Overseas

February 28, 2022

CRU: Sanctions Escalate on Russian Interests

Written by CRU Americas

By CRU Multi Commodity Analyst Alex Christopher and Research Analyst James Mills, from CRU’s Steel Sheet Products Monitor, March 3

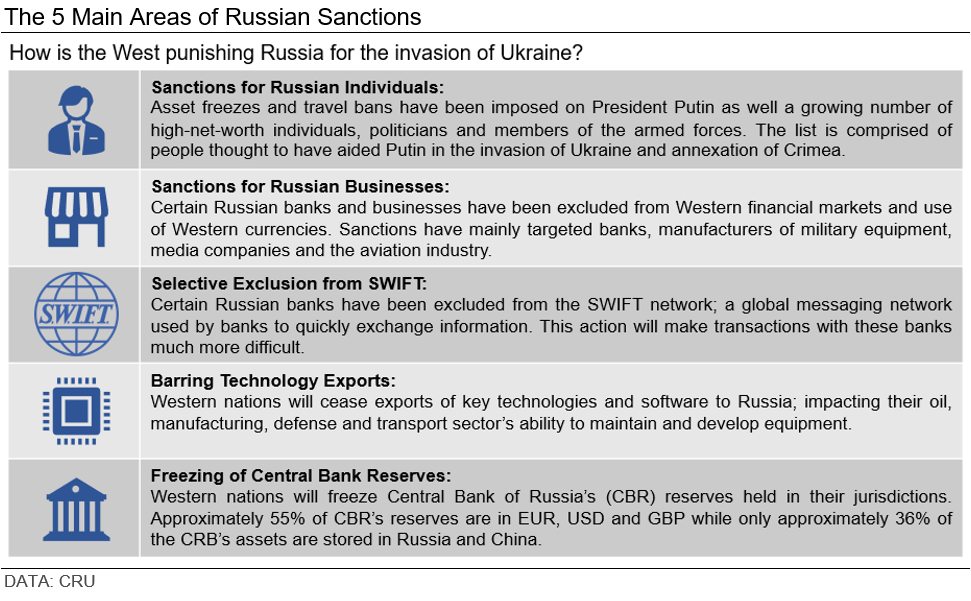

The sanctions imposed on Russia over its invasion of Ukraine will have direct and indirect implications for commodity markets, and their impact will be felt by everyone involved along the length of commodity value chains. Commodity prices have rallied in response despite Russian producers not being specifically targeted. We identify five strands to the sanctions and identify how commodity markets will be affected.

Sanctions Increase Risk Which Many Look to Avoid

For some, the sanctions imposed as a response to the invasion of Ukraine are too little, too slow, too weak, and full of holes; while, for others they are a set of increasingly tough targeted measures which are working to isolate the Russian economy. Sanctions are not measures that will directly stop the war, they are designed to put a high cost on the war for the aggressors with the aim of making the costs so high the invasion is brought to a conclusion.

The trade in commodities is primarily affected through indirect means as the risk premium of dealing with Russian entities has risen so significantly since the invasion of Ukraine: the risk of unknowingly dealing with a sanctioned entity or person, the risk of further sanctions being put in place before the trade is completed, the risk of default, the risk that goods can’t be delivered, the risk of reputational damage. This increased risk, together with the moral imperative many feel, results in companies “self-sanctioning.”

Sanctions have, to date, been carefully targeted to avoid directly sanctioning energy and commodity trade in markets where Russia has a significant market share. Although there are signs this might be changing.

Targeting Putin’s Associates Indirectly Affects Commodities

Sanctions against individuals typically involve asset freezes and travel restrictions, depriving that person of wealth and freedom of movement. Depending on the jurisdiction, it may prevent a business relationship with the individual, and this could also affect companies over which they are deemed to have a controlling stake. The difficulty many companies face is complex and opaque ownership structures, which creates the risk of not knowing the ultimate see-through owners of business partners.

While we don’t know of any raw material producing companies that have been directly sanctioned, a number of individuals linked to them have. Most notable are the additions of Alexei Mordashov, owner of Severstal Steel, Alisher Usmanov, owner of Metalloinvest, and Igor Sechin, CEO of Rosneft. Overall, these individuals own controlling stakes in a diverse range of companies, spreading the impact of these sanctions over a large swathe of the Russian economy.

Exclusion from SWIFT Puts a Barrier to Transactions

Although exclusion from SWIFT has received wide and popular attention, it is does not actually stop financial institutions from transacting across borders on behalf of businesses; nor will it directly prevent trade in commodities. However, transactions will be significantly more difficult and more expensive as it raises the risk premium of transitions.

The Society for Worldwide Interbank Financial Telecommunications (SWIFT) system is a member-owned messaging network used by banks and other financial institutions to exchange information quickly, accurately and securely. Each member institution has a physical SWIFT terminal and unique SWIFT code through which they communicate with one another. One of the main uses of the system is for money transfer instructions, foreign exchange settlement and trade finance.

Approximately 300 Russian banks and organizations are members. Russia, a key global supplier in multiple commodity markets, relies on the system to transact on its U.S. dollar exports in oil, gas, gold, nickel, titanium, agriculturals, fertilizers and other commodities sales. The exclusion of some Russian banks from the SWIFT network will not directly prevent trade with Russian entities but it places a significant barrier to completing financial transactions.

