Analysis

January 4, 2022

Final Thoughts

Written by Michael Cowden

Where will hot-rolled coil prices be at the end of the first quarter?

That’s what we asked respondents to SMU’s latest survey. And the short answer is that they’ll be lower – but there is little consensus on just how much lower.

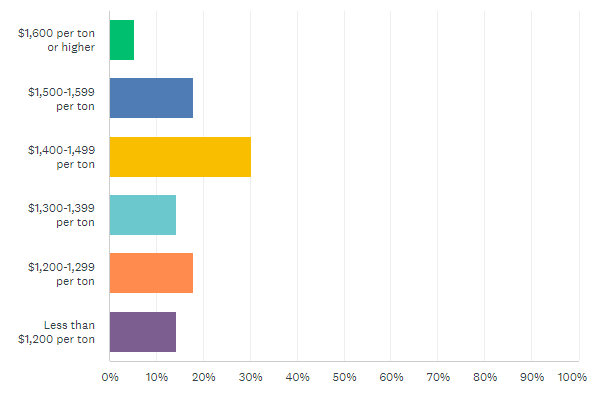

We asked this: “Hot-rolled coil prices averaged $1,600 per ton at the end of 2021. Where do you think HRC prices will be at the end of Q1 2022?”

Take a look at the results below:

SMU’s hot-rolled coil price stands at $1,535 per ton ($76.75 per cwt) as of today, down $65 from $1,600 per ton before the holidays.

Only 5% of respondents think prices will regain that lost ground by the end of the first quarter. Another 18% think that prices will end the quarter roughly within the $1,500-per-ton bandwidth they are in now. And the remaining 77% think prices will be lower – perhaps a lot lower.

Approximately 30% think prices will be in the $1,400s per ton, or where the low end or our range is now. But slightly more, 32%, think prices will be in the $1,200s per ton or lower.

That might sound nuts. How could prices fall from $1,600 per ton before the holidays to $1,200 per ton or lower in just three months? Consider this: HRC prices started out last year at $985 per ton. They ended the quarter at $1,330 per ton – so a gain of $345 per ton, or 35%, over the course of the first quarter.

If HRC prices fell 35% from where they are now, we’d be at just under $1,000 per ton by the end of the first quarter. And you could make the case that that’s conservative.

Consider the lead times published by Steel Dynamics Inc. (SDI) in late December. Hot-rolled coil lead times for both SDI Butler and SDI Columbus were approximately three weeks. The last time average lead times were around three weeks was in late April 2020, following the Covid-19 outbreak, when HRC prices averaged $460 per ton.

That’s probably not a fair comparison because the early days of the pandemic were without any recent precedent. So let’s rewind to mid-October 2017, another time when our average HRC lead time was around three weeks and when prices averaged $585 per ton.

Recall that the summer of 2017 had seen rampant speculation that Section 232 was imminent. And an inventory overhang developed as some buyers bought speculative tons in anticipation of higher prices. But then Section 232 didn’t happen, and prices slumped as inventories bulged. I recall one industry insider lamenting at the time that it was as if Trump had, in his analogy, walked into a bar with a loaded gun and said he was going to shoot someone. A frenzy ensued. And then Trump walked out of the bar without incident.

You could also make a good case that SDI typically keeps lead times short as a standard business practice. And so suggesting SDI lead times and average lead times are similar is not a fair comparison. You’d be right.

My point is this: Let’s say lead times continue to fall as sharply as they have in recent months. (We’ll update our lead time data later this week.) And let’s say they do eventually average around three weeks…. Well, we have no recent precedent where lead times are ~3 weeks and HRC prices are above $600 per ton. With that in mind, an HRC price of a little under $1,000 per ton at the end of the first quarter doesn’t sound like such a bad deal.

But those are my words. What are survey respondents saying? They’re generally more optimistic.

“Pricing still has a bit left to slide, but the major drops are probably over.”

“We are already almost into February now. Prices are coming down but will be moderated.”

“High inventory, lower lead times and more spot tons available on the market will keep the pressure on prices.”

“It will dip a bit more and then rebound higher.”

“Even with the falling pricing and holiday softness, we still wrapped up our best December in company history.”

“Don’t speculate – buy as needed – roll with the market.”

Roll with the punches. That’s good advice in a market like this. And don’t forget what a historic year 2021 was. We flirted with $2,000 per ton HRC prices. I doubt I’ll ever see something like that again in my career in steel.

By Michael Cowden, Michael@SteelMarketUpdate.com