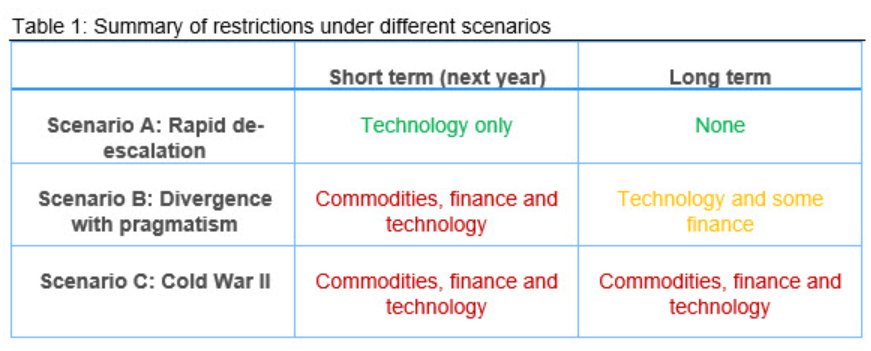

The key question now has become: How long will these impacts last? We set out three scenarios. Table 1 summarizes what happens to sanctions and trade flows under these three scenarios.

While there is huge uncertainty, our view at CRU is that Scenario B is the most likely one of the three.

Scenario A: Rapid De-escalation

The war ends quickly, sanctions are de-escalated, exports of disrupted commodities resume, and energy and commodity prices fall back close to where they were pre-invasion, all during 2022 Q2.

This scenario could come about if Putin decides it is taking too long to end the war through military means. With the sanctions on Russia taking a heavy financial toll, an end to the fighting is negotiated. Alternatively, there is regime change within Russia as those close to Putin decide his decisions have become too costly for them.

Right now, this seems unlikely. Having said that, the collapse of autocratic regimes is incredibly hard to predict (external analysts completely failed to predict the collapse of the Soviet Union or the Arab Spring of 2011), so it cannot be ruled out. Furthermore, both Russia and Ukraine have moved their public negotiating positions significantly. Russia is no longer publicly talking about “de-nazification” (e.g. regime change) or demilitarization, but about recognition of Crimea and the breakaway republics plus neutrality. The Ukrainians state that they are willing to consider agreeing to a future of neutrality (without NATO membership) if that is accompanied by security guarantees from both Russia and the West. Negotiations have not yet produced any concrete results, and the probability of Scenario A is still low, but it is still on the table.

Moreover, even if an end to the fighting is negotiated quickly, that does not necessarily mean there will be a quick easing of sanctions. The West may choose to maintain many or all of the sanctions to keep up the pressure on Russia during negotiations over Ukraine’s future, which could last for weeks or months. Although some of the risk premium in commodity prices would probably disappear, it would by no means be “business as usual.”

Scenario B: Divergence with Pragmatism

Sanctions and disruption to trade flows continue throughout 2022, then steadily normalize through 2023 as tensions de-escalate to some extent. Commodity prices remain high, though they do fall somewhat in H2 as global markets adjust to the sanctions.

Relations between Russia and the West have permanently deteriorated and never return to the pre-war “normal.” However, over time, pressures on both sides result in a pragmatic decision to de-escalate, which allows commodity flows to partially normalize.

On the Russian side, the cost of the war and subsequent occupation, and loss of export earnings, push it towards compromise. U.S. military and reconstruction spending in Afghanistan (which has a similar population) peaked at around $110 billion in 2011. Such an amount would be equivalent to 6.5% of Russian GDP (based on 2019). This is unlikely to be affordable for very long, particularly if there is a high level of resistance to Russian occupation, if there are substantial reconstruction requirements after heavy bombardment of civilian targets, and if Russia remains shut out of global capital markets.

On the Western side, sustained high prices for energy, food and other commodities will hurt consumers (and therefore voters). Although Europe has announced plans to diversify its energy mix away from Russian fossil fuels, building renewable capacity and LNG terminals takes time. There will be an incentive to reach a compromise in which Russia can export more commodities into world markets.

In this scenario, we assume that after approximately one year Russia reaches some agreement with the West. In exchange for a military withdrawal from Ukraine, the West eases sanctions so that Russia can export more commodities, either directly to the West or to third-party countries – such as China – which then loosens global markets.

Other aspects of the economic relationship do not normalize. The pull-back of western multinationals from Russia is not reversed. The U.S. continues to tightly limit Russia’s access to critical technologies such as advanced semiconductors. Most importantly for metals industries, Europe continues to diversify its energy policy away from Russian fossil fuels.

Currently, we think this is the most likely scenario. The key question is how costly the war/occupation becomes, and Russia’s ability to pay for it, as well as whether the degree of political unity in the West is maintained.

Scenario C: Cold War II

Russia becomes increasingly isolated from the West and the wider world trading system, and increasingly reliant on China as a market for its exports and as a source of technological imports. World commodity markets adapt to deal without supply from Russia and Ukraine. Prices do fall back from levels in 2022, but remain well above pre-war levels.

There is a long, drawn out occupation of Ukraine, which is costly and increasingly unpopular within Russia. However, Putin holds onto power and is able to avoid complete economic collapse. The Putin regime cracks down harder and harder on internal dissent and isolates Russia as much as possible from the West. The West arms the Ukrainian rebels and maintains sanctions at current levels indefinitely.

Presently, we see Scenario B as being more likely than C. However, if the costs of an isolated Russia prove manageable for both sides, and Putin is able to consolidate his power, then this will be the most likely outcome.

The role of China will be crucial in determining which scenario we end up in. China is the single largest trading partner for both Russia and Ukraine, and Russia’s isolation from the West has increased the leverage China holds. Pressure on Russia from China to negotiate an end to the fighting could increase the probability of Scenario A or B instead of C. Conversely, if China decides to support Russia – either through military aid or through circumventing the sanctions – then an even more serious scenario is possible, where U.S. sanctions aimed at punishing China lead to a broader fragmentation of the world trading system. This could have seismic impacts on trade and commodity flows. However, this remains a low probability event as the Chinese government will be keen to avoid such an outcome.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com