Market Data

January 14, 2022

November Shipments and Supply of Steel Products

Written by David Schollaert

Total mill shipments of steel products fell 3.3% in November to 8.334 million tons, slipping for only the second time in eight months. Apparent supply rose fractionally in November, up 0.2% after eroding successively the prior two months.

This analysis is based on steel mill shipment data from the American Iron and Steel Institute (AISI) and import-export data from the U.S. Department of Commerce (DOC). The analysis summarizes total steel supply by product from 2008 through November 2021 and year-on-year changes.

The supply/demand differential continues to shift as supply has topped demand. November imports expanded, up 13.7% month on month, recovering the 13.3% fall the month prior. The rebound in imports coincided with a 3.3% decrease in shipments (exports plus domestic production), driven largely by a 3.6% reduction in domestic production.

Domestic mill utilization averaged 83.8% through November, slipping 1.2 percentage points versus month ago totals. Reduced demand across certain sectors, supply-chain disruptions, and a boost in imports have slowed overall domestic shipments. Mill lead times continued to shorten, averaging just under six weeks, while steel prices have kept falling throughout the month as supply outpaces demand.

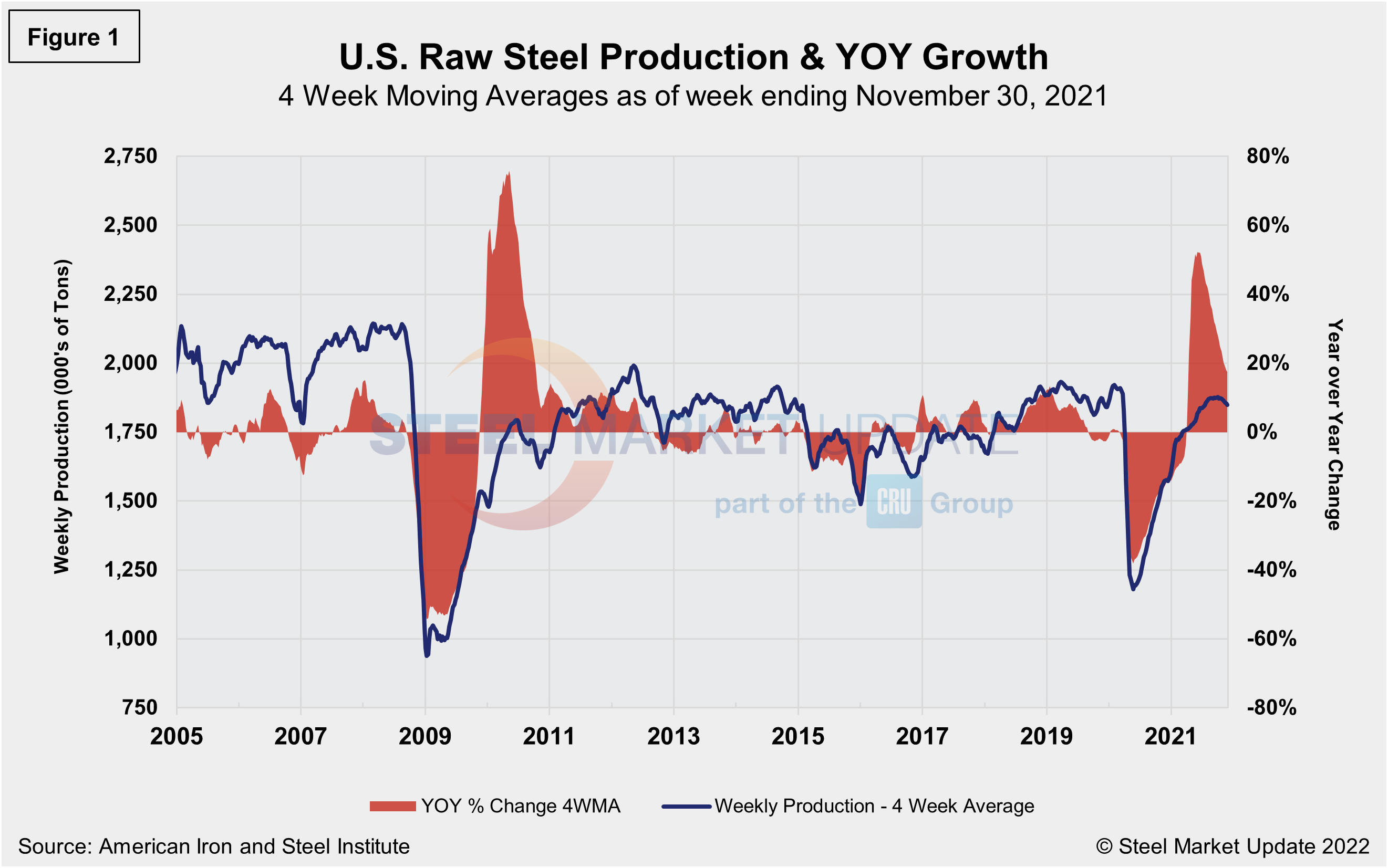

SMU’s benchmark hot-rolled coil price range averaged $1,930 per net ton FOB mill, east of the Rockies at the beginning of October. Prices dropped by $160 per ton through November and have continued to fall, down by $450 per ton to an average of $1,480 as of Jan. 11. Raw steel production shown below in Figure 1 is based on weekly data from the AISI displayed as four-week moving averages through Nov. 30, 2021.

