Analysis

September 21, 2021

Final Thoughts

Written by Michael Cowden

If you feel a chill in the air, it’s not just the first day of fall and cooler weather coming. We’ve noticed a cooling in market conditions – and it’s backed up by our survey results (which are colorful like fall leaves).

Let’s not talk about prices, at least not directly. Let’s talk about lead times, sentiment and when people think prices will peak. Let’s also dig a little into service center resale prices. Because those can be just as important as lead times as far as leading indicators go.

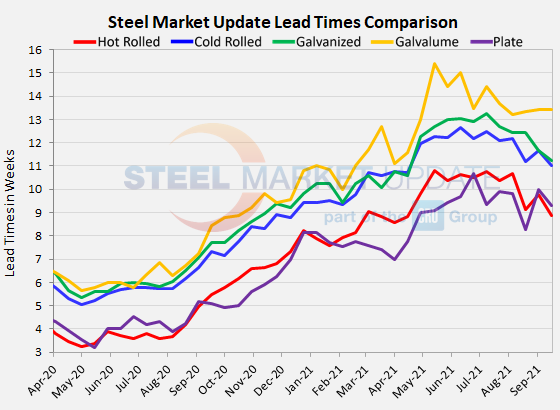

Lead times have come down significantly in recent weeks. They are down for all the products we track them for: Galvalume, galvanized, cold rolled coil, hot rolled coil and plate. The data can be bumpy, so I try not to read too much into any one week. But when I see a significant, synchronized decline across all five products, I think that is meaningful.

The chart below gives you some idea of just how big a change we’re seeing versus just a month or so ago. For almost a year, respondents to SMU’s surveys reported that lead times were slightly longer than normal or highly extended. That’s the red bars. More recently we’ve seen some normal and shorter than normal lead times – the blue and green bars – creep back into the picture. That’s not something we’ve seen since 2020.

