Prices

December 2, 2021

Preliminary October Steel Imports Down 17% from September High

Written by Brett Linton

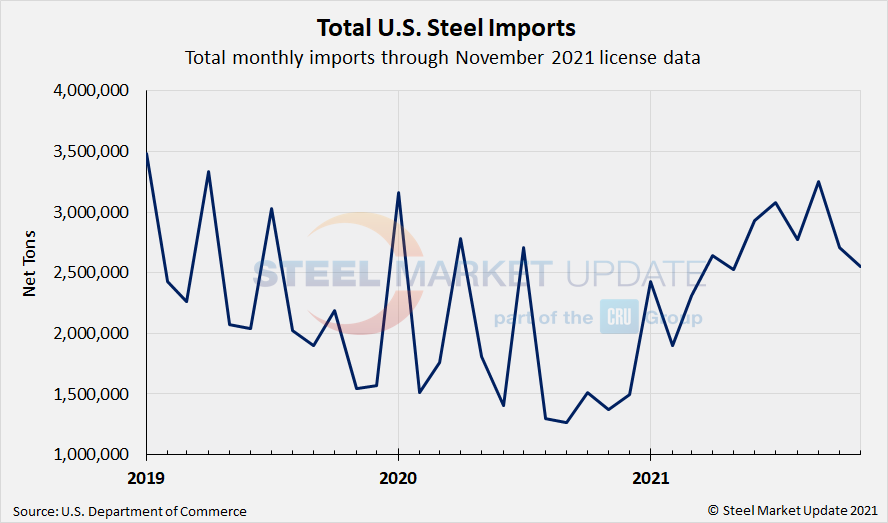

Preliminary Census data shows that total foreign steel imports declined 17% in October to 2.71 million net tons, easing from September’s 28-month high of 3.26 million tons. November import licenses are currently at 2.55 million tons, a 6% decline from October and down 22% compared to September.

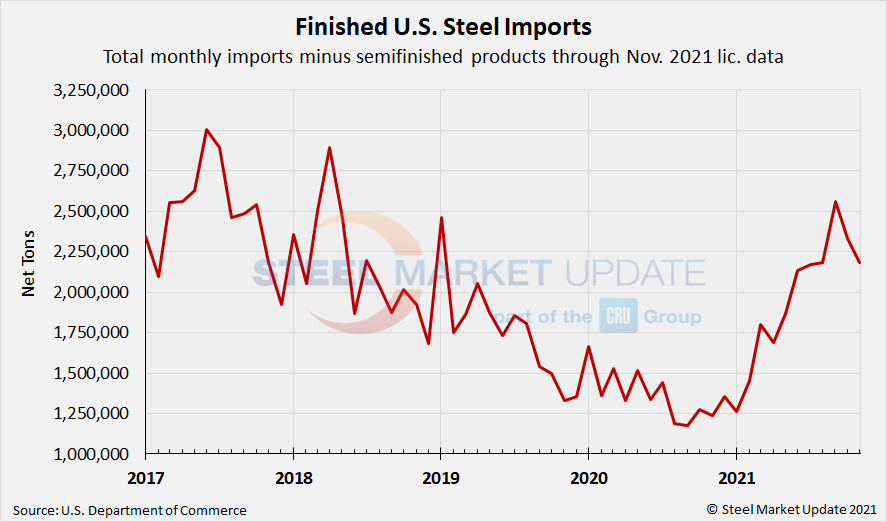

Total finished imports are preliminarily at 2.33 million tons in October, down 9% from the month prior (another multi-month record). Finished steel import licenses for November are currently at 2.18 million tons.

Due to large month-to-month swings in semifinished imports, the chart below shows total monthly imports on a three-month moving average (3MMA) basis in an attempt to more accurately display U.S. steel import trends. The 3MMA through preliminary October data is 2.91 million tons, down from a 3+ year high of 3.04 million tons in September. The lowest 3MMA level in our recent history was October 2020 at 1.36 million tons. Looking at November license data, that 3MMA is currently at 2.84 million tons.

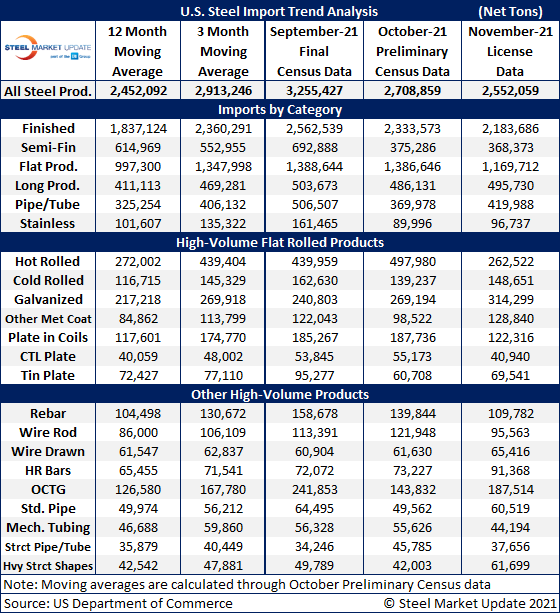

The table below displays flat rolled product imports as well as other high-volume products, including rebar, tin plate, wire rod, structural pipe and tube, and other long products. We also provide data on categorized imports divided into semifinished, finished, flat rolled, longs, pipe and tube, and stainless products.

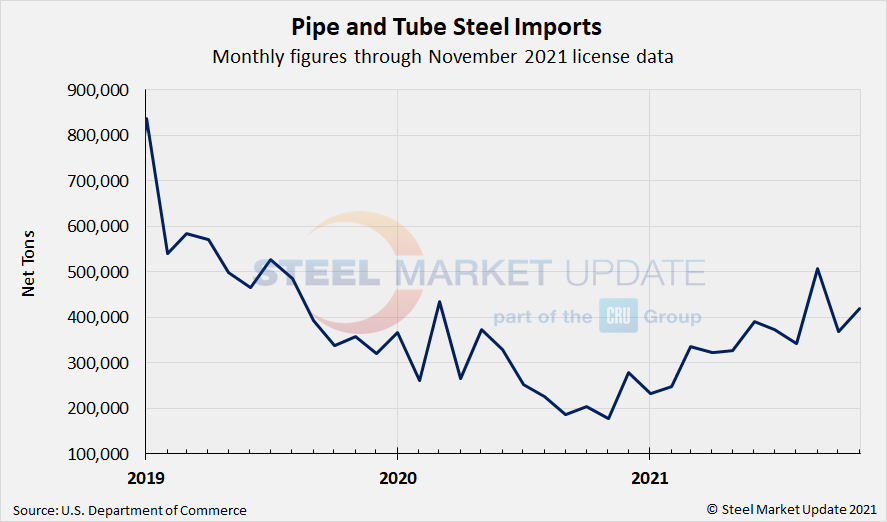

The two charts below show monthly imports grouped by product category: flat rolled imports and pipe and tube imports. November flat rolled imports remain near October’s multi-year high at 1.39 million tons, with the latest November license data showing 1.17 million tons coming into the country. Pipe and tube imports slipped to 370,000 tons in October, while November licenses are currently at 420,000 tons.

By Brett Linton, Brett@SteelMarketUpdate.com