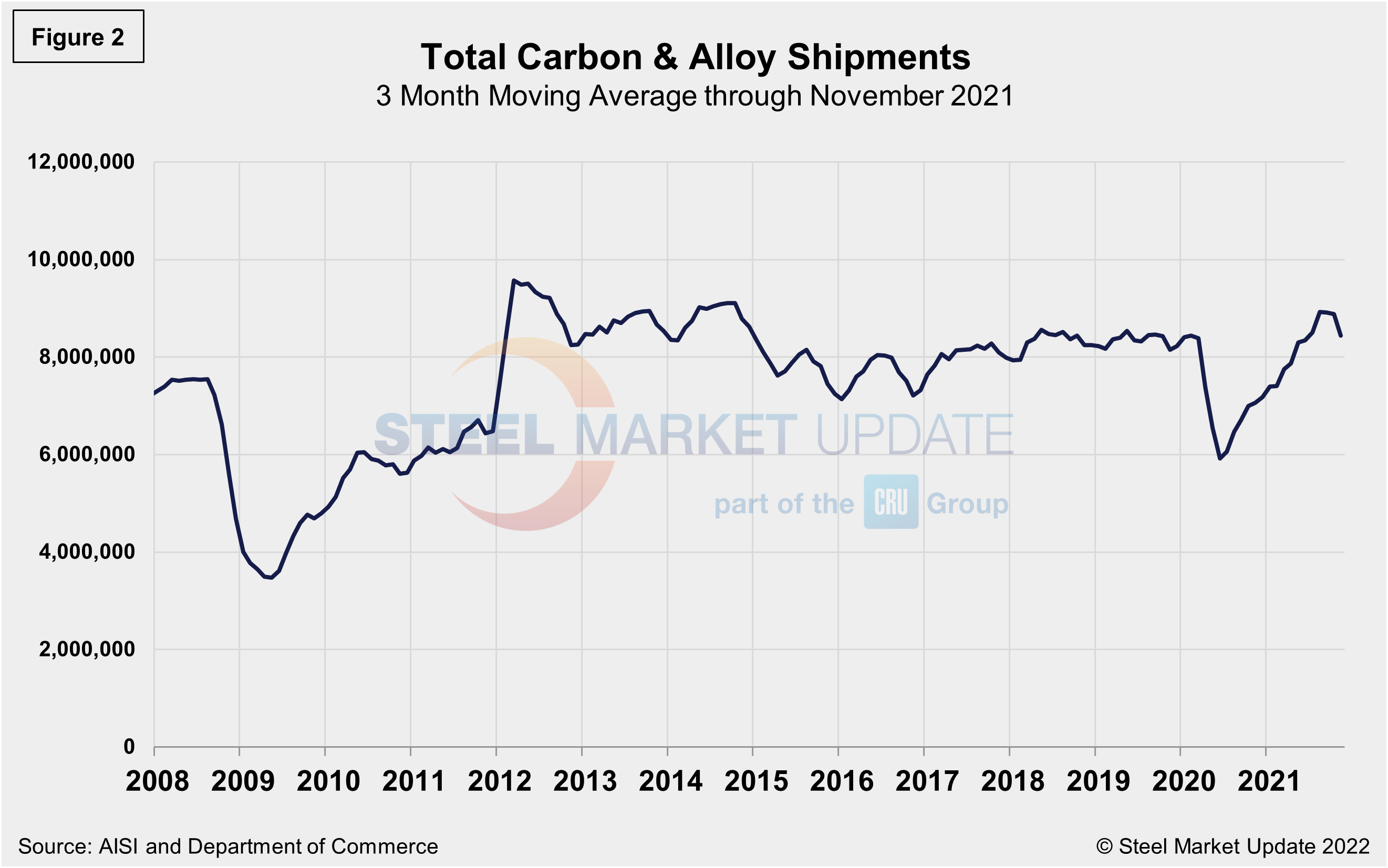

Monthly shipment data for all rolled steel products is noted in Figure 2. The trajectories of the rebounds since Q2 2020 are comparable in Figures 1 and 2. Measured as a three-month moving average (3MMA) of the monthly data, November’s total was 8.434 million tons, compared to 8.876 million tons in October, a decrease of 5.0% and the third straight decline since the initial COVID-related disruptions in March of 2020. Despite the month-on-month decrease, shipments were up 19.4% in November compared to the year prior when shipments were 7.161 million tons. The recovery from the COVID-related shutdowns has been meaningful. Current shipments are up 3.5% from the same pre-pandemic period in 2019.

