CRU

August 7, 2021

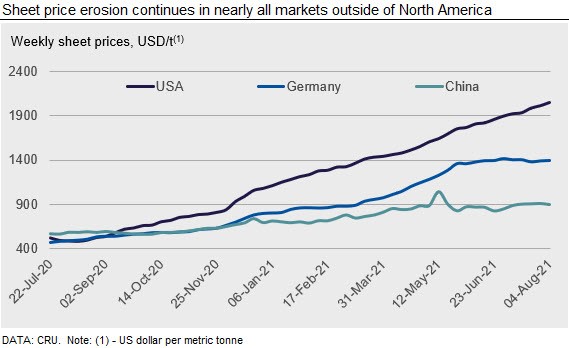

CRU: Sheet Price Direction Split Depending on Import Exposure

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Sheet Products Monitor

Prices fell w/w in southern Europe and China but were stable in Asia and up somewhat in India. Prices in the U.S. again were the outlier this week, rising by three times as much as anywhere else.

In fact, the differential between U.S. and German domestic prices is now at around $630 /t. Declines in southern Europe were again attributable to competitively priced import options and weakening demand, while those in China fell on renewed speculation that policy-driven steel output cuts will not be as strong as expected. In Asia, CRU understands that some Russian exporters to select countries may find exemptions from a recent export tariff set by the government there, which has helped keep import offers competitive. Meanwhile, Indian export deals have moved prices somewhat higher w/w, but this was partially the result of a decline in the Indian rupee.

USA

U.S. sheet prices continued to increase this week with HR coil gaining $33 /s.ton w/w. Spot buy opportunities were limited this week as mills continued to limit tonnage and product offerings, especially in light gauge HR coil. Despite the limitations on spot buys, more companies reported that they have been able to build some inventory. Market participants generally expect demand to remain high for the balance of the year, but other material supply shortages present a downside risk to end-use demand.

U.S. West Coast sheet pricing remained stable this week as buyers await the opening of mill order books. Expectations are that when the mills do open their order books, they will be securing tons for the balance of the year. New import offers from Asian mills were fewer this week, but there has been an increase in quoting activity from Mexican mills.

Europe

European sheet prices fell substantially in southern Europe this week. All sheet products in Italy decreased by between €28-€39 /t w/w. A combination of less expensive import options and slowing demand are putting pressure on the southern European market, which is more exposed to international trade than northern Europe. As northern European sheet prices have remained relatively stable w/w, the differential between German and Italian sheet pricing has expanded.

Italian steel service centers are said to have lowered their prices to end-users as demand has dropped slightly due to the market uncertainty. They are receiving material from imports at a low price yet still able to sell these volumes at a high margin. Current European lead times for most sheet products are into late Q4. Mills have good order books, but such high price levels are causing buyers to limit their purchase volumes.

China

Chinese domestic sheet prices fell this week as a seasonal demand lull continues to dampen spot market activity. Sheet inventories also fell slightly w/w. Speculation surrounding the latest central government meeting that output cuts could be eased and stabilize prices has again caused significant market volatility. Given unchanged fundamentals and confirmation from sources that production control policies will still be strictly enforced, prices started to pick up on Wednesday but still showing a w/w decline. As no further details have been announced, we expect that the current policy-led production cuts will continue to support prices in the short-term. However, future developments in policy will play a large role in determining the future direction of prices, as shown by the current swings in the market. As such, we still foresee volatility for sheet prices in the next week.

Asia

Prices of imported sheet products are stable w/w in Asia, and there are increasingly more competitive offers from a variety of exporters to the region.

A large volume of HR coil SAE1006 grade was sold at $910/t CFR Vietnam for October shipment by a Russian mill. There is market rumor that exports to Vietnam are exempted from Russia’s export tax scheme, but this could not be confirmed independently by CRU. HR coil offers from India were at $925-940 /t CFR Vietnam while offers for Chinese material remain uncompetitive at around $1,000/t CFR Vietnam with export tax uncertainty.

CRU assessed HR coil prices at $920 /t, CFR Far East Asia, flat w/w. CR coil prices were assessed at $ 1,100 /t CFR Far East Asia, flat w/w, while HDG prices were assessed at $1,120 /t CFR Far East Asia, also flat w/w.

India

HR coil prices in India rose by INR500-800 ($7-11) /t w/w, breaking the consistent decline observed since early June. The price rebound is a consequence of recent export deals and Chinese trade policy changes. Export sales have improved for Indian suppliers, owing both to INR depreciation and a rise in export prices. Meanwhile, China has recently cancelled export tax rebates on a wider set of steel products (encompassing ~95% of all exports during 2020), while there are strong rumors that the country will impose an export tax on HR coil very soon. CRU also learns from contacts that Russian exporters are also gradually backing off from the export market, with the export tax coming into effect from Aug. 1, 2021. Discounted Russian export offers to the Asian markets since early June was one of the key reasons that drove down Asian import prices.

In the domestic Indian market, demand remains subdued due to seasonal weakness. Restocking cycle for major manufacturers is likely to resume in late-August, until which point spot trade may remain under pressure. However, automakers reported an impressive growth in July 2021 sales, which may encourage them to increase output (thus consuming more sheet), but a possible semiconductor shortage for the remainder of the year may still dampen demand.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com