CRU

October 15, 2021

CRU: Futures Now Pricing in Further, More Significant Price Declines

Written by Josh Spoores

By CRU Principal Analyst Josh Spoores, from CRU’s Steel Sheet Products Monitor

Over the past five weeks since we last reviewed the CME Group’s HR coil futures market, there has been a renewed surge in volatility. Spot prices of physical HR coil have clearly plateaued, yet more likely started a new downtrend, and futures prices have started to move lower in a rapid manner. Granted, physical HR coil prices today are only lower by $18 /s.ton from our Sept. 8 assessment, yet the forward curve has moved at a much faster rate.

We look at contract values for the Monday that proceeds the publishing of this report. For just 2022 contracts, we have seen a steep fall, where futures prices are down $222 /s.ton from a prior value of $1,409 /s.ton for all of 2022 to $1,187 /s.ton as of earlier this week. Last month we mentioned how quickly the iron ore forward curve was repriced and now we have started to see some bearish activity emerge in the U.S. Midwest HR coil futures contracts.

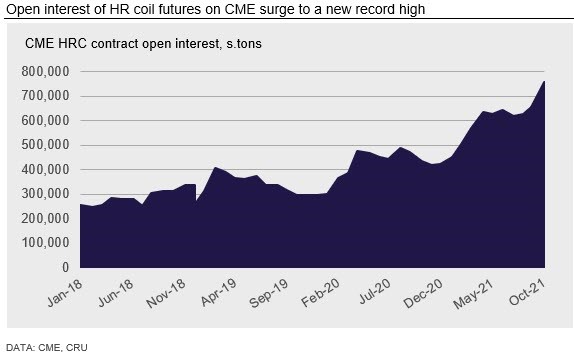

While future values of HR coil have fallen, we have seen an increase in the overall volume and open interest of these contracts. At the close of trading this past Monday, open interest of 37,777 contracts represents 755,540 s.tons of HR coil. This level of open interest has jumped by 15.7% from early September and is up 60% y/y.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com