CRU

September 7, 2021

CRU: Chinese Coking Coal Surges to $600 /t – What’s Causing the Rally?

Written by Richard Lu

By CRU Senior Analyst Richard Lu, from CRU’s Steelmaking Raw Materials Monitor

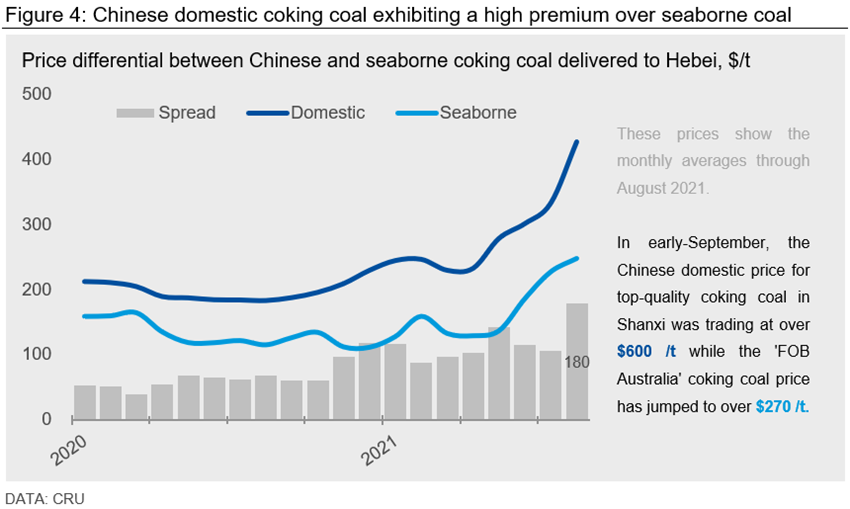

In a recent Insight titled “Iron ore at $140 /dmt – what’s driving the fall?”, we explained that weak demand in China has caused a sharp iron ore price fall and we expect the downtrend to persist for the rest of the year. In the past months, we have noticed another commodity experiencing a similar price move, but in the opposite direction. Chinese top quality coking coal prices have now reached $600 /t after averaging below $300 /t for the first seven months of the year.

Having bottomed out at a three-year low of ~$178 /t in August 2020, Chinese domestic premium coking coal prices have risen steadily and reached an all-time high, up to ~$603 /t at end-August 2021. Although coke and coking coal consumption have fallen in tandem with lower steel and hot metal production, mills’ restocking efforts mitigated such demand contraction. But, more importantly, coking coal supply has fallen due to lower domestic production and restricted imports.

Chinese Domestic Supply Falls on Various Restrictions

Following a few severe coal mine accidents early this year, the Chinese government started to conduct safety checks on coal mines and strictly prohibited overproduction. In particular, many coal mines across the country were asked to reduce output prior to the celebration of the 100th anniversary of the Chinese Communist Party (CCP) in early July to reduce the risk of accidents. Despite some recovery after the government’s event ended, coal mine production remained below the levels seen in previous years. According to official data, raw coal production, which includes both metallurgical and thermal coal, fell by 11 Mt y/y over June–July.

The fall in raw coal output was small relative to the production in those months, but the supply tightness of coking coal was exacerbated by coal mines that produce both thermal and coking coal prioritizing thermal coal to ease power shortages in the country. Meanwhile, more logistics capacity was allocated to thermal coal transportation for the same reason.

Coking Coal Imports Have Disappointed

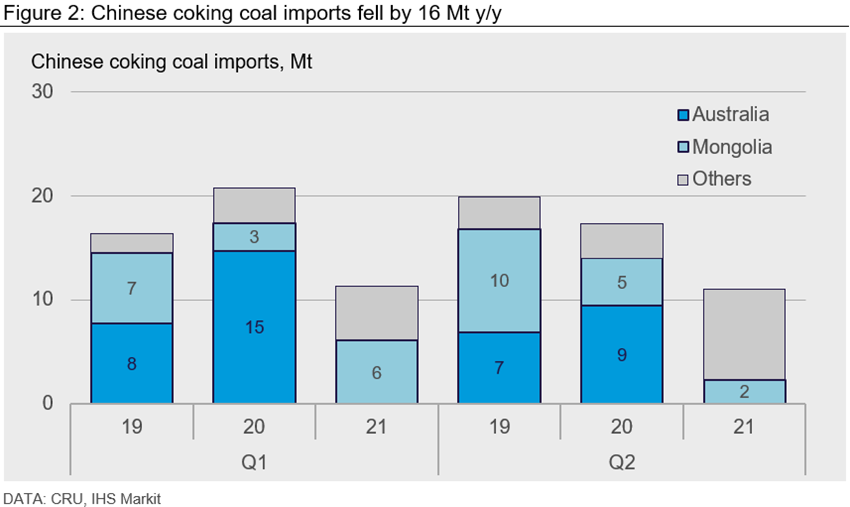

Chinese domestic coking coal production has been weak, and coking coal imports have also disappointed, falling by 16 Mt y/y in 2021 H1:

- Chinese coking coal imports from Australia have now completely disappeared due to the import ban on all Australian coal products, resulting in a y/y loss of 24 Mt of import supply.