The Russian banks named by the EU as excluded from SWIFT include VTB (Russia’s second largest bank), Bank Otkritie, Novikombank, Promsvyazbank, Rank Rossiya, Sovcombank, and VEB. The two notable exceptions from the list were Sberbank (Russia’s largest lender) and Gazprombank. Although these two banks are subject to other measures.

There are alternatives to the SWIFT system. Both China and Russia have made attempts to set up rival systems, notably the Chinese Cross-Border Interbank Payment System (CIPS) and the Russian System for Transfer of Financial Messages (SPFS), with the latter developed primarily in response to suggestions of Russian exclusion from SWIFT by the U.S. after the annexation of Crimea in 2014. Neither system has the global reach of SWIFT, but both have made a number of connections abroad in recent years.

Russian Central Bank Sanctioned

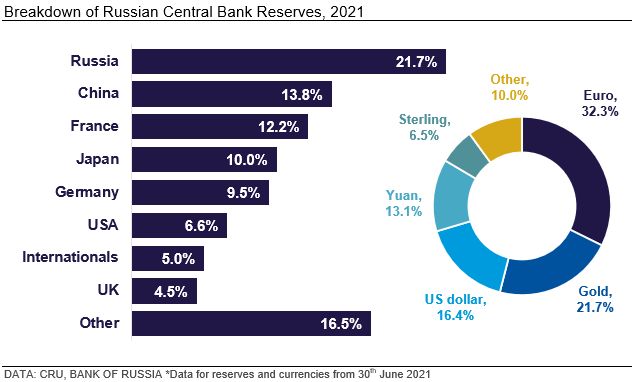

Economically more damaging to Russia than excluding its banks from the SWIFT network is the decision, taken by the U.S., EU, UK and Canada, to sanction the Central Bank of Russia (CBR), preventing it from accessing its reserve of foreign currency. Russia’s $630 billion of foreign exchange reserves could have been used to purchase key imports, service foreign currency debt, support the Ruble and even potentially circumvent sanctions.

As of mid-2021, 55% of these reserves were held in Euros, U.S. dollars or Sterling. And with the Russian state also blocked from issuing debt in G7 countries, the risk that Russia will default on its debt (as it did in 1998) has risen substantially, which has been reflected in bond yields and CDS spreads.

This has had a dramatic effect on the value of the Ruble, which initially depreciated around 30% against the U.S. dollar. In response, the CBR more than doubled interest rates to 20%, and imposed restrictions on foreigners selling local currency assets. Sanctions are affecting Russia’s internal financial system. Many Russians still have painful memories of the financial instability of the 1990s and are withdrawing cash from commercial banks in fear that the banking system will collapse.

The sanctions against the CBR increase the risk that the overall sanctions package is binding and so disrupts trade flows. However, they may in fact reduce the risk that Russia restricts the supply of energy or other commodities, as it will now be more desperate for foreign currency.

Sanctions on Russian Banks Disrupt Business

The effects of sanctions on Russian business are varied, ranging from barring a business from accessing a capital market in specific instances, to full asset freezes. Up to 50% of Russian business transactions take place in USD and GBP, making exclusion of these businesses from U.S. and UK markets a considerable issue.

The U.S., UK and EU have banned their citizens from doing business with a number of Russia’s largest banks, excluding these banks from their financial markets and currencies. Both the U.S. and UK have sanctioned Sberbank, Russia’s largest financial institution. The U.S., UK and EU have jointly announced a further raft of restrictions and asset freezes on VTB Bank, Russia’s second largest bank, as well as Bank Rossiya and Promsvyabank. Many smaller banks are also on Western sanction lists, especially those linked to defense financing and the occupation of Crimea.

Russia’s military-industrial complex has also been the most severely sanctioned. Among others the defense company Rostec and Shipbuilder United Shipbuilding Corporation have been sanctioned by the U.S., UK and EU. The U.S., EU and UK have also closed their airspace to both Russian military and civilian aircraft, including Russia’s state-owned airline Aeroflot. The UK and Canada have also closed their ports to Russian flagged or owned ships, with the EU currently considering similar measures.

While Russian raw materials producers have not been directly sanctioned, economic and physical disruption caused by the war in Ukraine will disrupt their business and ability to supply. Ferrexpo has declared force majeure on select iron ore contracts due to port disruption in Ukraine and UC Rusal PJSC has halted alumina shipments from its Ukrainian refinery to Russia.

Technology Exports to Russia Halted

Banning the export of key Western technologies to Russia is a key component of the current rounds of sanctions. Both the U.S. and EU have prohibited the export of dual-use goods, technologies, software and equipment developed in the West. This includes key technologies such as semiconductors, telecommunication, encryption security, lasers, sensors, navigation, avionics and maritime technologies. The aim is to cut Russia out of cutting-edge technologies and hobble the ability of Russian business to repair advanced equipment, build more and develop new technologies based on Western IP.

This export ban will directly affect Russian oil companies, whose oil refineries rely on Western technology and services for upgrades. The ban will also heavily impact the Russian aviation, defense and manufacturing sectors, which all rely on western machinery, vehicles and technology for production, maintenance and upgrades.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com