Product

February 20, 2022

SMU Deep Dive: HRC-Galv Spreads Continue to Balloon

Written by Michael Cowden

Prices for steel sheet have fallen across the board since September of last year. But the pace of declines for hot-rolled coil has been much faster than for galvanized products.

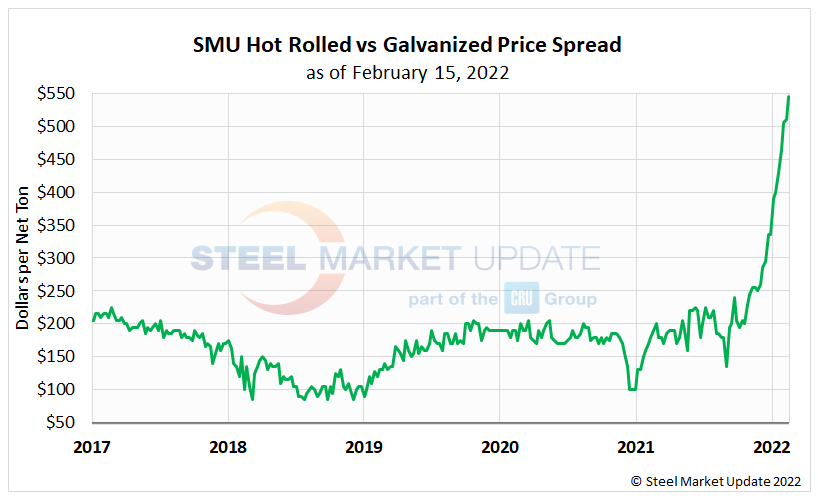

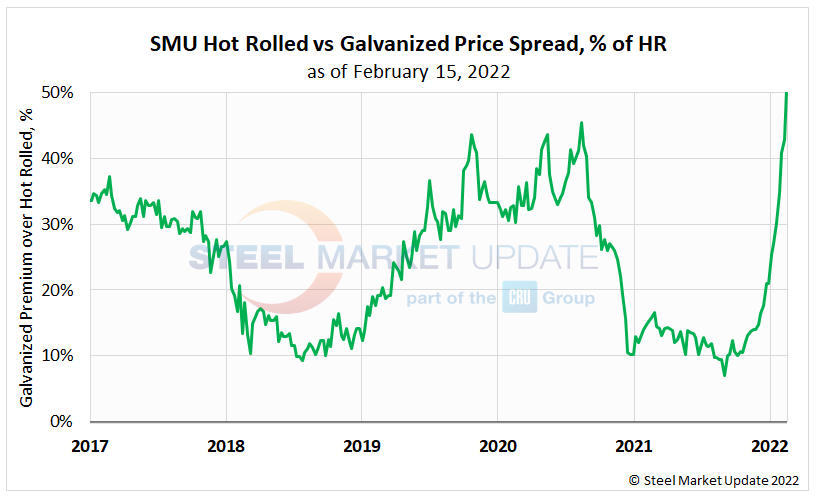

The result: Spreads between HRC prices and galv base prices – which have been at record levels since late last year – continue to widen. Check out the charts below:

{loadposition reserved_message}

The current HRC-galv base spread is $545 per ton ($27.25 per cwt), or a 50% premium over hot rolled.

The dollar amount of that spread has reached (or stayed at) a new record high each of the last 12 weeks. The 50% premium last week marked another new record, surpassing the previous record of 49% in October 2016.

The current spread between HRC and galv is higher than the price of HRC itself in past years. It is also more than double an average of approximately $150-200 per ton over the last five years. And some industry veterans would say that even that ~$175-per-ton figure is inflated compared to past norms.

What is driving such historic spreads: industry consolidation, new pricing structures or something else entirely? And are these spreads sustainable? Recent history would suggest not. But the issue is not specific to HRC and galv.

We’ve seen similarly unprecedented spreads between HRC and plate. And there is little overlap between plate markets (think energy, infrastructure and heavy equipment) and galv markets, which are more exposed to consumer or residential construction markets such as automotive, appliance and metal roofing.

The root cause of the spread between HRC and plate is easy enough to explain. Sheet mills have been lowering prices quickly even if those price decreases, as is typically the case in steel, are never officially announced. Plate mills in contrast have been officially holding the line on prices even as HRC prices have dropped like a rock.

Another difference: You can hedge the spread between HRC and galv on the CME. No such contract exists for the spread between HRC and plate, perhaps because the plate market is so much smaller.

The CME’s HRC-galv spread contract has struggled with low liquidity. That might have been because the spread was typically within a narrow and predictable bandwidth.

With that no longer the case – and the potential for volatility high – it will be interesting to see whether more volume comes into that contract in the days and weeks ahead.

By Michael Cowden, Michael@SteelMarketUpdate.com