Prices

December 14, 2021

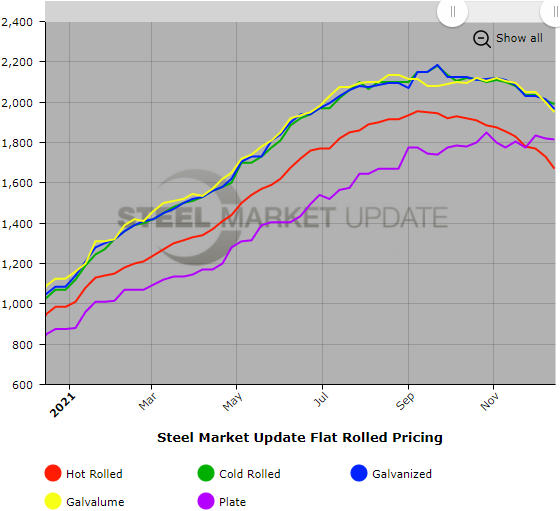

SMU Price Ranges & Indices: On the Way Down

Written by Brett Linton

Steel sheet prices fell again this week as mills continued reducing prices on shorter lead times and increased competition from both imports and other domestic producers. Published lead times are as low as 3-4 weeks for hot-rolled coil, for example, and sources reported orders being processed early. Some said mill offers declined substantially over the last week – in some instances by triple-digits. And with lead times falling, buyers said they could afford to sit out of the market for a while to see where the dust settles. As it stands now, SMU’s hot-rolled coil average of $1,670 per ton is at its lowest point since early June – or six and a half months ago. Spreads expanded as well, notably for coated products. The reason: Some mills are offering substantially lower prices in hopes of fending off imports slated to arrive at U.S. ports next year. One manufacturer recalled fear of HRC prices hitting $2,000 per ton a few months ago. “The panic of pricing heading up and up and up has been replaced with the exact opposite,” he said. SMU’s Price Momentum Indicators are pointing Lower for all sheet products – meaning we anticipate further price declines in the next 30 days. Plate momentum remains at Neutral, with sources noting a potential round of price hikes coming as soon as next week.

Hot Rolled Coil: SMU price range is $1,580-$1,760 per net ton ($79.00-$88.00/cwt) with an average of $1,670 per ton ($83.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $80 per ton compared to last week, while the upper end decreased $40. Our overall average is down $60 per ton from one week ago. Our price momentum on hot rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3-8 weeks

Cold Rolled Coil: SMU price range is $1,900-$2,080 per net ton ($95.00-$104.00/cwt) with an average of $1,990 per ton ($99.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end decreased $40 per ton. Our overall average is down $20 per ton from last week. Our price momentum on cold rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 5-12 weeks

Galvanized Coil: SMU price range is $1,850-$2,080 per net ton ($92.50-$104.00/cwt) with an average of $1,965 per ton ($98.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range decreased $50 per ton compared to last week. Our overall average is down $50 per ton from one week ago. Our price momentum on galvanized steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,928-$2,158 per ton with an average of $2,043 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-12 weeks

Galvalume Coil: SMU price range is $1,800-$2,100 per net ton ($90.00-$105.00/cwt) with an average of $1,950 per ton ($97.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $100 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is down $50 per ton from last week. Our price momentum on Galvalume steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,091-$2,391 per ton with an average of $2,241 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-10 weeks

Plate: SMU price range is $1,770-$1,860 per net ton ($88.50-$93.00/cwt) with an average of $1,815 per ton ($90.75/cwt) FOB mill. The lower end of our range decreased $10 per ton compared to last week, while the upper end remained unchanged. Our overall average is down $5 per ton from one week ago. Our price momentum on plate steel remains at Neutral until the market establishes a clear direction.

Plate Lead Times: 4-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.