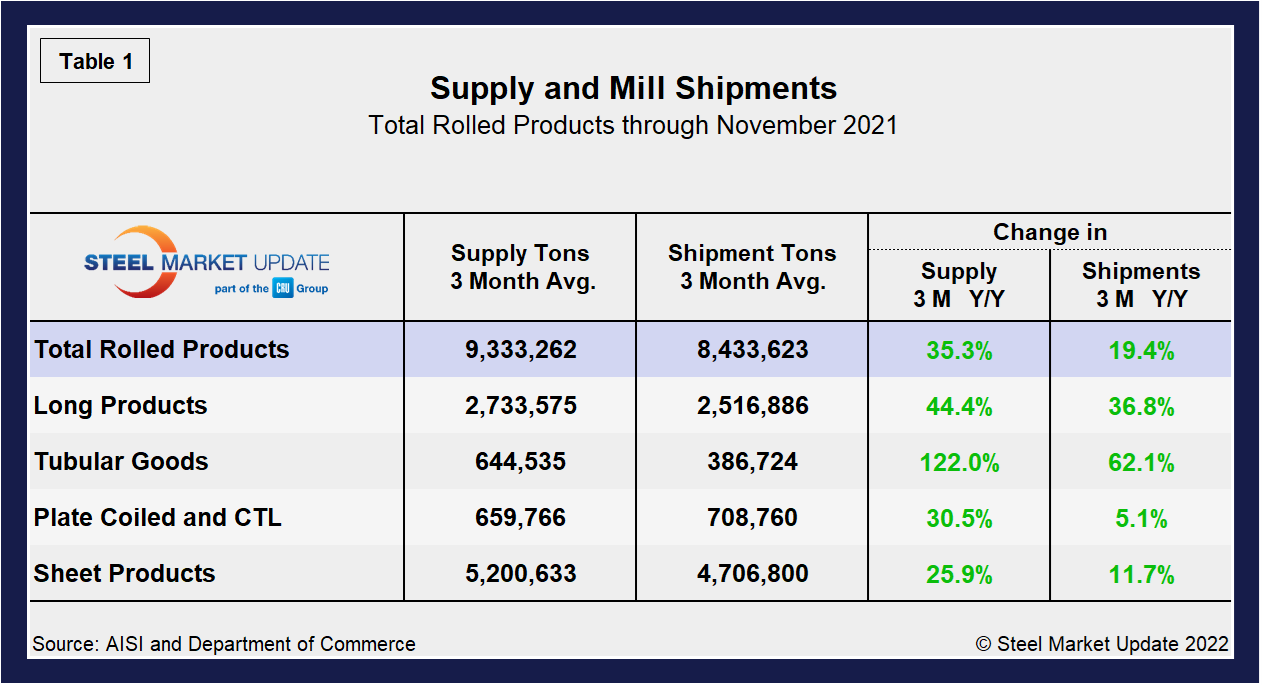

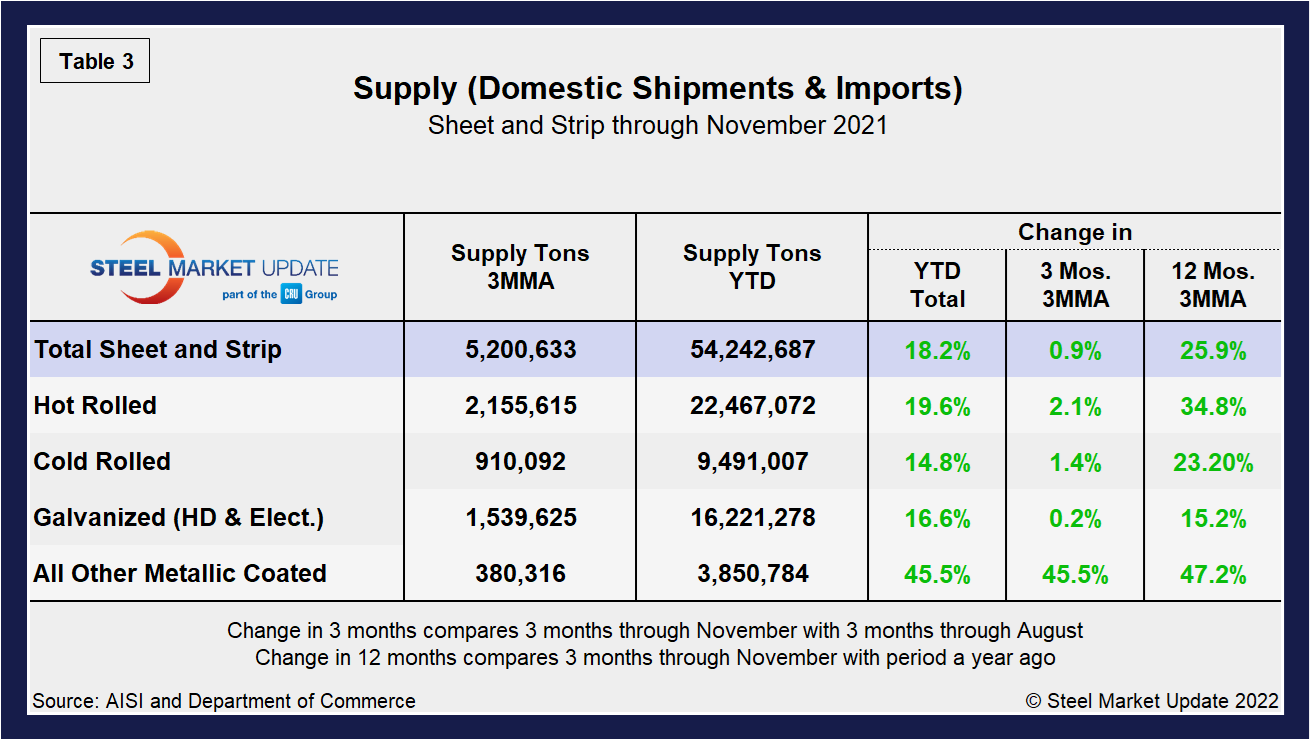

Shipment and supply details for all product groups are noted in Table 1, followed by individual sheet products in Table 2, and domestic supply (shipments and imports) in Table 3. Total supply (proxy for market demand) as a 3MMA was up 35.3% year over year in November, a big turnaround from the 17.5% decline the year prior as the market was trying to rebound from the pandemic-driven doldrums. Apparent supply is defined as domestic mill shipments to domestic locations plus imports. Mill shipments were up 19.4% in November, also a complete reversal from a decrease of 13.4% seen during the year-ago period in the same 3MMA comparison. The recovery has varied significantly among various products, but should remain up due to steady domestic output, especially if foreign material continues to make its way onto U.S. shores.

