Prices

December 9, 2021

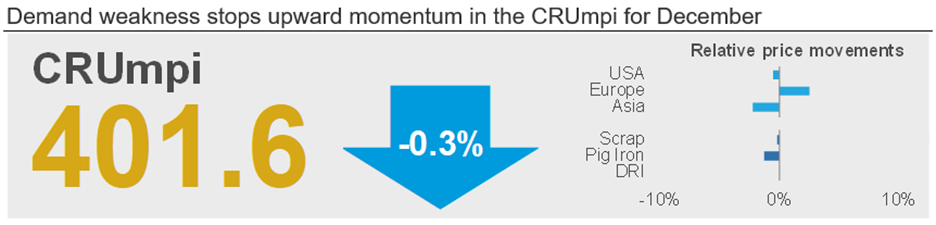

CRU: Global Metallics Prices Come Under Pressure as Demand Wanes

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Metallics Monitor , Dec. 8

The CRU metallics price indicator (CRUmpi) was little changed m/m in December at 401.6 after expectations of another price increase for metallics were dampened by weaker-than-expected demand. Supply is becoming seasonally scarcer in some markets. But, in our view, weakness in finished steel markets is likely to put downward pressure on metallics prices heading into January.

After surging in nearly every market in November, metallics prices across most of the world came under downside pressure in December as demand began to fade. Although sentiment was bullish in the U.S. and Europe heading into this month, a $20+ /t price decline in Turkish scrap import prices was once again a leading indicator that markets were going to be weaker than expected. In both markets, prices were somewhat mixed. But, overall, little changed from the prior month. In Asia, demand was subdued on high scrap and steel inventory levels, which caused buyers to withhold bids given expectations that prices have further to fall. In China, scrap prices again fell m/m as lower coking coal and iron ore costs reduced scrap use at integrated mills. Russia and Brazil were the two markets where scrap prices rose, but export offers for pig iron fell.

Turkish steel producers faced two headwinds leading into December that caused them to lower their scrap import prices. First, a sharp decline in the value of the Lira against the U.S. dollar and Euro, which eroded their buying power for scrap. Second, they have had some issues finding buyers for their finished steel products in international markets – meaning they lowered output and required less scrap overall. The effect so far has been a $20-30/t decline in scrap import prices into the country. With demand falling in their largest export destination, U.S. and European dealers focused more on selling to their own domestic markets. And this supply influx, combined with weaker domestic demand, helped cool expectations of a December price hike.

Scrap demand was also lower in Asia. The emergence of the Omicron variant of Covid-19 combined with lower billet buying interest in China caused EAF-based producers to lower their bids for scrap. Buyers in the region are cautious of another economic slowdown if pandemic countermeasures are deployed because of the new variant, and sentiment is generally bearish as demand for finished steel appears to be low.

Despite low scrap inventory levels at Chinese mills, domestic prices in the country have continued to fall this month along with finished steel prices. With coking coal and iron ore more competitively priced, integrated mills minimized scrap use at their facilities while EAF producers lowered output because they are less competitive.

The two exceptions to cooling scrap markets were in Russia and Brazil. For the former, seasonally weaker scrap collection rates and rising finished steel prices made domestic mills compete with on another for material. In the latter market, mills needed to restock ahead of resuming production in January and increased prices for the first time in six months as a result.

Conversely, pig iron export offers in both Russia and Brazil fell m/m. Part of this decline is a fall in the costs, with 62% Fe iron ore fines falling below $100/t and standard hard coking coal falling below $300/t in late November. Moreover, demand for pig iron from China has been essentially non-existent, and buyers elsewhere are still working through inventories they had built up in prior months.

Outlook: Markets to Remain Unseasonably Cool in January

Demand for both scrap and steel in December proved to be weaker than many market participants had expected, and our view is that this bearishness will persist into January. While seasonal factors will likely restrict supply in some markets, we see falling steel prices and lower hot metal costs as factors that could potentially drive scrap prices lower m/m. However, if price decreases do occur (which is unusual in January), we think they will be modest as collection rates slow.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com