Market Data

December 7, 2021

SMU Deep Dive: Lead Times Slipped as Mills Struggled to Close '21

Written by Michael Cowden

Looking for floor plate for Christmas? What about hot-rolled coil for the New Year? You’re in luck.

Cleveland-Cliffs Inc.’s steel mill in Riverdale, Ill., can get floor plate to you by Dec. 25, or just 18 days from now. And most of its sheet mills can get you hot-rolled coil by Jan. 1, or 25 days from now.

![]() That’s according to published lead times that were effective on Monday, Dec. 6. They indicate that Cliffs has joined a growing list of U.S. mills with steel available at the end of this year or early next.

That’s according to published lead times that were effective on Monday, Dec. 6. They indicate that Cliffs has joined a growing list of U.S. mills with steel available at the end of this year or early next.

Steel Dynamics Inc. (SDI) and NLMK USA, for example, have also published shorter lead times or circulated them among their customers.

Prior published lead time sheets from Cliffs – one effective Nov. 22 and another effective Nov. 29 – had hot-rolled coil lead times at Dec. 25 at most of the company’s sheet mills.

In other words, the company appears to have struggled to close out the year on hot rolled. And lead times over the last few weeks slipped from just under five weeks to just under four weeks.

By the Numbers

Cliffs’ lead times for hot-rolled coil are now at Jan. 1 for its mills in Burns Harbor and Indiana Harbor, both in northwest Indiana. It’s the same date for its Ohio sheet mills – one in Cleveland and another in Middletown. Hot-rolled coil lead times at Riverdale are modestly longer at Jan. 8.

The company’s lead times for cold-rolled coil are mostly late January or early February, although its mill in Dearborn, Mich., has cold-rolled full hard (CRFH) available in mid-January. Several are listed as “inquire.”

It’s a similar situation on the coated side. Galvanized product from Cliffs’ mills and coating lines – Double G Coatings in Byram, Miss., and Spartan Steel Coating in Monroe, Mich., for example – is available in late January or February.

The wait is longer for Galvalume, which Cliffs makes at Double G. Lead times for G’lume are into March – or at least 12 weeks from now.

The Takeaway

Lead times are a leading indicator of prices. They typically lead steel prices on the way up and on the way down. The current cycle is not an exception.

A 3-4 week lead time for hot-rolled coil would not be unusual in a normal market. But it’s a huge change from much of the past year – when lead times were mostly not published and could be measured in months.

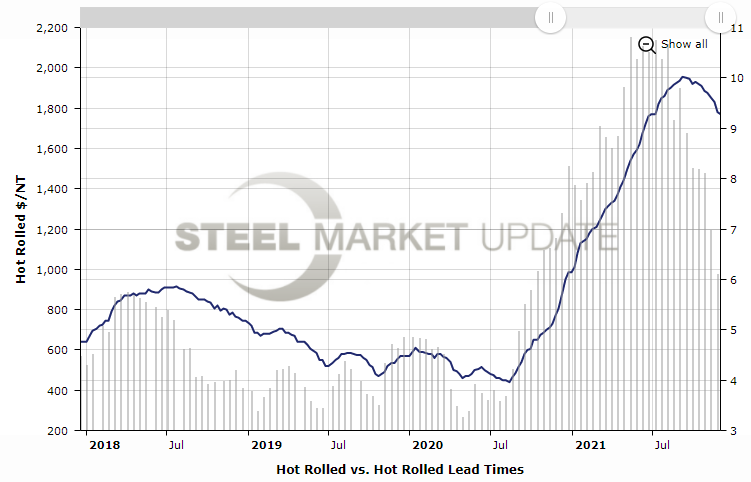

Look at this chart, which you can make for yourself using SMU’s interactive pricing tool. HRC prices are the blue line. Lead times are the gray bars:

The last time lead times were less than four weeks was in August 2020, when prices fell to $440 per ton ($22 per cwt) – what turned out to be a low for last year.

Lead times also fell under four weeks in October 2019, when prices hit $470 per ton – a low for that year too.

But lead times less than four weeks don’t always equate to low steel prices. Lead times dropped below four weeks in October 2018. But prices at the time remained above $800 per ton, well above the $640 per ton where they had started the year.

The strength in 2018 came thanks in large part to Section 232 tariffs of 25%, which were rolled out in March of that year and which sent prices to what at the time were considered historically high levels. Prices now are more than double what they were in the fourth quarter of 2018.

What the Market is Saying

“Why buy? Don’t need it. Can’t cost average our way through the market. That’s a major thing we’ve learned from prior markets,” one respondent to SMU’s most recent survey said.

“Some mills [are] shorter with production gaps from contract transitions. … Many customers went to their minimum contract requirements as prices fell,” a second survey respondent said.

That’s a reference to “min-max” contracts that allow contract buyers to buy on contract terms at a specified minimum or maximum monthly volume. More steel becomes available to the spot market when more contract customers buy their minimum tonnages.

The reverse happened earlier this year, when contract customers bought their maximum allotted amounts, resulting in a spot market squeeze.

But a third suggested the problem might be specific to hot-rolled coil.

“CR seems to remain strong/constrained. Pickling conditions and annealing remain constrained,” that respondent said.

By Michael Cowden, Michael@SteelMarketUpdate.com