Plate

November 21, 2021

Sheet, Plate Prices Near Parity - Will Plate Get Its Premium Back?

Written by Michael Cowden

Sheet and plate prices are nearing parity for the first time in about a year, the latest sign of a market in flux.

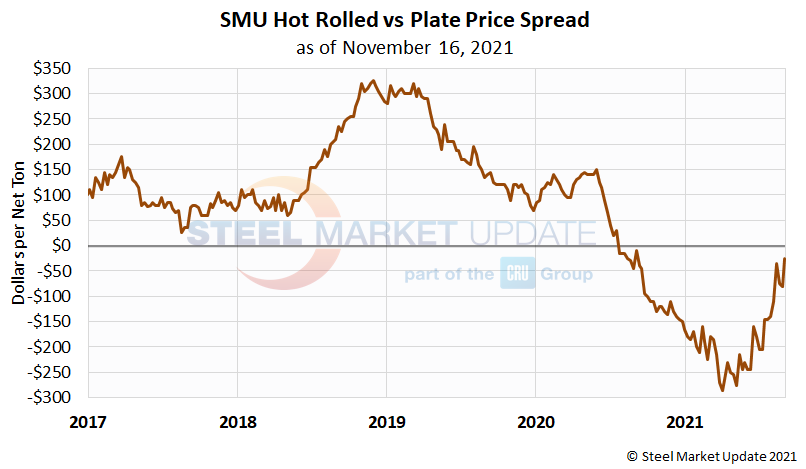

Below is a good way to visualize that trend. The chart below maps out the spread between sheet and plate going back to 2017.

If we rewind to mid-November of last year, hot-rolled coil was at $730 per ton ($36.50 per cwt), and plate was at $720 per ton. The $10-per-ton premium sheet carried to plate seemed unusual at the time. That’s because plate in recent years has often carried a spread of several hundred dollars per ton over sheet. The logic: plate is a value-added product that requires more time on the mill, and time is money – so producers are usually able to charge more for it.

As you can see in the chart above, plate’s premium over sheet is more often $10 per cwt – or $200 per ton. And it has at times climbed higher than $300 per ton, as was the case during much of the first half of 2019.

Like a lot of things, the sheet-plate spread started out 2020 looking relatively normal. Between $100-150 per ton – not the $200 per ton mills might like, but still worth their time to make. And while prices collapsed for both sheet and plate in the second quarter of 2020 following the outbreak of the pandemic, that spread remained roughly intact.

The trouble started when demand unexpectedly snapped back in the second half of 2020 – catching both producers and consumers by surprise.

Prices for both products bottomed out in mid-August 2020: $440 per ton for sheet and $590 per ton for plate – a spread of $150 per ton. But sheet staged a much stronger comeback than plate. The sharp rebound in demand was largely for consumer goods – cars and appliances, which are sheet intensive. Plate is more exposed to construction and energy markets, which lagged the initial recovery.

By the end of last year sheet was at $985 per ton and plate at $875 per ton – meaning sheet had within just a few months established a more than $100-per-ton premium over plate. And sheet’s premium over plate only increased from there, approaching $300 per ton this summer as steel prices continued their epic rally.

Why would mills let that happen? Simply put, sheet is an easier product to make. So, if a mill can make both, why not devote as much time and hot metal as possible to coil. Think of it this way: If diners are willing to pay more for burgers than steak, why not sell as many burgers as possible?

Similar dislocations have occurred in long products. Wire rod is more demanding to make than reinforcing bar and so typically costs more. But when construction markets heat up, rebar, a comparatively basic product, can hold a premium over rod.

The trend of sheet holding a premium over plate began to reverse in September, around when sheet prices peaked at $1,955 per ton.

Sheet prices have since fallen $125 per ton to $1,830 per ton, according to SMU’s interactive price tool. Plate prices, in contrast, have risen modestly from $1,775 per ton to $1,805 per ton on mill price hikes and expectations of higher scrap prices. Plate is now only $25 per ton away from being at parity with sheet.

Will plate regain a premium of $200 per ton or more over sheet in the months ahead? That depends on whether the declines seen in hot-rolled coil since early September continue and on whether plate will manage to buck that trend and move higher or at least not lose ground.

With the rig count up, signaling better days ahead for energy, and the infrastructure investment bill signed into law, the hope is that better days are ahead for plate.

By Michael Cowden, Michael@SteelMarketUpdate.com