Prices

December 2, 2021

Hot Rolled Futures: Waiting for a Trend to Accelerate

Written by Jack Marshall

The following article on the hot rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

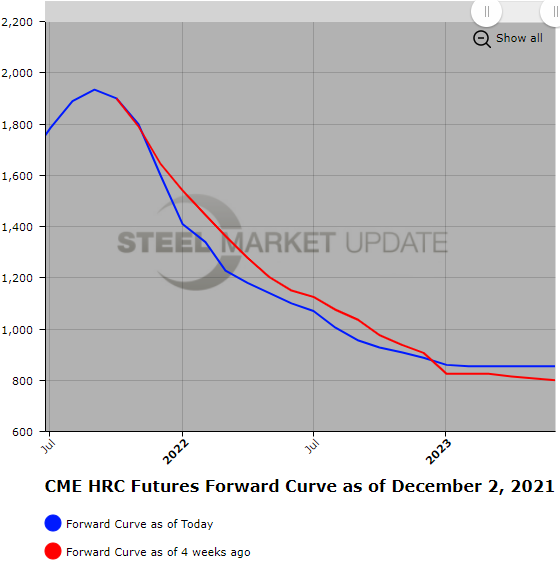

Hot rolled futures sellers are betting that the price of HR will drop significantly in December based on the latest daily settlement of $1,600/ST for Dec’21 HR. The most recent index price drop has doubled the previous price trend decline leaving some to wonder whether the price declines of the last month-plus are about to accelerate.

Last year the price span of the weekly HR averages from the last Wednesday in November 2020 until the final December 2020 index settlement rose $246/ST, from $735/ST to $981/ST. So the potential for a drop of a similar magnitude is not out of the question as December’s average includes five Wednesdays.

Will a COVID-SARS exhausted populace along with an exhausted manufacturing base change the year-end cycle as HR imports continue to increase while tariffs roll back? What will demand look like in Q1’2022? Did the recent bout of hysterical consumption see futures sales moved forward?

Since the spot peaked back at the end of September just above $1,950/ST, the spot market has given back over $250/ST, which is small peanuts when you consider this market has risen over $1,500/ST since mid-August 2020.

In the last two weeks, the HR forward curve has shifted lower with Q1’22 settlements declining by $104/ST and Q2’22 declining by $125/ST. The latter half quarter prices have declined by roughly $30-plus over the same period. The majority of trading activity has occurred in Q1’22 with a fair amount of calendar spread trading. HR volumes are down as participants wait for further clues to potential market volatility.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

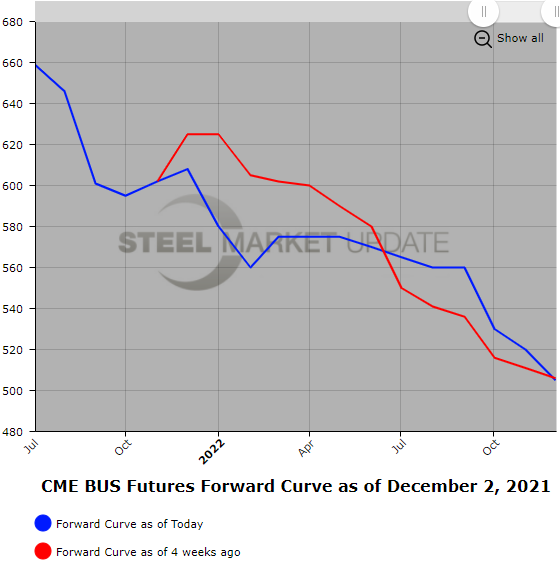

The BUS futures have seen the near dates ease somewhat with Q1’22 backing off $15/GT, while the balance of the curve has been relatively unchanged. The Cal’22 is hovering around the $555/GT level. Early indications had BUS up $10-20/GT, but recent slowdown and HR softness is pointing to a sideways to slightly higher December settlement. Turkish-bound scrap exports are holding steady and domestic shred is expected to be sideways after recent strong buying.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

Editor’s note: Want to learn more about steel futures? Registration is open for SMU’s Introduction to Steel Hedging: Managing Price Risk Workshop to be held Feb. 14-15. You can get more information by clicking here.