Canada

February 23, 2022

Stelco Posts Record Profit in '21, Warns of Lower Demand in '22

Written by Michael Cowden

Stelco Holdings Inc. posted record annual results in 2021 but warned – unlike other North American steelmakers – that the good times would not roll into this year.

“We certainly benefited from exceptional price levels for much of the year,” Stelco Executive Chairman and CEO Alan Kestenbaum said.

![]() “In 2022, however, we expect to see pressure on margins due to lower pricing and inflationary pressures on some of our cost inputs as well as a reduction in demand,” he said.

“In 2022, however, we expect to see pressure on margins due to lower pricing and inflationary pressures on some of our cost inputs as well as a reduction in demand,” he said.

Kestenbaum made the comments along with fourth quarter earnings data released after the close of markets on Wednesday, Feb. 23.

The Hamilton, Ontario-based flat-rolled steelmaker swung to a profit of Canadian $1.61 billion ($1.26 billion U.S.) in 2021 after losing C$159 million ($124.9 million) in 2020 on revenue that more than doubled to C$4.12 billion ($3.24 million).

The record results in 2021 came thanks to record steel prices and strong shipment volumes.

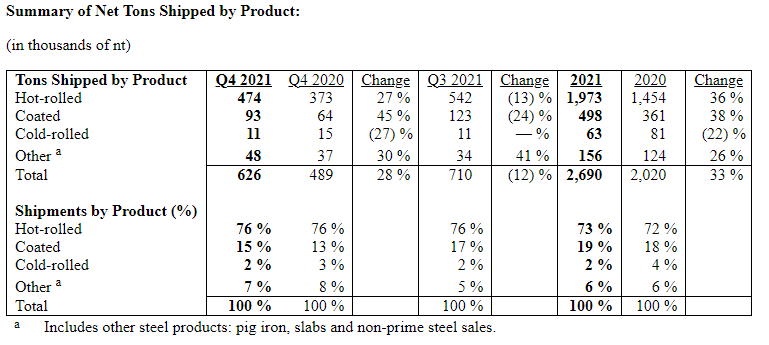

Stelco posted an average selling price of C$1,473 per ton ($1,157 per ton) in 2021, more than double C$705 per ton ($554 per ton) in 2020 on shipping volumes that rose nearly 83% to 2.69 million tons year-over-year.

Fourth-quarter 2021 results were also up sharply from the year-ago period. But they were down quarter-over-quarter.

Stelco recorded net income of C$513 million ($403 million) in the fourth quarter of 2021 after losing C$47 million ($37 million) in the final quarter of 2020 on revenue that more than doubled to C$1.19 billion ($930 million).

Profits, however, were down 16% from C$614 million ($482 million) in the third quarter even as average selling prices rose 2% to C$1,845 per ton ($1,449 per ton) in the fourth from $1,808 per ton ($1,420 per ton) in the third.

The reason for the decline in profitability: Shipment volumes fell to 626,000 tons in the fourth quarter, down 12% from 710,000 tons in the third.

Details on Stelco’s product mix, which is heavily tilted toward hot-rolled coil, are below.

Stelco executives said they had the low-cost operations and strong balance sheet needed to weather a market downturn.

“While the outlook for 2022 is unclear, we expect that the foundation we have built … and the continued commitment of our employees to continually and relentlessly focus on costs, will allow Stelco to remain the North American leader in steel industry profit margin,” CFO Paul Scherzer said.

The company said it had C$1.2 billion ($940 million) in total liquidity at the outset of 2022, including $955 million ($750 million) in cash on hand.

By Michael Cowden, Michael@SteelMarketUpdate.com