Overseas

February 22, 2022

CRU: Russia Invades - How Conflict Affects Ukraine’s Steel Industry

Written by Erik Hedborg

By CRU Principal Analyst Erik Hedborg and Senior Coal Analyst Dmitry Popov, from CRU’s Steelmaking Raw Materials Monitor, Feb. 24

On Feb. 24, Russia launched an invasion of Ukraine as President Vladmir Putin ordered a large-scale “specialized military operation.” Russian troops entered Ukrainian territory – from Belarus in the north, the separatist-controlled regions in the east and from Crimea and the Black Sea in the South. As reported by news sources, Ukrainian military infrastructure was under attack throughout the country.

The situation is evolving rapidly and CRU is monitoring the development closely. At the time of this writing, it is too early to make any predictions on how the conflict will develop. What we do know is Ukraine has a large steel industry, which includes supply of raw materials, among them iron ore and metallurgical coal. These markets will undoubtedly be affected, mainly by disruptions to infrastructure, shortages of supply or power, or simply by losing workers that are joining military forces.

Ukraine – An Important Steel Exporter

CRU estimates that Ukraine produced 21 Mt of crude steel in 2021, of which 17 Mt was produced through the BF-BOF route. The country is a massive steel exporter, with around 15 Mt of finished and semifinished steel being exported last year. Key destinations include Mediterranean countries Italy and Turkey, together accounting for 30% of Ukraine’s steel exports. Other important destinations are in Eastern Europe, including Poland and Bulgaria.

