Prices

December 2, 2021

CRU: Iron Ore Continues Strong Recovery Despite Calm Market

Written by CRU Americas

By CRU Research Analyst Aaron Kearney-Keaveny from CRU’s Steelmaking Raw Materials Monitor Dec. 7

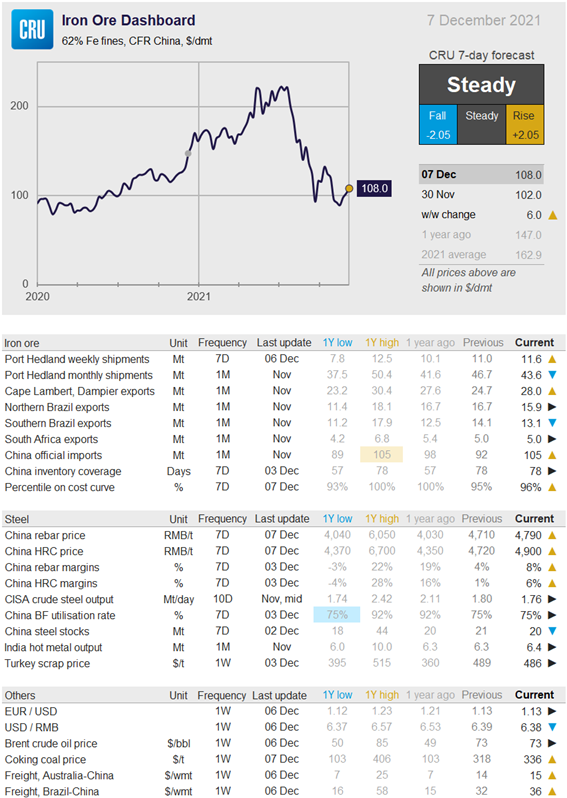

Iron ore remained largely stable in the past week, before rising noticeably on Monday and Tuesday, now standing at $108.0 /dmt. Supply is rising and demand seems stable, but speculation around China has resulted in the iron ore price rising yet again.

![]()

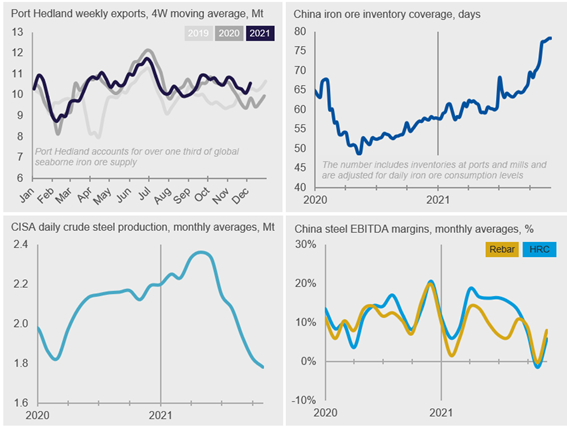

Last week, Chinese steel production remained low while demand improved, further accelerating inventory drawdown. There was an announcement of 50 bp cuts to China’s Reserve Requirement Ratio (RRR) on Monday. Chinese domestic steel prices continued to rise, which helped lift steel margins to ~8% for rebar and 6% for HRC.

Optimistic market sentiment and the expectation of BF restarts helped to push up iron ore prices, particularly in the futures market. This happened despite surveyed BF capacity utilization edging down again and inventories further building at ports with total volume exceeding 155 Mt. Chinese steelmakers often buy up more iron ore in December as they raise rebar production to hold and sell in Q1, but we are not seeing the same increase as in previous years. Demand has remained stable but rising margins and speculation surrounding easing monetary policy and loosening controls over the real estate market are appealing indicators for steelmakers in China.

Supply has improved considerably in the past week, with strong shipments particularly at Port Hedland and in northern Brazil. Rio Tinto is also increasing shipments and the November exports from Cape Lambert and Dampier, the company’s two ports, showed a significant improvement from October. However, its low-grade SP10 product continues to make up a high proportion of exports. In southern Brazil, exports are falling mainly due to miners reducing exports of low-grade material as discounts are high. Another interesting development in the past week is China’s sharp rise in iron ore imports for November (see data below). In our view, this is not indicative of a sudden rise in Chinese demand, but rather the result of offloading activities at ports accelerating throughout Q4. Freight prices have increased after stabilizing at lower levels from historic peaks this year. Brent crude oil prices have reduced after the dramatic fall due to fears of the Covid-19 Omicron variant. India has been retracting from the international market, with both imports and exports reducing.

For the next week, we expect the price to be steady. We have generally seen the price moderate up until the current spike, while demand remains tame. The high inventories and strong supply are likely to diminish increases in demand as a response to higher steel margins. Speculation may remain as an important factor, but without notable and sustained changes to steel production it will eventually run its course.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com