Prices

September 7, 2021

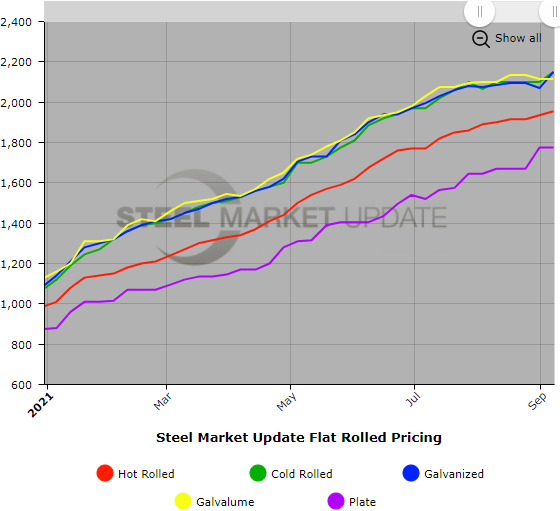

SMU Price Ranges & Indices: Market Still Has Momentum

Written by Brett Linton

Market momentum suggests that flat rolled steel prices are likely to continue moving up, at least in the short term, as hot rolled hit a new record high once again this week at an average of $1,955 per ton, up $20 over last week, according to SMU’s check of the market on Monday and Tuesday. Cold rolled and galvanized saw even bigger jumps. Buyers report that demand remains robust and supplies tight, with little or no spot tonnage available from steelmakers. Competition from lower priced steel imports arriving in the U.S. does not appear to have had much impact yet on domestic prices. As one exec commented: “The mills remain very much in control.” Added another: “It seems like there is some extra demand due to the very destructive Hurricane Ida.”

Hot Rolled Coil: SMU price range is $1,910-$2,000 per net ton ($95.50-$100.00/cwt) with an average of $1,955 per ton ($97.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to last week, while the upper end remained unchanged. Our overall average is up $20 per ton from one week ago. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 7-12 weeks

Cold Rolled Coil: SMU price range is $2,100-$2,200 per net ton ($105.00-$110.00/cwt) with an average of $2,150 per ton ($107.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $100 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $50 per ton from last week. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 9-13 weeks

Galvanized Coil: SMU price range is $2,100-$2,200 per net ton ($105.00-$110.00/cwt) with an average of $2,150 per ton ($107.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $165 per ton compared to last week, while the upper end decreased $5. Our overall average is up $80 per ton from one week ago. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $2,178-$2,278 per ton with an average of $2,228 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 10-14 weeks

Galvalume Coil: SMU price range is $2,040-$2,190 per net ton ($102.00-$109.50/cwt) with an average of $2,115 per ton ($105.75/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from last week. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,331-$2,481 per ton with an average of $2,406 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-15 weeks

Plate: SMU price range is $1,650-$1,900 per net ton ($82.50-$95.00/cwt) with an average of $1,775 per ton ($88.75/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to last week. Our overall average is unchanged from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 8-10 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.