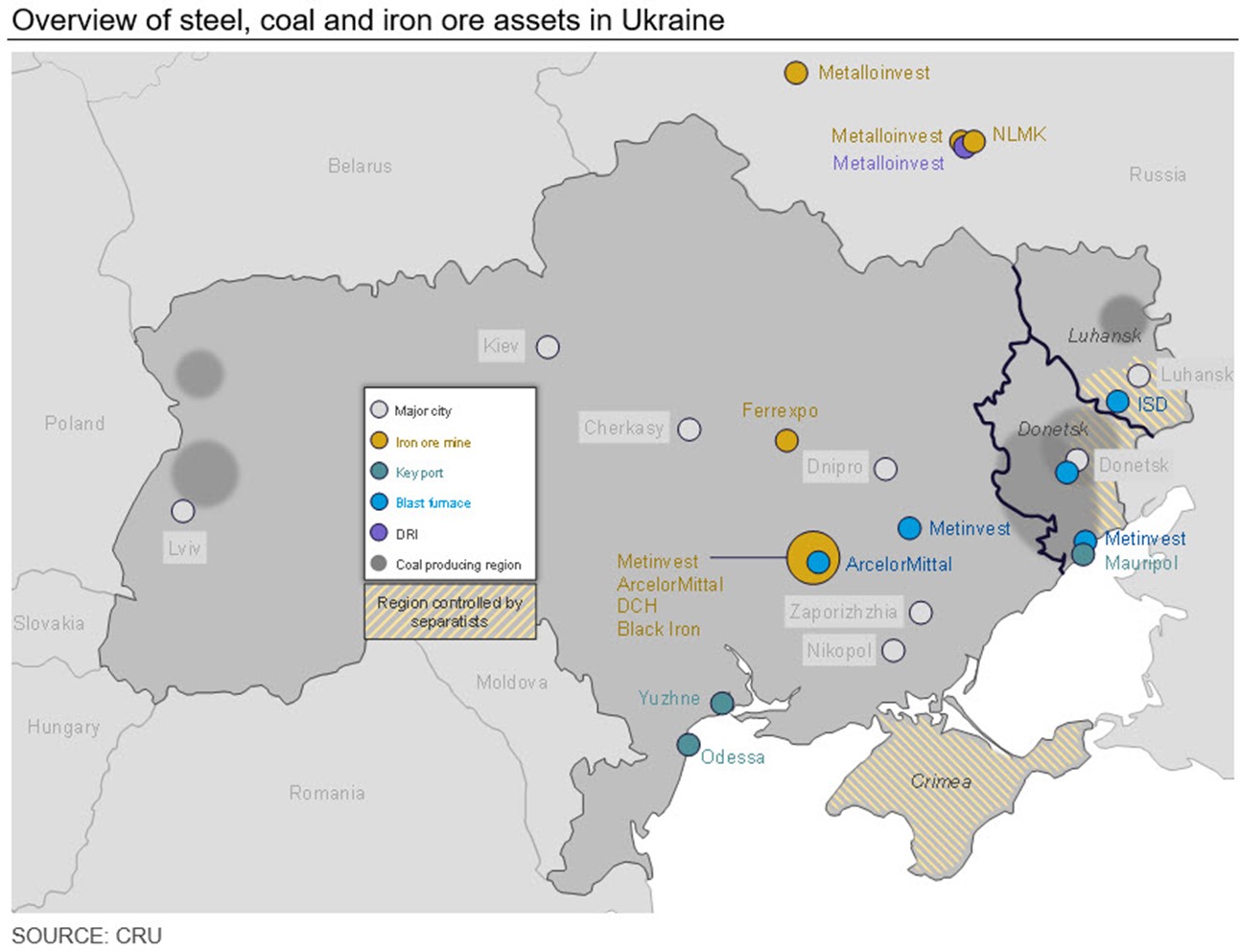

Importantly, there are a number of plants that are located in the Donetsk and Lugansk regions, including the separatist-controlled parts of these regions. These plants were formerly owned by Ukrainian companies and are now privately owned, or their ownership structure is unknown. They also do not report either production or export numbers. CRU’s analysis shows that some of the facilities are not operational now, but we estimate that they account for nearly half of Ukraine’s steel exports. (Click map to enlarge.)

Iron Ore Production Already Being Impacted

Ukraine exported 44 Mt of iron ore in 2021, accounting for nearly 3% of global exports. The country supplies mainly magnetite concentrate or pellets and is an important supplier to east European steel mills as well as Austria. Around 20 Mt of iron ore was exported by rail or barge to these regions, and the rest of the volume was exported to the seaborne market, mainly through the port of Yuzhne in the southern parts of the country. Ferrexpo and Metinvest are the country’s most important iron ore suppliers, but ArcelorMittal also owns iron ore mines that supply both the export market and its own steel mills in the country.

Our sources have confirmed that iron ore shipments have already been disrupted as some railways are not operating and port operations have also been halted to some extent.

Disruptions to Coal Supply Pose Risk to Domestic Industries

Ukrainian coal production is concentrated in the east of the country in the Donetsk, Luhansk and Dnepropetrovsk regions. In 2021, metallurgical coal production in Ukraine was 5 Mt, while imports were 12 Mt and there were virtually no exports. The country’s thermal coal production in the same year was 23 Mt with both imports and exports of around 1-2 Mt, which is negligible compared to the size of the global seaborne thermal coal market of around 925 Mt.

Consequently, any coal production disruptions in Ukraine will not lead to any significant issues for the global coal markets. However, interruptions to the domestic coal supply could lead to disruptions with coke, pig iron and steel production in the country. Additionally, problems with domestic thermal coal supply could disrupt the domestic electricity sector as share of coal in Ukraine’s electricity mix was 24% in 2021.

Scrap Market Unlikely to See Any Impact

Scrap exports from Ukraine have been limited since the end of last year following an increase of the minimum export duty rate to EUR180 /t from Dec. 2, 2021. Basically, such a high rate prevents overseas scrap shipments as it makes trade unprofitable. If there is any disruption in scrap supply in Ukraine, the global scrap market should not experience substantial shocks.

For other metallics, Ukraine is among the largest merchant pig iron suppliers globally. Last year, Ukraine exported around 3.1 Mt of pig iron, which equals 24% of global exports. The USA, Italy and Turkey are the major export destinations. If pig iron supply is disrupted, we might see prices increase sharply as no other supplier has the ability to quickly increase production.

No Global Impacts from Stainless Disruptions in Ukraine

Stainless crude steel production in Ukraine accounted for 0.1% of the global market in 2021 and generally supplies domestic demand. Similar to carbon steel production, domestic production might be impacted by labor shortages as parts of the mill workforce join the army.

Supply Risk to European Manganese Alloy Markets

Ukraine is home to the largest European manganese alloy producer, Privat, with plants in Nikopol just to the west of the Dneiper river and Zaporozhzhia, just to the east. Ukraine accounts for over 10% of global silicomanganese production, excluding China. Exports are focused on Europe, where it is an important supplier, especially to eastern and southern European countries, and Turkey, where Ukrainian market share is very high.

CRU will continue to monitor the situation closely and will be updating subscribers accordingly. The conflict will also impact the Russian resource sector as sanctions on the Russian economy have already been announced, and CRU expects these to become more stringent and wide-ranging in the following days.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com