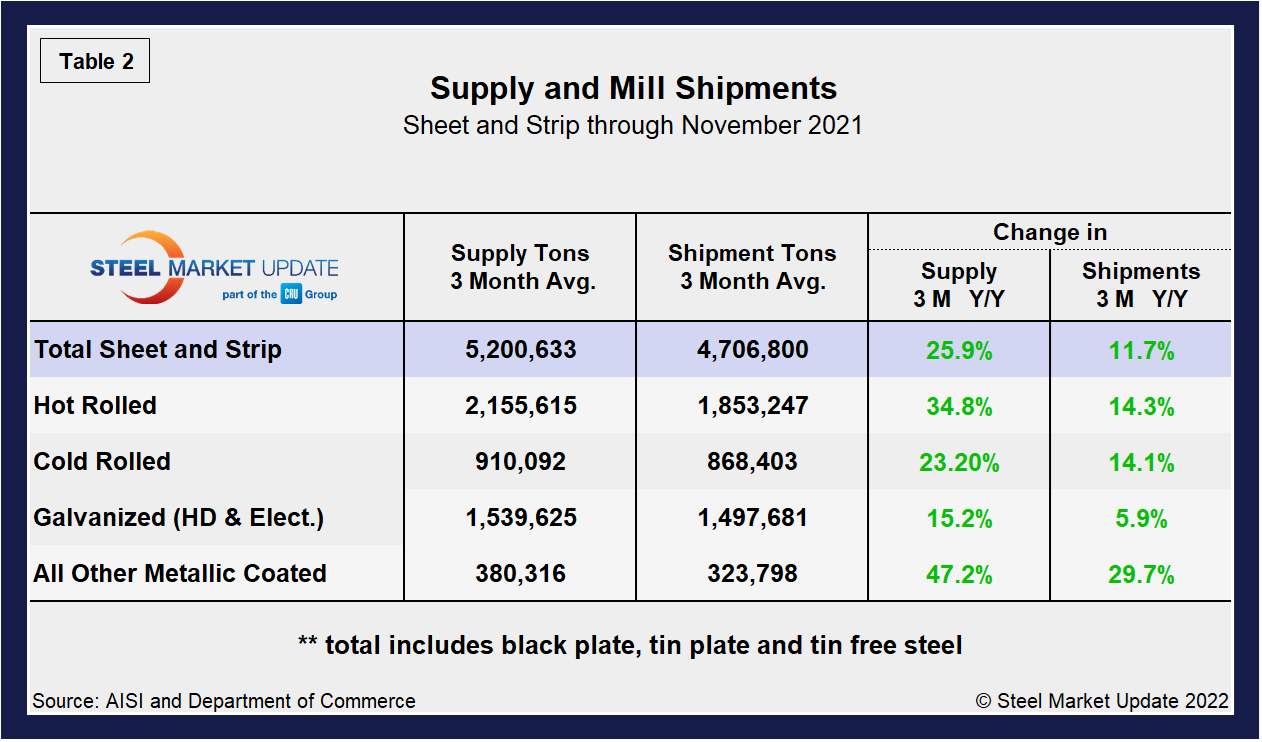

Overall sheet product shipments and supply (Table 2) have improved markedly month on month. Sheet supply increased by 25.9% and shipments by 11.7% in November, a strong recovery from declines of 8.6% and 6.0% seen one year ago. In the three months through November 2021, the average monthly supply of sheet and strip was 5.201 million tons down from 5.258 million tons or 1.1% below the prior month. Total sheet and strip apparent supply is up 17.6% year to date (Table 3) compared to 2020. Note that year-over-year comparisons have seasonality removed.