- The other key supplier, Mongolia, managed to lift exports in Q1 that led to a y/y growth of 3 Mt, but its exports have been below normal levels in Q2 as Covid-19 outbreaks in the country restricted coal transportation into China. As of early-September, Mongolian coking coal exports to China remain constrained, evidenced by both main border crossings remaining closed after a few Mongolian truck drivers tested positive for Covid-19.

- Although coal suppliers in countries including Russia, the USA and Canada have attempted to maximize sales to the Chinese market to benefit from higher prices, the increase in exports from these countries have so far not been able to mitigate the import shortfall.

Chinese Coking Coal Prices to Ease Towards Year-End

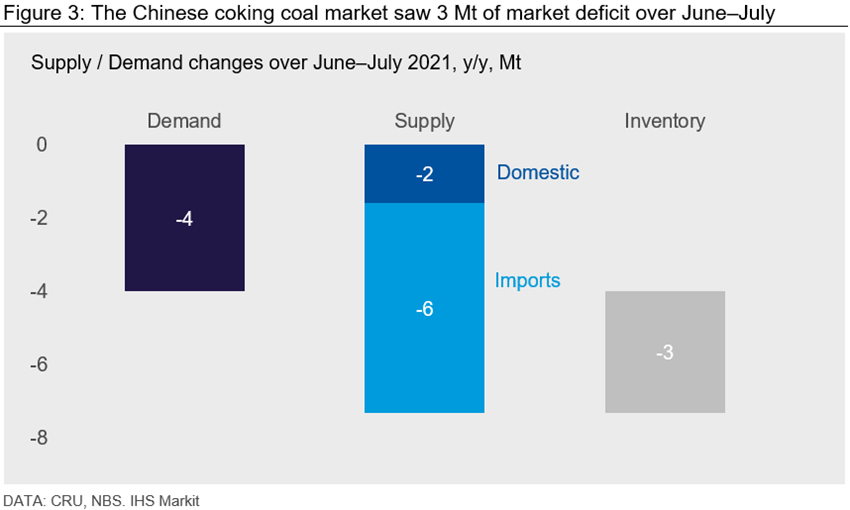

In the June-July period, as Chinese domestic coking coal price increases accelerated, we measured a relative market deficit of ~3 Mt that was largely met by inventory drawdown across the entire supply chain (see below chart). For August, we expect the market deficit to have worsened, as indicated by sharper price increases.

During September-December, CRU forecasts, in a ballpark, that hot metal production will fall by 20 Mt y/y, resulting in ~12 Mt of coking coal demand loss on a washed basis. We believe Chinese domestic coking coal production will ramp up for the rest of the year, but will remain below the levels at end-2020, when coal mines were operating hard to make up for production losses earlier in the year due to Covid-19. If we assume 2019 production to be a fair proxy, domestic coking coal production will be ~8 Mt lower y/y over these four months. As demand will fall faster than supply, the market balance will ease by 4 Mt compared with the same period in 2020.

Meanwhile, the large price differential between Chinese domestic coking coal over seaborne alternatives (see below chart) will encourage non-Australian coal suppliers to maximize their exports to China. If major suppliers excluding Australia and Mongolia can keep the same export rate as in H1, Chinese imports from these suppliers will lift by ~5 Mt during September-December, enlarging the relative market surplus to 9 Mt.

In summary, a combination of weaker coking coal demand and improving supply will ease the supply/demand tightness in the Chinese coking coal market, which will pull down the price from the current level. Having said that, we do not expect this will occur in a drastic manner but more gradually and with three major upside risks for Chinese domestic coking coal prices:

- Strict steel production cuts have been announced and enforced in H2. However, there is always the risk of some of these restrictions being rolled back, which would mean rising steel production and stronger demand for coking coal.

- At the time of this writing, domestic production is still curbed in provinces such as Shanxi, which is the largest coking coal production hub in China. If these cuts remain in place for the rest of the year, it will be challenging for Chinese coal miners to increase supply in order to balance the market.

- The Covid-19 situation in Mongolia is already restricting Chinese imports and, at the time of writing, Mongolia has just recorded a new record high for daily Covid-19 cases. If the Covid-19 pandemic situation does not improve and Mongolian coal exports to China were to keep the same export rate as in Q2, Mongolian coal imports into China would fall by ~8 Mt during September-December, almost offsetting the aforementioned market surplus of 9 Mt.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com