Analysis

August 20, 2021

Final Thoughts

Written by Michael Cowden

It’s not wise to call an inflection point based on one week of data. But I’m going to do it anyway.

Because while SMU might have just one week of somewhat bearish survey data, there are plenty of other data points out there to say with some confidence that we’re at or near a peak and about to go down the other side.

![]() Have you looked at iron ore prices or lumber prices recently? A saw mill is a lot easier to start up than a steel mill, I know. But I’m not concerned about overcapacity at this point. That’s more of a Q4 2021-1H 2022 story, as SMU’s new capacity table indicates.

Have you looked at iron ore prices or lumber prices recently? A saw mill is a lot easier to start up than a steel mill, I know. But I’m not concerned about overcapacity at this point. That’s more of a Q4 2021-1H 2022 story, as SMU’s new capacity table indicates.

What I’m paying more attention to are our latest survey results. Some key indicators are flashing red for the first time in a while.

Yes, sentiment is at or near record highs. But sentiment tends to lead prices on the way up and to follow prices on the way down. Lead times, in contrast, tend to lead prices on the way down.

And while I noted in early June that lead times were flattening out, this is the first time SMU has recorded a clear drop for hot rolled coil in particular.

Another data point to keep an eye on: Service center inventories were up substantially for the first time in a long time in July. And 78% of survey respondents now report being comfortable with their inventory levels. Rewind to May and only 39% reported being at comfortable levels – most were still struggling to find steel to replenish stocks.

Also, import volumes are up. The gap between U.S. and foreign prices is about as wide as it’s ever been in recent memory – and while prices in the U.S. are up, prices in the rest of the world are falling.

But what I’m paying closest attention to is the nitty-gritty of our survey data. If you dig into the data, you’ll see some slippage when it comes to service center resale prices – even if fob mill prices haven’t show any real signs of weakness yet.

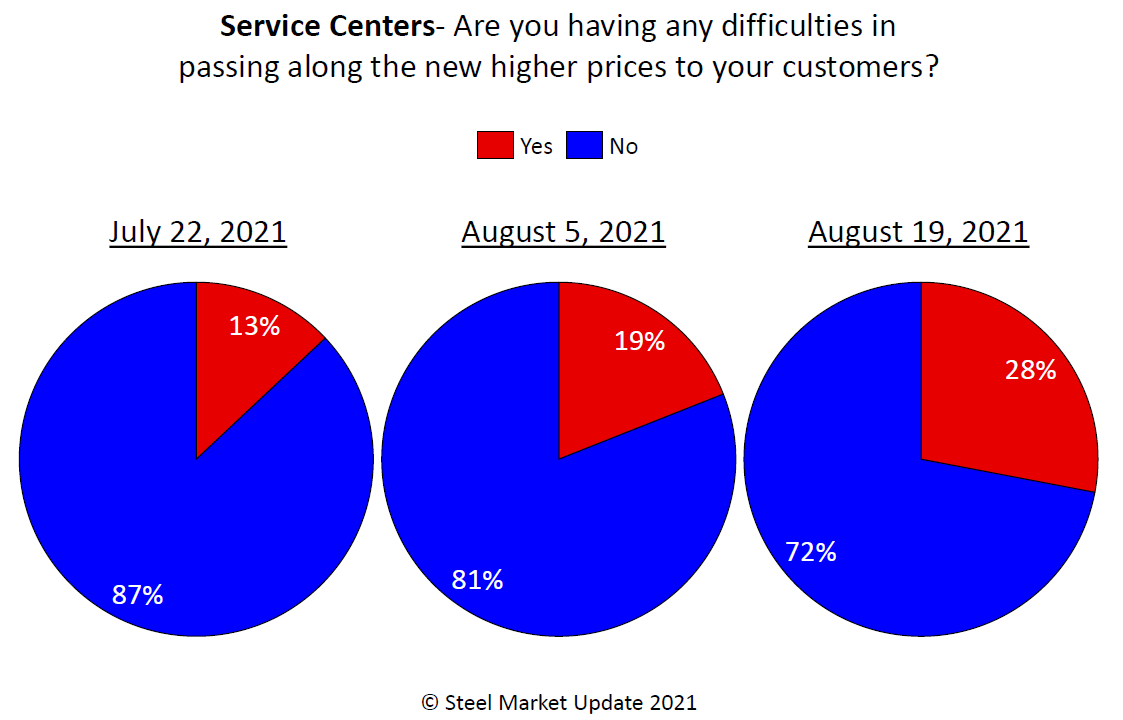

Approximately 28% of service center respondents report they are having trouble passing along higher prices to their customers, up from 13% about a month ago.

