CRU

November 2, 2021

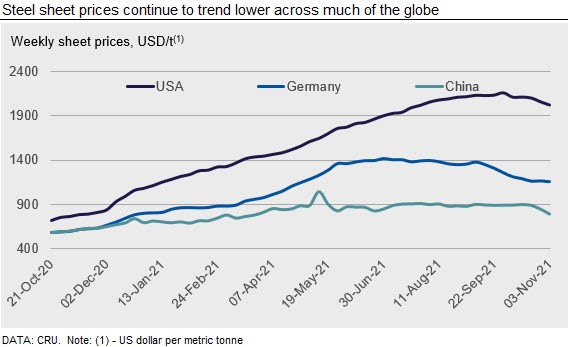

CRU: Sheet Prices Fall in Most Markets on Weakening Demand

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley from CRU’s Steel Sheet Products Monitor

Falling demand in most markets around the world has continued to weigh on steel sheet prices. Meanwhile, the announcement that the USA will remove Section 232 tariffs on steel and aluminum producers in the EU and replace them with a quota system means that imports are even more viable for U.S. importers. At the same time, rising inventory levels and slowing demand have already caused domestic HR coil prices to fall. Conversely, this announcement means EU producers will have an outlet for material that has not yet been placed in their domestic markets, and market sentiment is growing more bullish as a result. The largest sheet price decreases this week occurred in China, where easing electricity shortages has allowed for higher steel production even as end-use demand evaporates. Chinese traders are now offering material into other markets in Asia, causing import prices in those countries to fall. The exception to this was in India, where low import levels have allowed for a small increase in prices.

USA

U.S. CR coil and HDG coil prices were unchanged, while HR coil prices continued to fall this week. Transaction volumes remain limited, with more deals occurring at lower price levels. HR coil prices declined by $34 /s.ton w/w, but are still well above global pricing levels, leading to the expectations that prices will continue to erode over the coming weeks. Material originally destined for the automotive industry is now being offered to distributors as supply shortages continue to negatively affect vehicle production. Most steel sheet buyers report that their inventories are balanced with current demand levels, but there are rising concerns that as mills begin delivering past-due orders inventories could become inflated. Competition for new orders is increasing between service centers, as companies feel pressured to work through high priced inventory before prices fall further. The U.S. and EU reached an agreement to replace the current 25% steel tariff with a tariff rate quota system, set to begin Jan. 1, 2022. Under the new arrangement, a certain amount of steel and aluminum will be allowed into the USA without facing Section 232 tariffs.

U.S. West Coast prices were stable again this week as buyers wait for January mill order books to open. Buyers have not begun to see competitive pricing from domestic mills located outside of the West Coast, but are hopeful that may change when lead times reach 2022 Q1. There had been speculation earlier in the year that demand would not be affected by the normal holiday slowdown, but contacts have already started to observe declining demand.

Europe

European sheet prices were mixed following the news that the USA will remove Section 232 tariffs on steel and aluminum in favor of a quota system. While Italian sheet prices fell by €10-12 /t w/w across all sheet products, German sheet prices found a bit more support with CR coil stable and HDG rising by €7 /t w/w. Market sentiment turned somewhat bullish as the new quota system may provide an outlet for unfilled orders at European mills.

China

Supply tightness in the Chinese domestic sheet market eased as operations restarted at some mills this week. While power rationing had previously halted steel mill production, energy availability has increased following government action. However, demand remained subdued, especially after the release of the October manufacturing PMI, which registered an eighth consecutive fall m/m. Adding to bearish sentiment was a drop in the futures market, with sheet prices falling by 4-6% w/w. While end-use buyers withheld purchases, offers from panicked traders have caused mills to worry because margins at the levels offered by traders would now be at 6.1% for HR coil. The spot market remains volatile and has yet to find a bottom, and it is difficult to see any material end-use demand improvement that would support a significant rebound as we move to the end of the year. Therefore, our sheet price forecast remains bearish for November.

Asia

Import prices in Asian sheet markets are coming under increasingly strong downside pressure as steel prices fall in China. While offers for HR coil SAE1006 grade from India were stable at $890 /t CFR Vietnam, there have been increasingly larger amounts of material being offered by Chinese traders. According to market contacts in Vietnam, offer ranges are wide as more traders are trying to do short selling. Offers for January shipments were heard at $855-870 /t CFR Vietnam, while offers for February shipments were at $840-855 /t CFR Vietnam.

For HR coil/sheet SS400, a deal was heard at $870 /t CFR Vietnam for Chinese material with December shipment last week. Buying interest was muted this week while offers for Chinese material fell to $855/t CFR Vietnam.

CRU assessed HR coil prices at $860 /t, CR coil prices at $1,110 /t, and HDG prices at $1,130 /t CFR Far East Asia—all down by $10 /t w/w.

India

Sheet prices in India have maintained upward momentum at the start of November, with prices rising by INR300-600 ($4-8) /t w/w. With this increase, sheet prices have breached the ceiling set during the second week of June (i.e. CRU’s assessment as of June 9, 2021). Meanwhile, the spread between HR and CR coil prices has narrowed further because the level of price increase is higher for HR coil than for CR coil. Demand for CR coil in India is currently being impacted by a slowdown in automotive sales and output.

For the month of October 2021, aggregate wholesales (i.e. sales from carmakers to dealers) of passenger vehicles by 12 major carmakers were down by 21% y/y to 258,774 units, with India’s largest carmaker Maruti Suzuki reporting a 33% y/y decline in sales. The carmaker has projected its vehicle production to be 85% of the normal output in November 2021, as the industry continues to struggle with shortages of key components. Furthermore, the Federation of Automobile Dealers Associations (FADA) has termed the 2021 festive season as the worst in a decade for automobile sales.

Nevertheless, current elevated levels of sheet prices are being supported by lack of imports and robust demand from white goods, machinery, and construction end users. Steelmakers continue to pass on rising cost of raw materials to consumers, but we have observed instances of buy-side resistance to these price increases, wherein several consumers are deferring their purchases to the next quarter, expecting steelmaking input costs to ease.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com