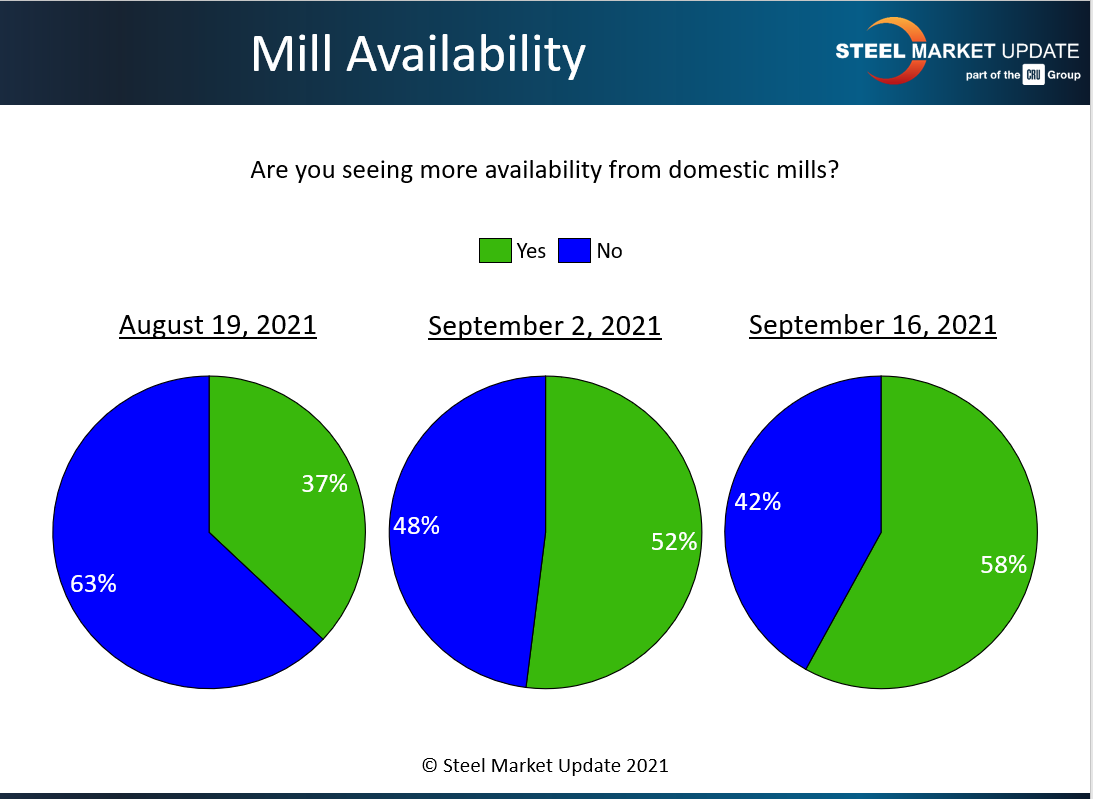

Why is this happening? Simply put, mills have more availability now than they did a month ago, according to our survey respondents. That doesn’t mean steel isn’t still tight. But it means the scramble for steel is, if not over, at least not as frenzied as it had been. And keep in mind that restocking drove a lot of demand over the last 12 months.

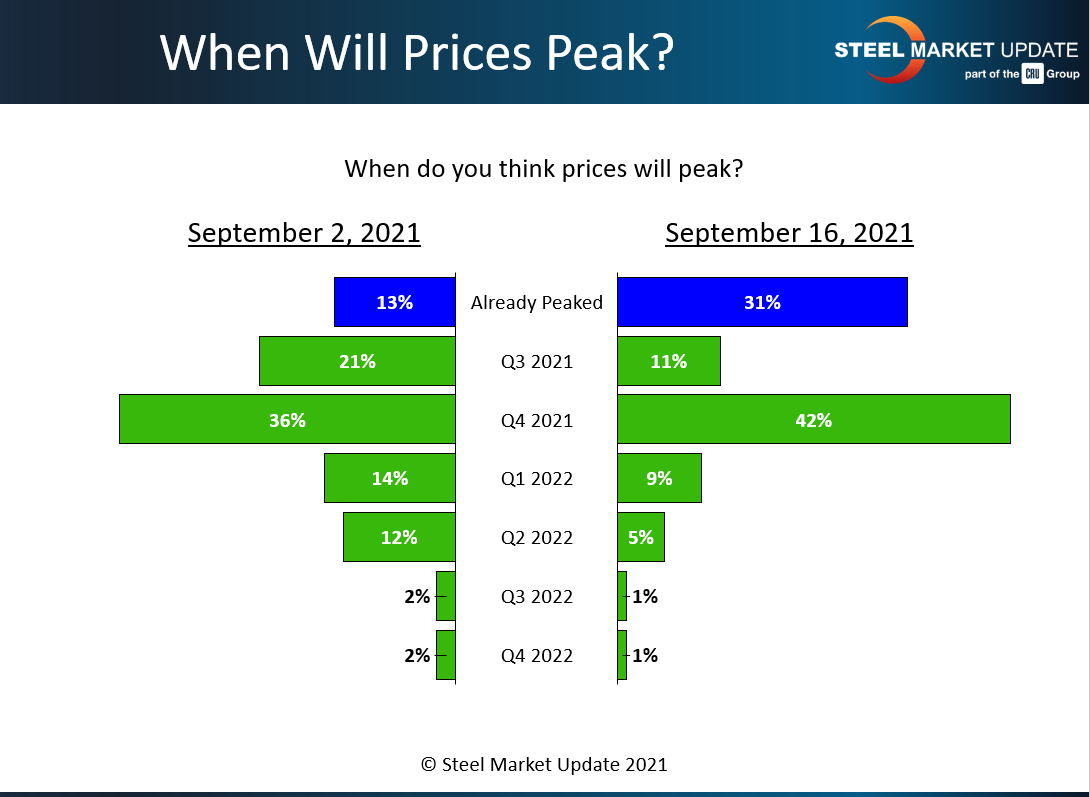

Again, I’m not going to talk specific prices here. You can look at our prices ranges for that. We’re going to look at when people expect prices to peak. Nearly 85% of survey respondents think prices have peaked or will before the end of the year. That’s a big change too. Because not all that long ago, the camp saying that prices would keep going up well into 1H 2022 was bigger than it is now.

