CRU

October 15, 2021

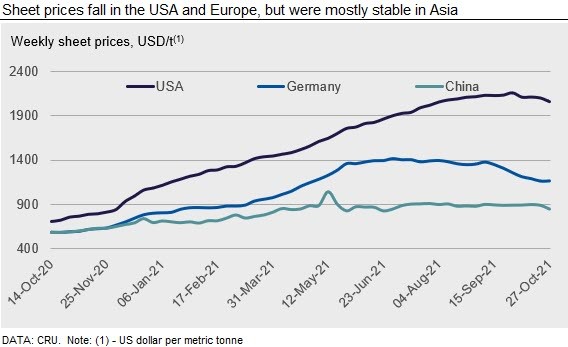

CRU: Sheet Prices Fall in Western Markets as Lead Times Shorten

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Sheet Products Monitor

Steel sheet price declines continue in the USA and Europe as lead times shorten further and inventories build. In the former market, small transactions are occurring at levels above $1,900 /s.ton, but there are many more deals occurring at well below this level. As such, we expect to see high levels of price volatility in the coming weeks. Meanwhile, European mills are still competing with less expensive imports, driving prices lower once again w/w. Chinese prices moved lower on concerns surrounding the possibility of major problems in the real estate market, while in other Asian countries prices rose on restocking activity in Vietnam and increasing demand in India.

USA

HR coil prices in the U.S. continued to decline this week, falling by $38 /s.ton w/w. As expected during times of market adjustment, we are seeing a larger than normal range of transaction prices. While we did receive spot transactions at $1,900 /s.ton and higher, these purchases were at minimum mill volume levels. We continued to record an increasing number of spot transactions well below the $1,900 /s.ton level from a variety of data providers. Now that inventories have been rebuilt, buyers are hesitant to purchase material that is not necessary for a contractual obligation or an immediate need, leading to fewer reported transactions at lower volumes. The rate of growth for sheet consumption has decelerated from earlier this year and is expected to continue decreasing as we enter a seasonally slower shipping period. With domestic mill lead times shortening and imported material expected to arrive during the balance of 2021 Q4 and 2022 Q1, many companies are waiting for clarity regarding future pricing and demand before making large spot purchases. There was uncertainty among buyers about whether the newly announced maintenance outages at several domestic mill locations would limit supply enough to prevent any further price erosion.

Domestic steel sheet prices on the U.S. West Coast were unchanged this week. Import offers for 2022 Q1 arrival are reported to be well below domestic mill pricing, with many mills willing to negotiate further to secure an order. While ports are now operating around the clock, seven days per week, they are still facing large backlogs of ships to unload. Rail car and truck availability is still very tight with most buyers expecting the situation to last well into 2022.

Europe

European sheet prices have seen smaller declines this week as both German HR coil and CR coil have come down by €2 /t w/w. Italian prices on the other hand have had a relatively similar slowdown to last week, falling by €18-€24 /t w/w across all sheet products. Despite the generally bearish mood in the market mainly due to the slower demand from the automotive sector, most European buyers are aware that energy costs, increased scrap prices and rising export prices from Turkey and Russia will likely favor the position of European producers during their 2022 Q1 contract negotiations.

European mills are understood to have some space in their order books for the end of the year. Market sources said that an Italian mill had been offering HR coil priced at €920 /t delivered for December shipment. Some smaller mills in central Europe have helped to press down prices as they reportedly look to fill order books by offering volumes at more competitive prices. Imports are still appearing at lower price levels than the spot market with Korean HR coil said to be offered at €850-870 /t CFR to Italian buyers.

China

Chinese domestic sheet prices continued to decline, falling by RMB200-300/t over the past week. While the domestic property market slows amid the Evergrande crisis, market participants have become bearish due to a weaker-than-expected local government bond issuance to date. Moreover, the recent property tax pilot program has further hurt confidence on new housing starts, putting further downward pressure on construction steel demand. Scarce transactions this week due to the sudden price decline, together with continuous production controls, drove sheet inventories down by 2% w/w. Worries that the government will further restrict coal price movements have dragged down sentiment, and spot prices reacted quickly following a dip in futures market on Wednesday. We expect sheet prices to stay volatile in the short term amid unstable sentiment.

Asia

The market of imported sheet products in Asia was active last week amid restocking activity in Vietnam.

Deals for cargoes of HR coil SAE1006 were concluded at $890-900 /t CFR Vietnam. However, these deals are for prompt shipments that either already arrived at Vietnam’s ports or were scheduled to arrive within the next two weeks. According to market contacts, these deals for Indian material were earlier concluded at $920 /t CFR Vietnam.

An Indian steel mill was heard to have sold 10kt of HR coil SAE1006 grade to a Vietnamese reroller at $872 /t CFR Vietnam for December shipment.

For HR coil SS400, some Chinese mills lowered their offer this week to $850 /t FOB China for December/January shipments but, because of the high freight costs, the price would be $890-900 /t CFR Vietnam.

CRU assessed HR coil prices at $870 /t, CFR Far East Asia, a $10 /t fall w/w. CR coil prices were assessed at $1,120 /t CFR Far East Asia, unchanged w/w, while HDG prices were assessed at $1,140 /t CFR Far East Asia, also unchanged w/w.

India

Indian domestic sheet prices have increased by another INR1300-1600 ($17-21) /t w/w. The extent of price rises continues to be larger for HR coil than for cold rolled and coated sheet products. This has led to further narrowing of the HR-CR coil price spread, as growth of downstream sheet offtake from key manufacturing end users remains affected by shortages of other input materials. In the automotive sector, the latest vehicle registration data from Indian Ministry of Road Transport and Highways suggests a fall of just over 11% y/y in automobile registrations in October. Accordingly, automakers may continue to curtail their production levels.

Nevertheless, the latest price hike has reverted the Indian HR coil price to the year’s peak (achieved in June 2021) and there remains a likelihood of further price increases in the coming weeks as steelmakers promptly pass on coal cost increases to consumers. Moreover, India’s largest steelmaker, JSW Steel, has announced plans to introduce a differential pricing mechanism for OEM contracts to adequately capture price fluctuations in coking coal. This follows the shift from bi-annual to quarterly steel price contract negotiations with automakers in order to address intense price volatility.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com