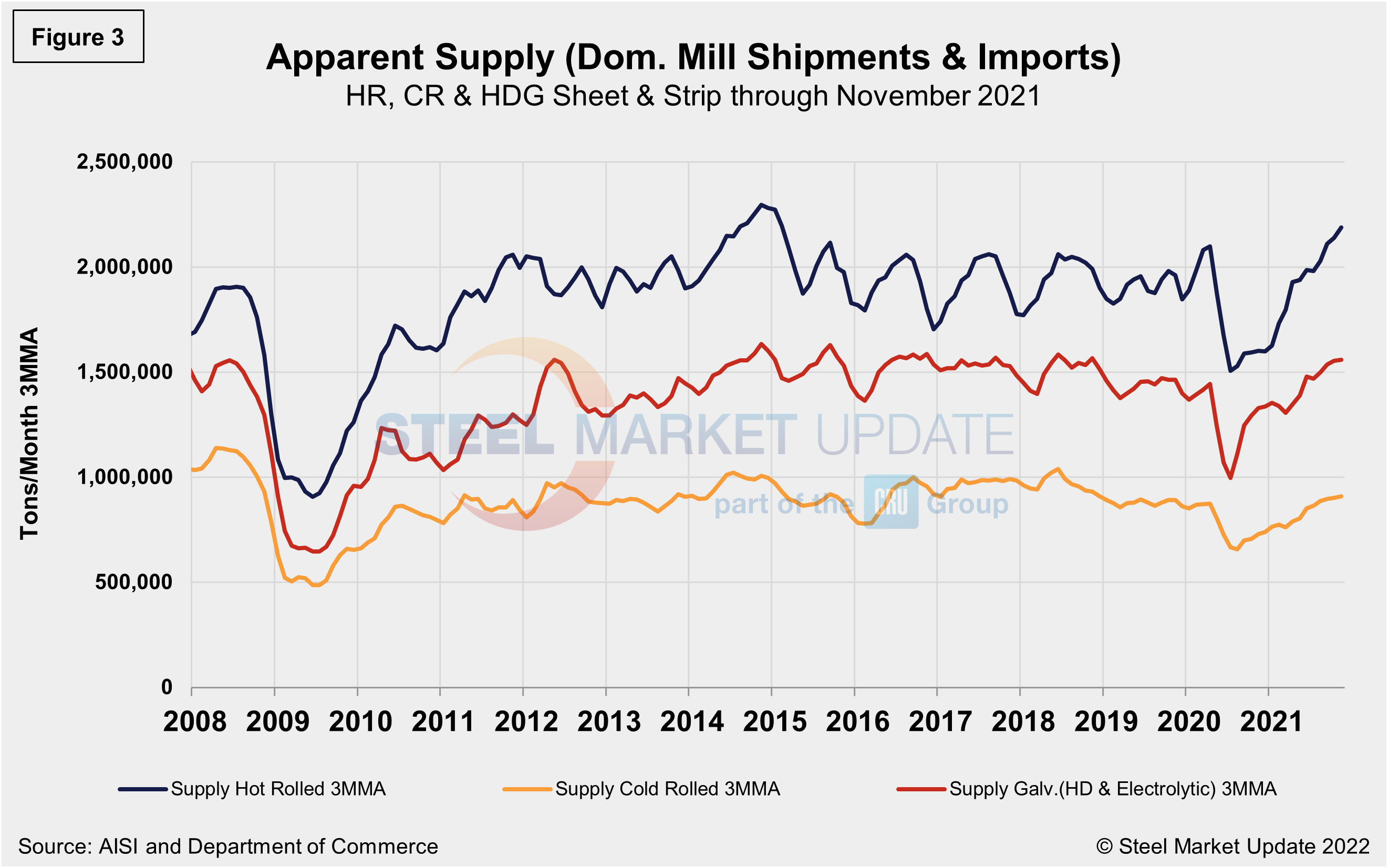

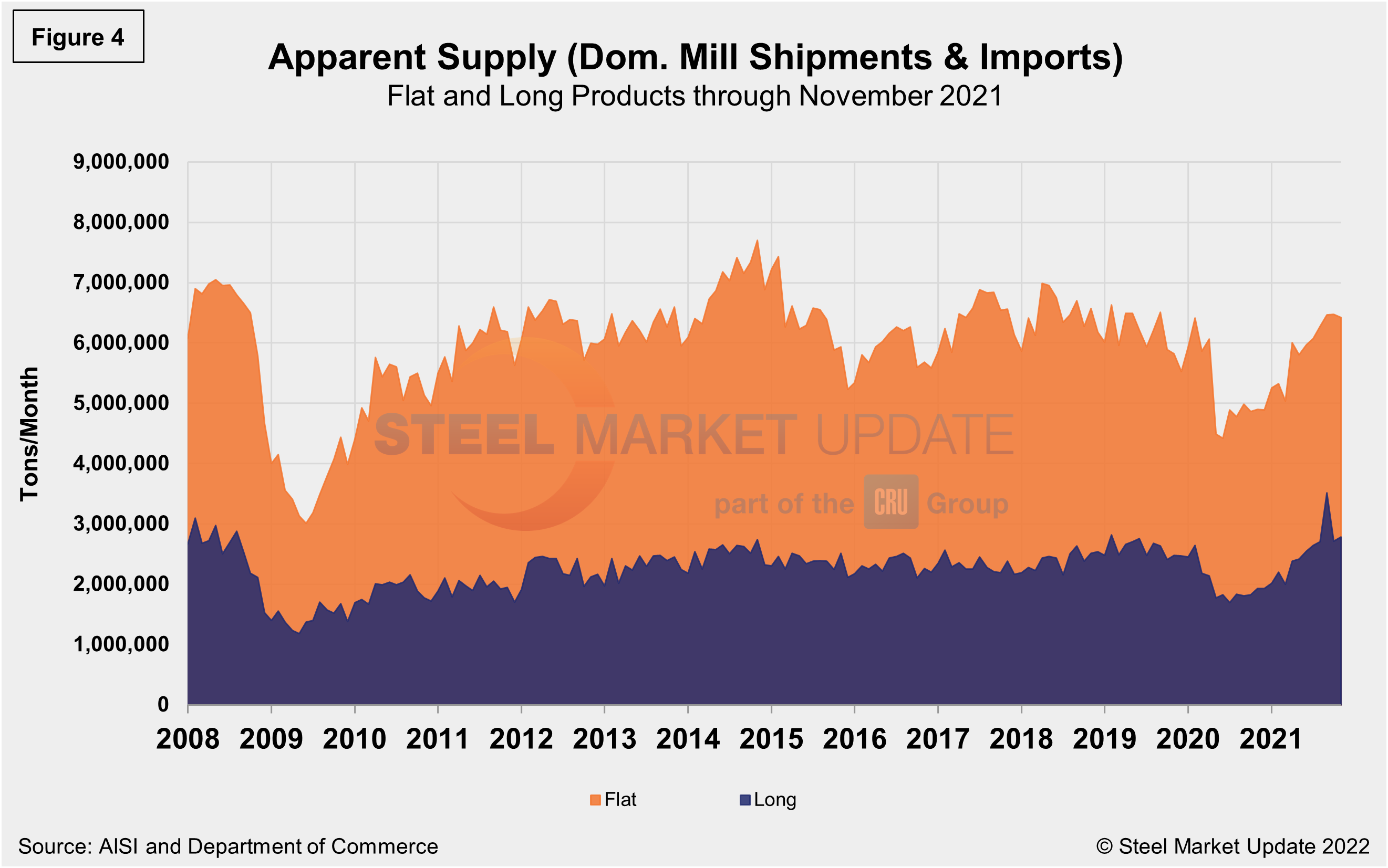

The supply picture for HRC, CRC and HDG since August 2008 as three-month moving averages in Figure 3 and Figure 4 shows the long-term comparison between flat and long products. All three sheet products have experienced some improvement since mid-2020, but galvanized (hot dipped and electrolytic) has seen the strongest rebound, a 54.4% jump since reaching bottom in June 2020, but down 1.3% month on month in November. When compared to the same pre-pandemic period in 2019, the supplies of all three products are presently higher; hot rolled coil at a 16.7% increase is the highest, followed by galvanized (hot dipped and electrolytic) at 10.0% higher, while cold rolled is 5.0% above the same pre-pandemic period in 2019. In Figure 4, note that these are monthly numbers (not 3MMAs), which show the trend difference between longs and flat products including plate.

By David Schollaert, David@SteelMarketUpdate.com