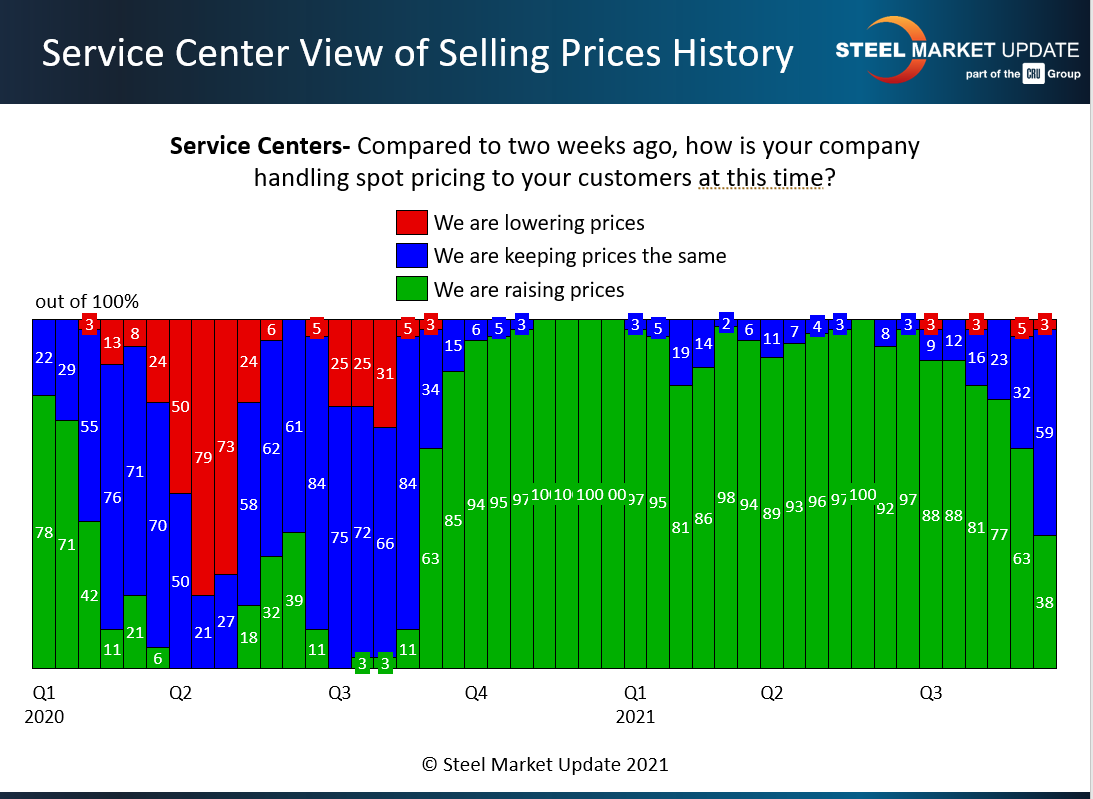

Keep in mind we might not see lower prices from mills first. We might first see – in fact we already have seen – service centers having a little more trouble passing along higher mill prices to customers. Very few report lowering prices. But a clear majority are no longer raising prices. They’re keeping prices the same. Since Q4 of last year, service centers have been consistently raising prices. That’s the green bars. But in recent weeks there has been a clear shift to them holding them steady – that’s the blue bars. And it’s been a pretty dramatic shift in just the last few weeks.

Also, the negative data points outside of the limited universe of our survey are piling up: higher import volumes at lower prices enticing buyers near ports, lower steel prices in Asia and Europe, sharply lower iron ore prices abroad, and lower scrap prices at home. And, outside of steel, I’m starting to wonder if I believe that the Evergrande contagion in China won’t spill over elsewhere. The Wall Street consensus seems to be that Beijing has it under control. I remember hearing that in the early days of the COVID-19 pandemic too. A virus and a big default have almost nothing in common. That said, I think it’s fair to say that humans sometimes overestimate their ability to control events.

