Prices

January 16, 2022

CRU: Metallics Prices Stabilize in Most Regions of the World

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Metallics Monitor, Feb. 10

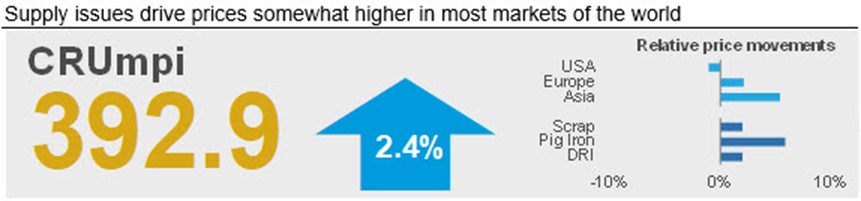

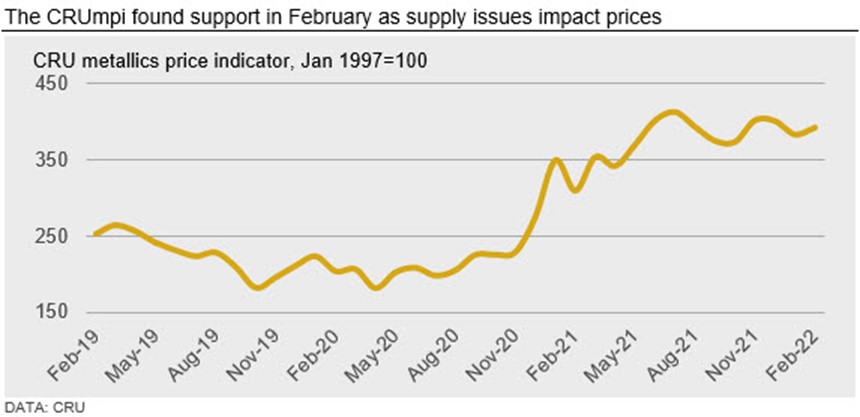

The CRU metallics price indicator (CRUmpi) rose in February m/m by 2.4% to 392.9, gaining back some of the ground lost during January’s unusually bearish market. This slight upward trend was driven primarily by supply scarcity for obsolete grade scrap and pig iron, although plentiful prime scrap and falling finished steel prices dragged some prices lower in North America. We expect supply issues to persist into March, creating yet more upside price pressure for metallics.

Following relatively large, unseasonable price declines in January, global metallics markets stabilized in February. Although prime grade scrap prices in the USA fell again on top of last month’s decline, a supply scarcity for obsolete grades caused mills to roll over monthly prices. Likewise, slower collection rates and reduced automotive output limited obsolete and prime scrap availability in Europe and caused prices for both to rise. Demand for European and U.S. scrap also rose in Turkey, where mills have had to pay increased prices for prompt import volumes as demand for their finished steel increased in other areas of the world. Turkish Black Sea import options were limited by tariffs that have reduced the competitiveness of CIS scrap exporters. New Year holiday celebrations kept trade activity low in Asia, although bids and offers rose somewhat m/m. For ore-based metallics, prices rose around the world on output issues in Brazil and rising political tensions in the CIS.

In the USA, the gap between prime and obsolete grade scrap has narrowed to a more historically normal level as prices for the former again came under pressure in February. This pressure arose from rapidly falling finished steel sheet prices that have caused mills to reduce output, while slower collection rates caused a growing scarcity for obsolete grades. In European markets, this scarcity also extended to prime grades due to a reduction in automotive (and other manufacturing) output. Demand from Turkey added to price support in both regions as mills there looked to secure material as quickly as possible following an increase in demand for Turkish finished steel exports. However, this import scrap price rise was not enough to make CIS exporters profitable given newly implemented export tariffs, and sellers in the region redirected scrap to their domestic markets.

New Year holiday celebrations across much of Asia greatly restricted scrap trading activity on the continent, but both bid and offer levels have started rising. This increase was the result of rising iron ore prices and increasingly bullish market sentiment now that Covid-19 has been better contained and restriction measures have eased. In China, we do not expect trading activity to pick up again until after the Lantern Festival on Feb. 15.

Prices for ore-based metallics increased by more than scrap m/m on reduced output and logistic issues in Brazil and geopolitical tensions in the CIS. Pig iron producers in Brazil are still behind on shipments following torrential rain downpours in key regions that damaged infrastructure and hindered transport. Meanwhile, demand for pig iron, particularly in Europe, has increased with buyers stocking up as diplomatic relations between Ukraine and Russia deteriorate.

Outlook: Market Conditions Turning Bullish for March

With scrap collection rates still relatively low and demand from abroad high, we foresee another price increase in both the U.S. and European markets in March. Similarly, as industrial activity returns to a more normal level following the holidays in Asia, we expect to see an uptick in demand and, by extension, prices in most countries there. Pig iron prices are also likely to stay supported by production and transportation delays, and there is a possibility that China will re-enter the market and drive demand higher.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com