Prices

March 8, 2022

SMU Price Ranges & Indices: HRC Prices Jump $50/ton, First Gains Since Early September

Written by Brett Linton

Hot-rolled coil prices are up an average up $50 per ton ($2.50 per cwt) this week, breaking a six-month trend of flat or falling prices. And that gain might prove modest compared to what’s in store in the weeks ahead. Why? Because the war in Ukraine has the potential to shock the steel market at least as much as the COVID-19 pandemic did two years ago, some market participants said. On the finished steel side of the equation, Nucor announced a price hike of $100 per ton. Other steelmakers have quietly followed. And we’re told certain mills have not released new pricing because they need to get a better handle on their costs first. That’s because pig iron prices are skyrocketing by the day and scrap prices are expected to settle substantially higher this month –$100 per gross ton, $150 per gross ton or $200 per gross ton? No one expects lower scrap tags. The result: the high end of SMU’s HRC price range jumped to $1,200 per ton, reflecting the latest offers from mills following the recent price hikes. The low end of our range, $900 per ton, reflects larger orders placed at pre-increase numbers and has little chance of being in the market next week, sources said. Cold-rolled and coated price trends were mixed this week – with cold rolled down modestly, galvanized up $60 per ton and Galvalume flat. But most sources we contacted agreed that tags for value-added products would move up in the weeks ahead. Plate prices remained largely unchanged around $1,815 per ton – as has been the case since the beginning of the year. We’ve adjusted our price momentum indicator for hot-rolled coil to higher. The momentum indicators for other products remain neutral until a clearer trend is established.

Hot Rolled Coil: SMU price range is $900-$1,200 per net ton ($45.00-$60.00/cwt) with an average of $1,050 per ton ($52.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $100 per ton. Our overall average is up $50 per ton from last week. Our price momentum on hot rolled steel is pointing toward Higher prices over the next 30 days.

Hot Rolled Lead Times: 2-6 weeks

Cold Rolled Coil: SMU price range is $1,450-$1,600 per net ton ($72.50-$80.00/cwt) with an average of $1,525 per ton ($75.25/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end decreased $40 per ton. Our overall average is down $20 per ton from one week ago. Our price momentum on cold rolled steel is at Neutral until the market establishes a clear direction.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU price range is $1,380-$1,580 per net ton ($69.00-$79.00/cwt) with an average of $1,480 per ton ($74.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $110 per ton compared to one week ago, while the upper end increased $10 per ton. Our overall average is up $60 per ton from last week. Our price momentum on galvanized steel is at Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $1,477-$1,677 per ton with an average of $1,577 per ton FOB mill, east of the Rockies. Effective this week, we have increased the galvanized extras used in our benchmark prices from $87 to $97 per ton, in response to the revised U.S. Steel galvanized coating extras.

Galvanized Lead Times: 4-8 weeks

Galvalume Coil: SMU price range is $1,380-$1,580 per net ton ($69.00-$79.00/cwt) with an average of $1,480 per ton ($74.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week, while the upper end decreased $20 per ton. Our overall average is unchanged from one week ago. Our price momentum on Galvalume steel is at Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,671-$1,871 per ton with an average of $1,771 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks

Plate: SMU price range is $1,810-$1,820 per net ton ($90.50-$91.00/cwt) with an average of $1,815 per ton ($90.75/cwt) FOB mill. The lower end of our range remained unchanged compared to one week ago, while the upper end decreased $10 per ton. Our overall average is down $5 per ton from last week. Our price momentum on plate steel remains at Neutral until the market establishes a clear direction.

Plate Lead Times: 3-6 weeks

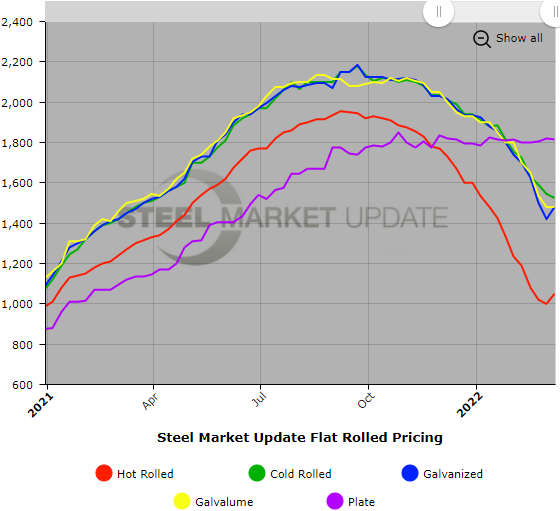

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.