Prices

August 31, 2021

SMU Price Ranges & Indices: Coated Slips - Trend or Noise?

Written by Brett Linton

Flat-rolled steel prices are again mixed. Hot rolled is up $20 per ton, cold rolled is unchanged, and coated products are down $20-25 per ton. (Plate – following mill price hike announcements – is up a sharp $105 per ton.) The mixed signals are not a sure sign of the market inflecting. And Hurricane Ida hasn’t had its final say yet. But it’s a trend worth keeping an eye on, especially with imports putting more pressure on coated markets in particular. What’s propping this all up? Solid demand. Which we think will save us from a repeat of 2008-09, when demand vanished and prices collapsed. In fact, a little moderation in prices and lead times might be just what the doctor ordered. For the time being, we have opted to leave our Price Momentum Indicators at the Higher readings where they have been for the past year, but acknowledge that change may be in the offing and we could soon be switching to Neutral so as not to influence the market as it establishes a clear direction.

Hot Rolled Coil: SMU price range is $1,870-$2,000 per net ton ($93.50-$100.00/cwt) with an average of $1,935 per ton ($96.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to our last price update two weeks ago, while the upper end increased $60. Our overall average is up $20 per ton from two weeks ago. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 7-12 weeks

Cold Rolled Coil: SMU price range is $2,000-$2,200 per net ton ($100.00-$110.00/cwt) with an average of $2,100 per ton ($105.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to two weeks ago, while the upper end increased $10. Our overall average is unchanged from two weeks ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 9-13 weeks

Galvanized Coil: SMU price range is $1,935-$2,205 per net ton ($96.75-$110.25/cwt) with an average of $2,070 per ton ($103.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $75 per ton compared to two weeks ago, while the upper end increased $25. Our overall average is down $25 per ton from two weeks ago. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $2,013-$2,283 per ton with an average of $2,148 per ton FOB mill, east of the Rockies. Effective this week, we have increased the galvanized extras used in our benchmark prices from $69 per ton to $78.

Galvanized Lead Times: 10-14 weeks

Galvalume Coil: SMU price range is $2,040-$2,190 per net ton ($102.00-$109.50/cwt) with an average of $2,115 per ton ($105.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $50 per ton compared to two weeks ago, while the upper end increased $10. Our overall average is down $20 per ton from two weeks ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,331-$2,481 per ton with an average of $2,406 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-15 weeks

Plate: SMU price range is $1,650-$1,900 per net ton ($82.50-$95.00/cwt) with an average of $1,775 per ton ($88.75/cwt) FOB mill. The lower end of our range increased $100 per ton compared to two weeks ago, while the upper end increased $110 per ton. Our overall average is up $105 per ton from two weeks ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 8-10 weeks

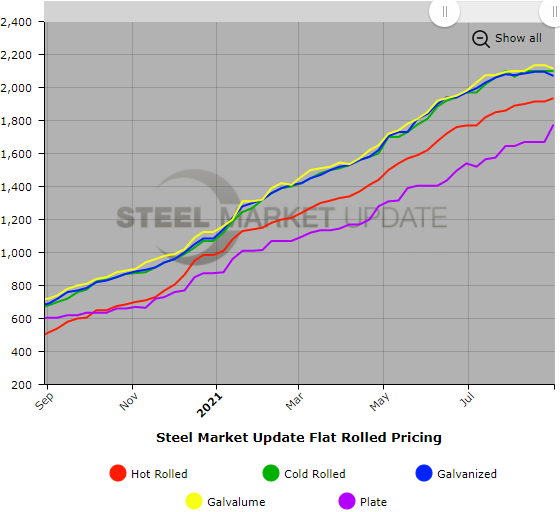

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.