Prices

September 23, 2021

Futures: Iron Ore – Selling Pressure Continues!

Written by Tim Stevenson

SMU contributor Tim Stevenson is a partner at Metal Edge Partners, a firm engaged in Risk Management and Strategic Advisory. In this role, he and his firm design and execute risk management strategies for clients along with providing process and analytical support. In Tim’s previous role, he was a Director at Cargill Risk Management, and prior to that led the derivative trading efforts within the North American Cargill Metals business. You can learn more about Metal Edge at www.metaledgepartners.com. Tim can be reached at Tim@metaledgepartners.com for queries/comments/questions.

Iron ore is of course one of the key raw materials for steelmaking. Blast furnaces combine ore with a number of other ingredients (including coke which is made from metallurgical coal) to make steel. While minimills don’t use ore directly – scrap is really just ore and energy combined. Consequently, at the end of the day, ore prices matter for all steel production costs.

The brutal selloff in iron ore that we have seen over the past two-plus months is nothing short of stunning. Some people have asked – why do you watch ore prices in China; does it really matter for the U.S.? The answer is yes – though it can take some time for it to matter, despite the fact that most of the integrated mills here in the U.S. have their own captive iron ore supplies and don’t pay the seaborne ore price. Here is a chart of the spot ore price CFR Qingdao, China:

You can see that ore actually peaked in May of ’21, then fell off sharply before rallying back to the low $200s in early July. Then the harsh selloff began. Why might this matter to steel prices back here in the U.S.? Lower ore prices in China mean lower costs of slab, pig iron and steel production. Lower costs there mean the Chinese can export steel at lower prices to Asia and other countries around the world. While it is true that very little Chinese steel can actually come into the U.S. due to tariffs, when Chinese export prices fall, other prices in Asia fall. Consequently, countries that export steel out of Asia into other geographies can offer lower prices, dragging prices down outside of Asia. Subsequently, import prices into the U.S. can then also move at lower prices. These dynamics take some time to play out, which is why changes in seaborne iron ore don’t necessarily have an immediate impact on U.S. prices, but normally if the price differential is too high, it doesn’t last.

Iron ore futures have been under pressure as well. You can see from the chart above that prices for Calendar 2022 have declined significantly over the past month, with the current price for the year sitting at roughly $102. This is off the bottom a bit, as this 2022 number was $87 just a week ago.

One market phenomenon that has been a bit perplexing is why domestic Chinese steel prices haven’t followed the ore price down – at least not yet. Check out this chart (left hand scale is China steel prices in RMB, right hand scale is ore in $/ton):

What may be the reason? It could be metallurgical coal – or coking coal:

Coking coal prices have soared as China banned imports of Australian coking coal, and the border between Mongolia and China has been almost closed off due to COVID. This slowed coking coal imports from Mongolia to a trickle. While the Chinese mills are getting a big cost savings from ore declining, coking coal has taken up the slack and may be part of the reason why HRC prices in the country are holding up. If this changes, it could have important ramifications for steel prices in the region and around the world.

Now shifting over to the U.S., the HRC futures curve has been in turmoil:

Over the past couple of weeks, the curve has fallen by over $200/ton in some months, and there are many theories as to why. One possibility was news that the U.S. had submitted a potential plan to remove the Section 232 tariffs to the EU, though few details are known about the proposal. In addition, there has been buzz about more aggressive import prices into the U.S. Lastly, there has been speculation about potentially lower prices being available from some domestic mills. We haven’t seen changes in the indexes, but sometimes sentiment and/or rumors are enough to get people to react.

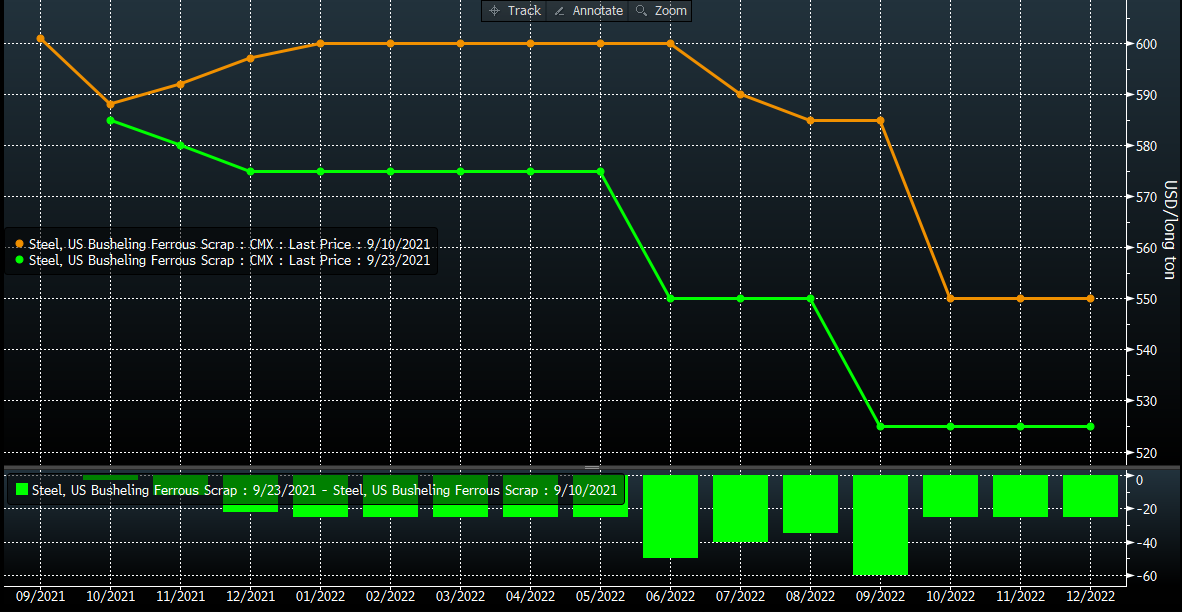

Over the same period, busheling futures have also come under some pressure, the cause of which is also up for debate. The limited auto production here in the U.S. should mean less supply of busheling, and EAF mill capacity is set to grow, which should boost demand. However, both of these factors would push prices higher not lower. While we don’t know – we suspect the lower ore prices may be partly to blame. As we mentioned before, lower ore prices weigh on pig iron prices, and then generally lower scrap prices around the world, including the U.S. In this latest steel price cycle, scrap and steel prices have become decoupled, so lower busheling may not matter. For now.

One last point. Looking at where we hear import offers are for early 2022 arrivals, it will be tough to hedge these imports at current levels. If you have to pay $1,400 for imported steel, selling the forward curve at that level (or below) isn’t a profitable hedging option. Unless something changes, this could limit further import buys. With that we will wrap up. Thanks for reading and stay healthy!

Disclaimer: The information in this write-up does not constitute “investment service,” “investment advice” or “financial product advice” as defined by laws and/or regulations in any jurisdiction. Neither does it constitute nor should be considered as any form of financial opinion or recommendation. The views expressed in the above article by Metal Edge Partners are subject to change based on market and other conditions. The information given above must be independently verified and Metal Edge Partners does not assume responsibility for the accuracy of the information