Prices

February 22, 2022

SMU Price Ranges & Indices: Sheet Falls Hard, Will a Price Hike Change Momentum?

Written by Brett Linton

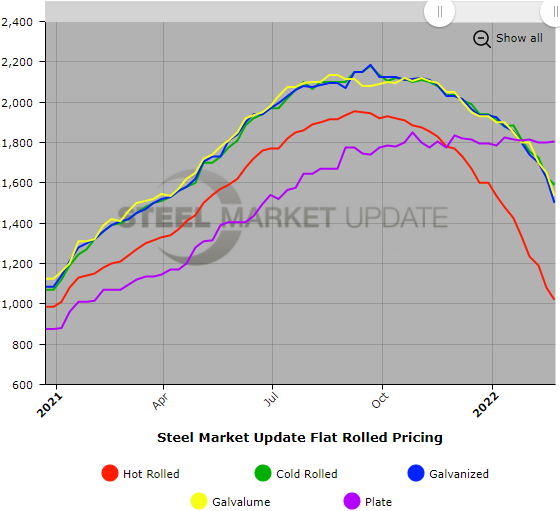

Sheet prices fell hard again this week. Our average hot-rolled coil number now stands at $1,020 per ton ($51/cwt), down $60 per ton from last week and marking the lowest point for HRC prices since January 2021. Large buyers reported deals in the mid-$900s. Another notable trend: Prices for coated products led the way downward for a change, with both galvanized and Galvalume tags falling more than $100 per ton. That big drop came as market participants said that a wide spread between HRC and coated base prices was not tenable. Cold-rolled prices, however, continue to defy gravity – a move that some said would keep them active in the import market for that product. Wide spreads between HRC and plate have led to predictions that plate, too, is due for a correction. But the plate price dam did not break this week. The other big news: Cleveland-Cliffs Inc.’s $50-per-ton price increase for sheet products and debates about whether it will stick. The fundamentals justify the price hike, some sources said. And current low-priced deals are an indication that other mills are trying to bring in orders and stretch out lead times before announcing hikes of their own. But others contend that such price announcements can be a sign of weakness, and that attempts to change market psychology can backfire. SMU has changed our sheet price momentum indicators to neutral as we wait to see where the dust settles.

Hot Rolled Coil: SMU price range is $940-$1,100 per net ton ($47.00-$55.00/cwt) with an average of $1,020 per ton ($51.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $80 per ton compared to one week ago, while the upper end declined $40 per ton. Our overall average is down $60 per ton from last week. Our price momentum on hot rolled steel is at Neutral until the market establishes a clear direction.

Hot Rolled Lead Times: 3-5 weeks

Cold Rolled Coil: SMU price range is $1,500-$1,680 per net ton ($75.00-$84.00/cwt) with an average of $1,590 per ton ($79.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $60 per ton compared to last week, while the upper end decreased $20 per ton. Our overall average is down $40 per ton from one week ago. Our price momentum on cold rolled steel is at Neutral until the market establishes a clear direction.

Galvanized Coil: SMU price range is $1,400-$1,600 per net ton ($70.00-$80.00/cwt) with an average of $1,500 per ton ($75.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $150 per ton compared to one week ago, while the upper end decreased $100 per ton. Our overall average is down $125 per ton from last week. Our price momentum on galvanized steel is at Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $1,487-$1,687 per ton with an average of $1,587 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-8 weeks

Galvalume Coil: SMU price range is $1,470-$1,600 per net ton ($73.50-$80.00/cwt) with an average of $1,535 per ton ($76.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $130 per ton compared to last week, while the upper end decreased $100 per ton. Our overall average is down $115 per ton from one week ago. Our price momentum on Galvalume steel is at Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,761-$1,891 per ton with an average of $1,826 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-9 weeks

Plate: SMU price range is $1,780-$1,830 per net ton ($89.00-$91.50/cwt) with an average of $1,805 per ton ($90.25/cwt) FOB mill. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $10 per ton. Our overall average is up $5 per ton from last week. Our price momentum on plate steel remains at Neutral until the market establishes a clear direction.

Plate Lead Times: 4-5 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.