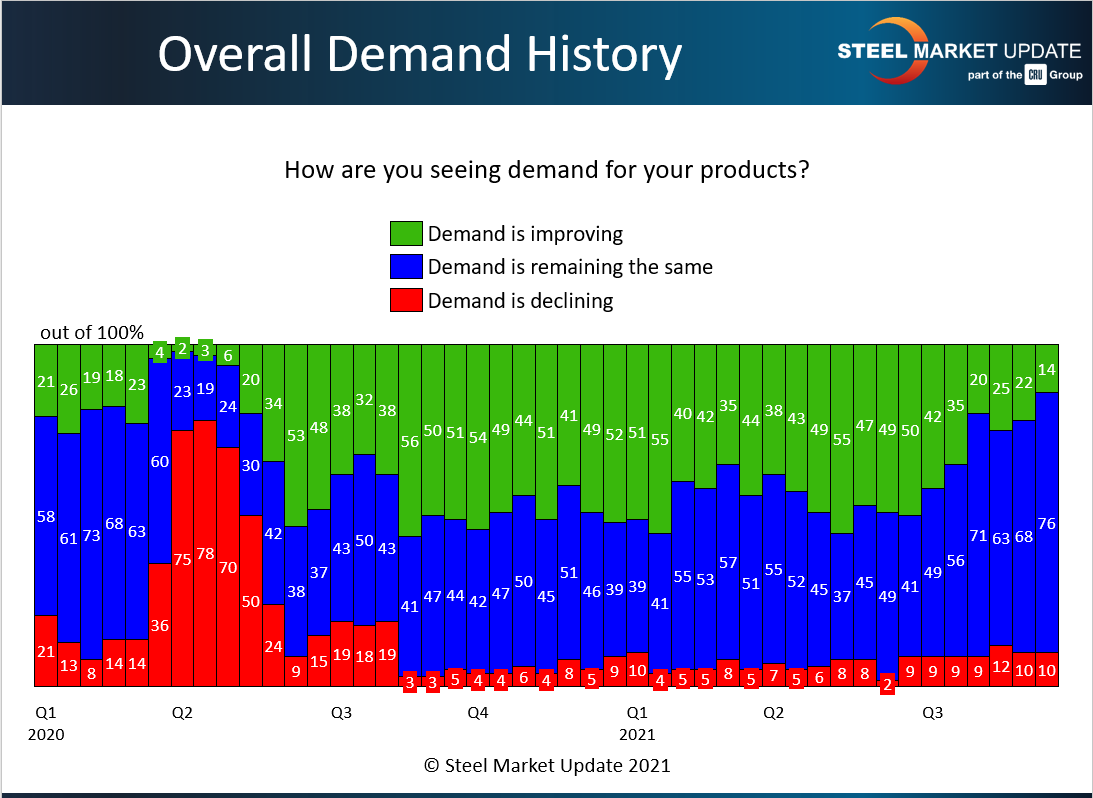

So why am I not joining the sky-is-falling crowd just yet? Overall demand is still pretty good. If there is one thing that worries me, it’s that fewer survey respondents are saying that demand is improving. In other words, the green bars are noticeably lower now than at the beginning of the quarter. Like a lot of people in the industry, I hope there is a soft landing should we start to come down off the peak. But let’s remember that other commodities – lumber and more recently iron ore – were afforded no such luxury.

