Prices

September 16, 2021

Hot Rolled Futures: Beware Near-Term Turbulence

Written by Jack Marshall

The following article on the hot rolled coil (HRC), scrap and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Hot Rolled

Please fasten your seatbelts. Hot rolled futures are approaching some near-term turbulence.

On the one hand, HR pricing is still very strong in the spot market and demand remains very robust. On the other hand, COVID-19 disruptions to global supply chains and a move to take off global risk trades have created enough headwinds to slow the price rise of the HR index for CME futures.

For the first week since Aug. 12, 2020, the index the CME uses to settle its HR contract was negative. The latest Sep’21 HR futures are hovering in the mid-$1,920 area as the markets await the final two weekly HR indexes to gauge whether the slight weekly decline in HR spot price transactions from last week is an aberration or the beginning of a reverse price trend.

A few rough air issues approach: SMU has reported a slight mill lead time decline, which market players will be keeping a close eye on. Recent developments regarding Section 232 indicate some form of loosening of tariffs as a November trade deadline with Europe approaches – which points to more supply. New production facilities coming online in Q4’21 should ease supply concerns even with the scheduled maintenance at a number of mills. SMU data shows flat roll inventories continuing to rise. Market risk concerns rise as forecast opacity becomes even more difficult.

Any number of the above issues gave rise to a pickup in sell orders in the last few days. The strong price retracement also provided an opportunity for HR futures buyers to pick up well-discounted hedges from just a week or so ago. Market sentiment seems divided, which could be more related to regional or industry concentrations.

In general the HR futures curve prices have shifted lower with the mid curve dates declining at a faster rate. By quarterly average, the rates of decline basis settlements are as follows for the period of Sept. 1 through today: Q4’21 declined $102/ST. Q1’22 declined $152/ST. Q2’22 declined $120/ST. Q3’22 declined $73/ST. Q4’22 declined $38/ST. The average decline for Cal’22 HR is about $100/ST with the 1H dropping almost 2.5 times more than the latter half. The bulk of the trading of late has been in Q4’21 and Q1’22. HR futures transaction volumes have been healthy this month. Just over 500,000 ST of HR was traded month to date. HR futures open interest increased this month by over 5,000 contracts.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

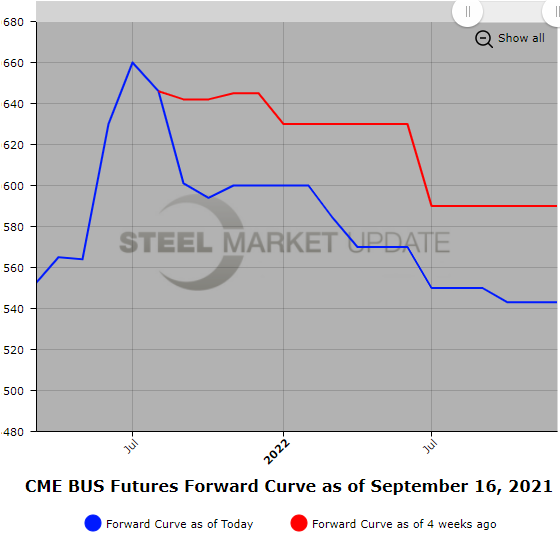

BUS futures led HR futures lower. Global market softness impacted the scrap markets more quickly due to strong competition from imports. Early chatter had BUS down $40/GT, but the actual settlement was a bit more at down $50-plus coming in at $601/GT. Since Sept. 1, the BUS futures curve has declined on average about $33/GT.

The near six months have on average declined about $21/GT, while the latter six months have declined on average about $45/GT. The current mid value for Cal’22 BUS is roughly $565/GT. For those interested in the metal margin spread, Cal’22 MM settled at $790/ton on Sept. 1 ($1,395/605). As of today, Cal’22 MM settled at $735/GT ($1,300/565).

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

Editor’s note: Want to learn more about steel futures? Registration is open for SMU’s Introduction to Steel Hedging: Managing Price Risk Workshop to be held Nov. 2-3. You can get more information by clicking here.