Market Segment

January 27, 2022

U.S. Steel Posts Record Annual Profits, But Q4 Lower Than Q3

Written by Michael Cowden

U.S. Steel joined competitors Nucor Corp. and Steel Dynamics Inc. (SDI) in posting record annual profits.

But the Pittsburgh-based steelmaker’s fourth-quarter net earnings were significantly lower than those in the third quarter.

![]() U.S. Steel recorded net earnings of $1.07 billion in the final quarter of 2021, down 46.5% from $2.00 billion in the third quarter but still up massively compared to profits of only $49 million in the fourth quarter of 2020.

U.S. Steel recorded net earnings of $1.07 billion in the final quarter of 2021, down 46.5% from $2.00 billion in the third quarter but still up massively compared to profits of only $49 million in the fourth quarter of 2020.

And 2021 was one for the record books even if the fourth quarter wasn’t. U.S. Steel swung to an annual profit of $4.17 billion last year after losing $1.17 billion in 2020 on sales that more than doubled year-over-year to $20.28 billion from $9.74 billion.

The banner year – and the resulting beefy balance sheet – has fundamentally transformed U.S. Steel for the better, company President and CEO David Burritt said in a statement released with earnings data after the close of markets on Thursday, Jan. 27.

“We enter 2022 from a position of strength and are relentlessly focused on continuing our disciplined approach to creating stockholder value,” he said.

U.S. Steel will use the 2021 windfall to become “a better, not bigger company” as it focuses on its low-cost iron ore operations, electric-arc furnace (EAF) steelmaking and finishing capabilities, Burritt said.

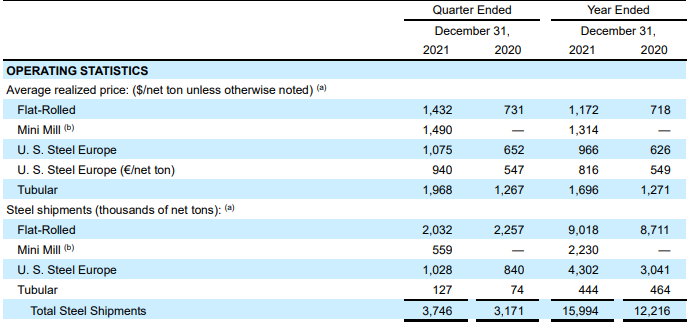

The huge 2021 profit came thanks in large part to higher steel prices and increased shipment volumes. Note that U.S. Steel’s “Mini Mill” segment in the chart below refers to EAF sheet producer Big River Steel, which U.S. Steel acquired in total on Jan. 15, 2021, after previously holding only a minority stake.

By Michael Cowden, Michael@SteelMarketUpdate.com