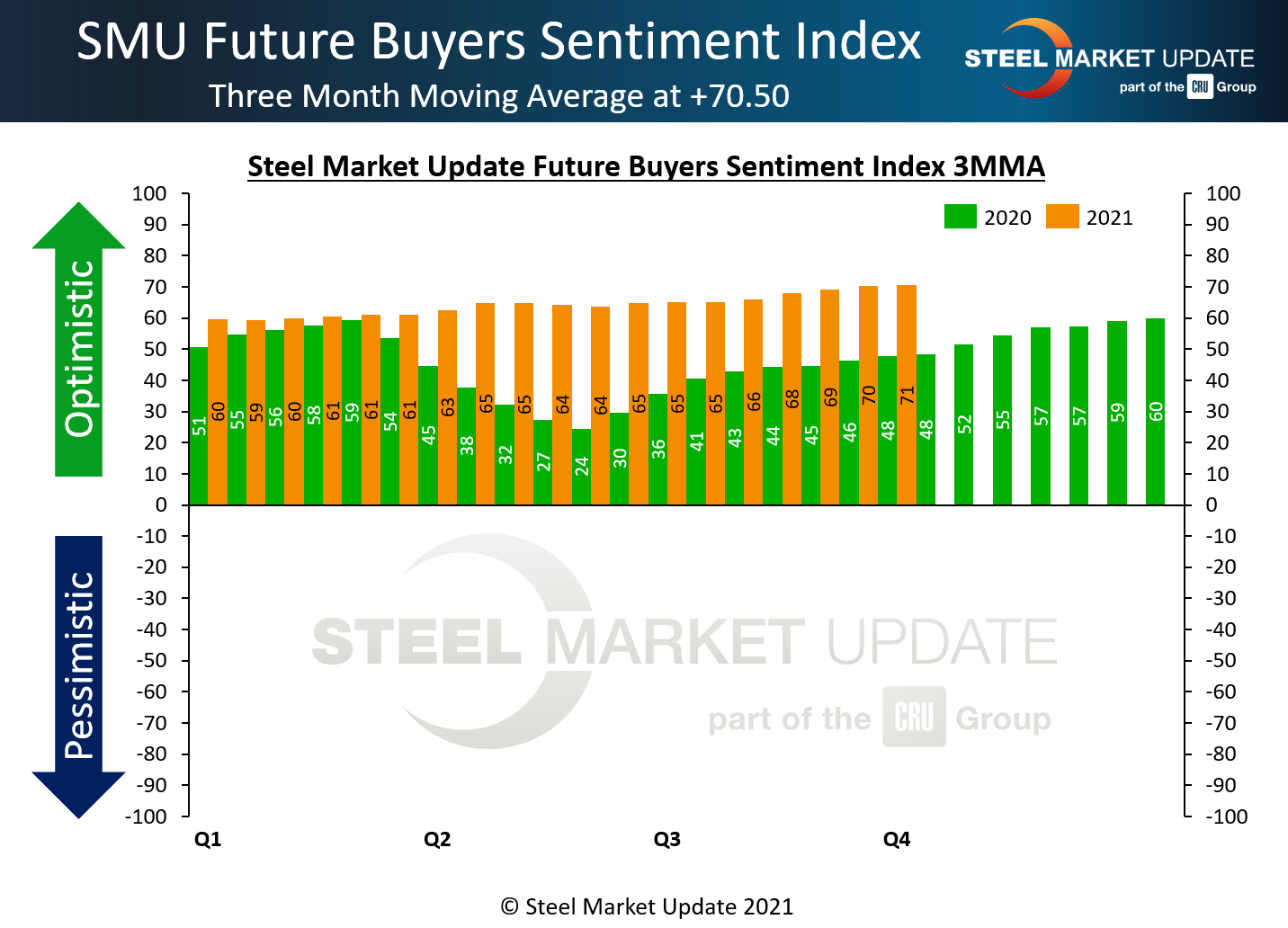

And yet future sentiment remains as bullish as ever. I’m not sure what to make of that.

I think sentiment tends to lead on the way up and lag on the way down. And who wants to acknowledge that arguably the best times for steel since just after WWII might be drawing to close? Also, it certainly doesn’t hurt that, even if spot prices peak in Q3, record profits will probably persist well into 2022 thanks to the lag effect of index-based contracts.

Speak Up!

Do you agree with the survey results above or not? Let us know.

And remember that our survey is only as accurate as you, our members, make it. So if you don’t already participate, please sign up by contacting Brett Linton at Brett@SteelMarketUpdate.com.

Your voice ensures that our data reflects the market as it is on the street – and not as folks with no skin in the game think it should be.

Good luck out there. And thanks from all of us at SMU for your business. We truly appreciate it.

By Michael Cowden, Michael@SteelMarketUpdate.com