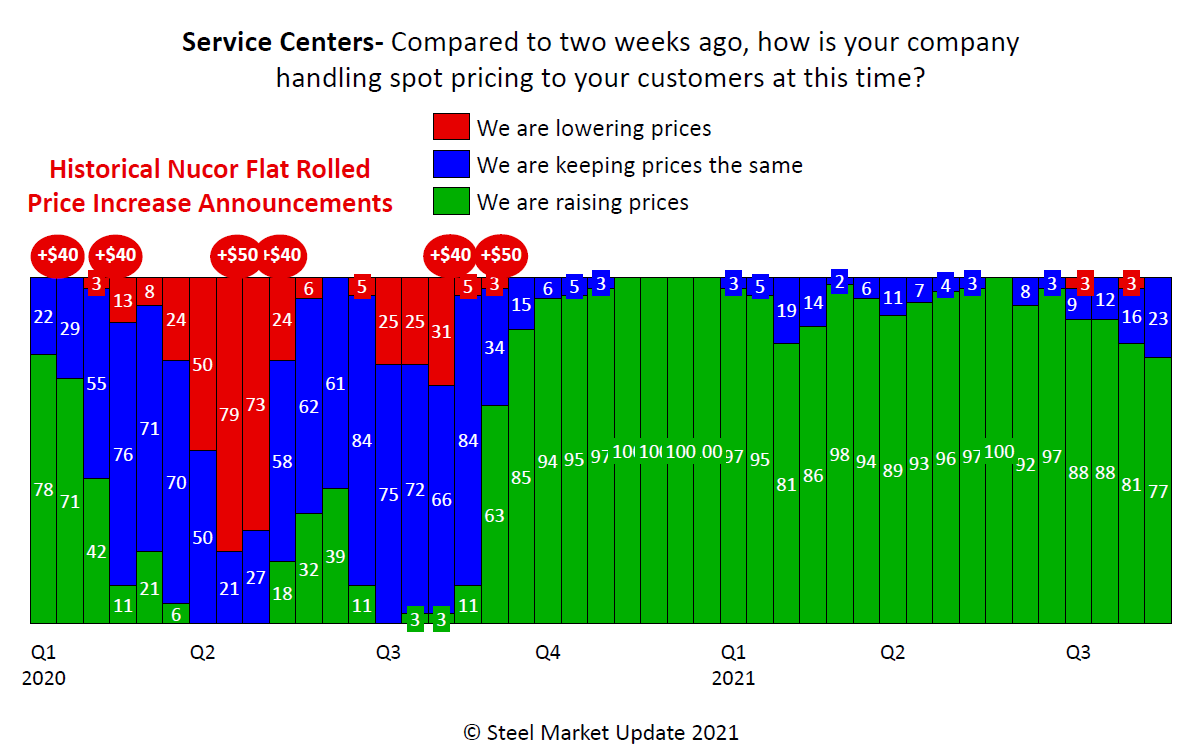

And about 23% of service center respondents report they are keeping prices the same. The other 77% continue to raise prices. In any other market, that would be a very, very bullish signal.

But this is no ordinary market. We’ve gone a year that saw time times when all service centers respondents reported raising resale prices. In fact, we haven’t seen this many people reporting they are keeping prices the same since late in the third quarter of last year – or around when HRC prices bottomed out at $440 per ton.

So, in the chart above, keep a very close eye on the blue bars on the right. This is a trend we’ve been hearing about for a while now out in the market – namely, service centers not raising prices as aggressively. And now we’re starting to see it in the numbers, too. We’ll start to worry if mills start announcing their price hikes again.

It’s not my job to predict prices. They remain at record highs – $1,915 per ton ($95.75 per cwt) – and I would not be shocked if we make it to $2,000 per ton. But I also wouldn’t be surprised – given all the red flags noted above – if things plateau and fall at or slightly below that level.

If you want to see what far more informed people than me think, check out our Steel Summit next week in Atlanta. It’s too late to register to attend live, but you can register to attend virtually by clicking here.

Michael Cowden, Michael@SteelMarketUpdate.com