CRU

August 11, 2021

CRU: Continued Price Gains Realized in North American Markets

Written by Josh Spoores

By CRU Principal Analyst Josh Spoores, from CRU’s Steel Sheet Products Monitor

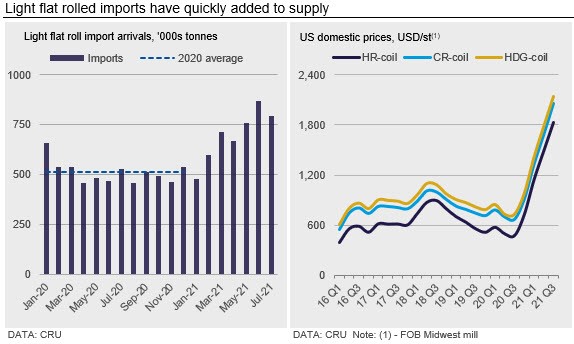

Sheet prices in the U.S. Midwest market have continued to rise, though the rate of increase has slowed since the end of May. The price of HR coil has increased $21 /s.ton w/w and is now $126 /s.ton higher than our assessment on July 14. Compared to a year ago, HR coil is now 331% higher, a level that represents the peak y/y change as HR coil would need to rise by an additional $400 /s.ton in the next four weeks to surpass this level.

These gains have run counter to prices in most other markets and this has resulted in even wider price spreads than we noted last month. Currently, the spread of HR coil in the U.S. is over $600 /s.ton higher than domestic prices in Germany and over $1,000 /s.ton higher than prices in the Southeast Asian market.

These price spreads have continued to widen, even as higher levels of light flat rolled import arrivals have come in. The latest data suggest that over the past three months, May through July, light flat rolled imports have averaged 800,000 t, which is 34% higher than what arrived in 2021 Q1. Buyers have clearly turned to the import market to secure needed supply.

Much of these imports were required as supply from domestic mills has not been able to keep up with new orders. Indeed, with lead times for sheet products at 10 weeks or more, service centers continue to have historically high levels of material on order at mills and low levels of inventory. According to preliminary data from service centers for July, it appears that inventories are now in balance with outbound shipments. However, both of these data points remain below pre-pandemic levels. Additionally, continued automotive production limits may be skewing this to show that automotive related supply is in surplus while other end markets continue to have lower than ideal levels of inventory.

On the U.S. West Coast, sheet prices increased 10-12% m/m on orders placed for October production. Buyers are still struggling with a lack of domestic buying opportunities, as tonnage from local mills remains restricted and the Midwest and Southern mills remain largely absent from the market. Material imported from Asia and Mexico has played an important part in bridging the gap left in supply chains, although rising freight costs and logistical delays have made the situation more complicated. Prices are expected to increase in two weeks when mill order books open for November/December production.

In Mexico, sheet price increases have accelerated this month with HR coil prices up 11% and CR coil up 9% m/m. These increases followed the trend of the U.S. market and have not been reflective of the conditions in the domestic market, which remain below pre-pandemic levels, with only the manufacturing of durable goods, excluding vehicles, showing positive signs. In fact, according to Inegi, light vehicle production in Mexico fell by around 16% m/m and 26% y/y in July, with strong limitations coming from the semiconductor shortage. Meanwhile, domestic supply is expected to increase further as Ternium announced it plans to produce 600 kt of HR coil in 2021 H2 at the new rolling mill at Pesqueria, 50% more than announced previously.

Outlook: Further Upside Momentum Limited Without Unplanned Catalysts

The market has widely been planning for the upcoming maintenance outages being carried out between September and December. These outages are primarily at EAF mills, though one large one is a planned 45-day outage at Cleveland Cliffs’s Indiana Harbor #7 furnace. This outage is scheduled to take place from Sept. 1 until Oct. 15. It may take the entire 45 days and the risk is that the furnace may have issues restarting. If this outage runs long, it will be an upside risk to prices.

However, at this moment, lead times are estimated to be very near mid-October, which to us makes this outage somewhat irrelevant at this point. Indeed, we see four outages in November as more relevant to the market. Buyers though, have been planning for this and ordering imports to help cover their needs. The widening spread has allowed these orders to get placed at an increasing pace recently and, with the futures market continuing to price in historically high prices in 2021 Q4, buyers are able to fully hedge all their price risk of these purchases.

Mill production in the USA has been on the rise in July and August and while production may slow with the outages, we expect that mills have been working away at their record levels of order backlogs. As previously mentioned, service center inventories appear to now be in balance with outbound demand while slower seasonal demand may reappear in 2021 Q4. Barring any further unplanned disruptions or catalysts, we expect that sheet prices will soon peak.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com