Prices

October 21, 2021

Hot Rolled Futures: Mixed Bag Leaves Market Divided

Written by Jack Marshall

The following article on the hot rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

Three minutes of weightlessness before gravity takes hold!

This month has been a mixed bag in HR futures. Lack of a clear trend and uncertainty due to COVID-19 supply-chain issues has left the market divided. Forecasters are trying to answer the following questions: Given that HR demand remains robust, have HR imports increased enough to offset the lower domestic mill production rates triggered by COVID? How soon will the new mill production facilities impact supply?

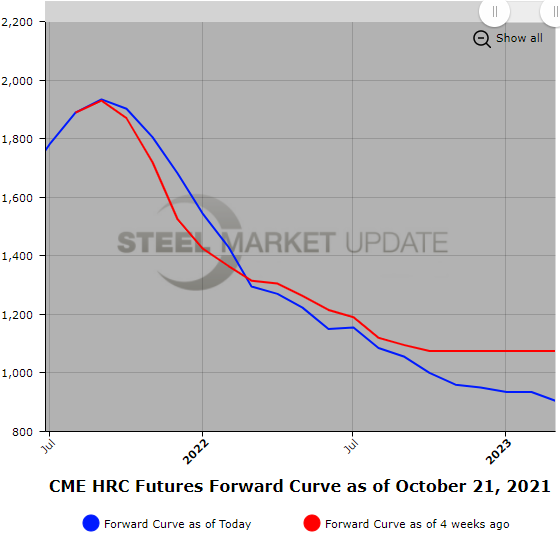

Spot appears to be somewhat rangebound just north of $1,900/ST with futures hedging activity either extremely muted or extremely active. Previous monthly hedging activity was more consistent. The Dec’21 HR through Feb’22 HR months have been supported of late, which could signal a slower price retracement in the near term. Yesterday, HR futures volume was over 60,000 ST with most months through Dec’22 averaging about 4,000 ST and Oct’21, the front month volume, north of 8,300 ST. Interestingly Q4’21 and Q1’22 average prices ($1,795 and $1,423) are unchanged when you compare Oct. 1 and Oct. 21 settlements, while the latter 12-month quarters are lower by just about $33/ST per quarter. Based on the latest CAL’22 HR settles – Jan’22 HR minus Dec’22 HR leaves a $595/ST discount versus a $530/ST discount from the Oct. 1 settle.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

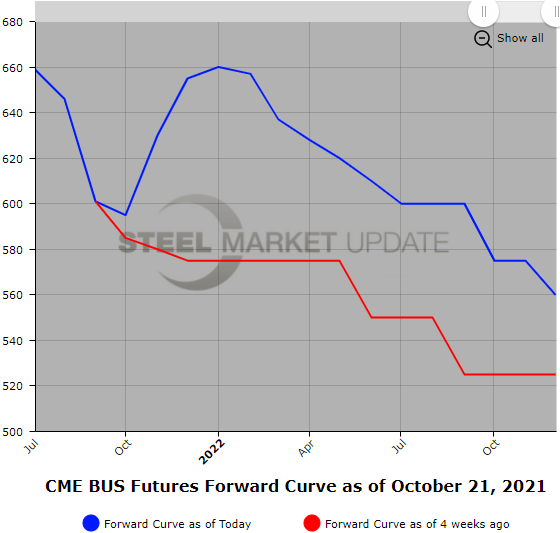

BUS prices have seen a healthy pickup in the last week or so. Early chatter has prime scrap up $40/GT, coinciding with a healthy rise in export cargoes of 80/20 scrap, which are up over $45/MT.

Near date BUS is valued around $625/GT. Most of the BUS futures curve reflects the anticipated $40/GT increase in spot.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

Editor’s note: Want to learn more about steel futures? Registration is open for SMU’s Introduction to Steel Hedging: Managing Price Risk Workshop to be held Nov. 2-3. You can get more information by clicking here.