Market Data

November 23, 2021

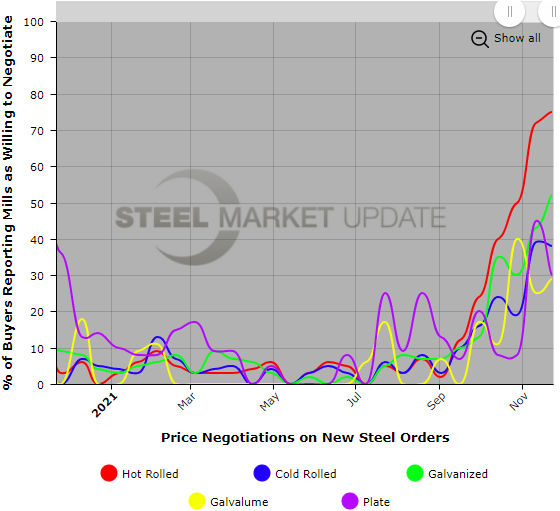

Mill Negotiations: Buyers Gain Pricing Power on HRC, Galv

Written by Michael Cowden

Steel buyers have gained a clear advantage when it comes to negotiating lower prices for hot-rolled coil and galvanized product.

The change in pricing power toward buyers – following a year in which mills could name their price – comes as prices for most products are down, lead times are coming in, and inventories are increasing.

SMU has also shifted its momentum indicators for all sheet products, and not just for HRC, lower.

The one product that mills were clearly less willing to negotiate price on was plate, where the dust is yet to settle on a recent round of price hikes.

That’s the takeaway from Steel Market Update’s latest survey. We ask buyers every two weeks whether mills are willing to talk price on spot orders.

Mills are willing to negotiate “in a small band,” one survey respondent said. “We’re still not seeing a willingness to tank the market.”

Others characterized mills’ willingness to negotiate on a broad spectrum from “very little” to “absolutely flexible.”

By the numbers, 75% of hot rolled coil buyers responding to this week’s survey said mills were more willing to negotiate lower prices to get an order. That’s roughly in line with our last check of the market.

The percentage of galvanized respondents reporting mills willing to negotiate was 52%, up from 43% in our last survey. That marks the first time since August 2020, when the market hit bottom after the COVID-19 outbreak, that more than half of galvanized buyers reported mills willing to consider lower prices.

Check out the rest of our data in the charts below:

By Michael Cowden, Michael@SteelMarketUpdate.com