Prices

July 8, 2021

Final May Steel Imports at 2.5 Million Tons, June Licenses Near 3 Million

Written by Brett Linton

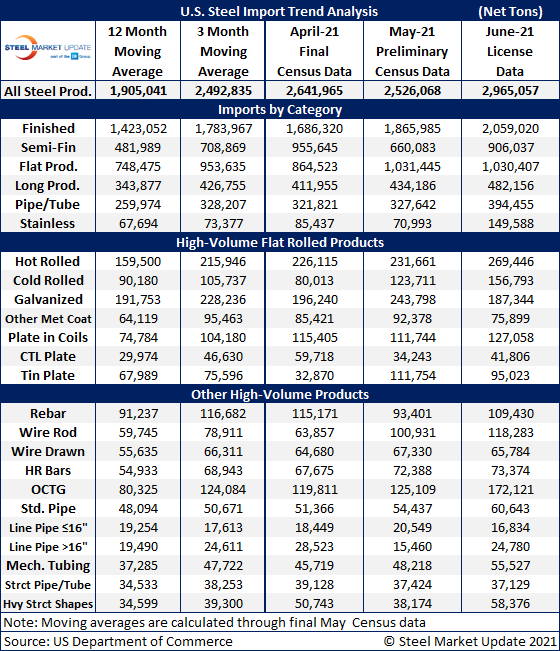

Final Census data shows that May foreign steel imports totaled 2.53 million tons, down 116,000 tons compared to the month prior, a 4% decline. Although May was down from the month prior, levels remain strong compared to recent months; April imports had reached the highest level seen since July 2020.

Current June import licenses through this week are up to 2.97 million tons, up 17% from May, and up 12% over April. For comparison, the average monthly import level for 2020 was 1.84 million tons, down from 2.32 million tons in 2019 and 2.81 million tons in 2018.

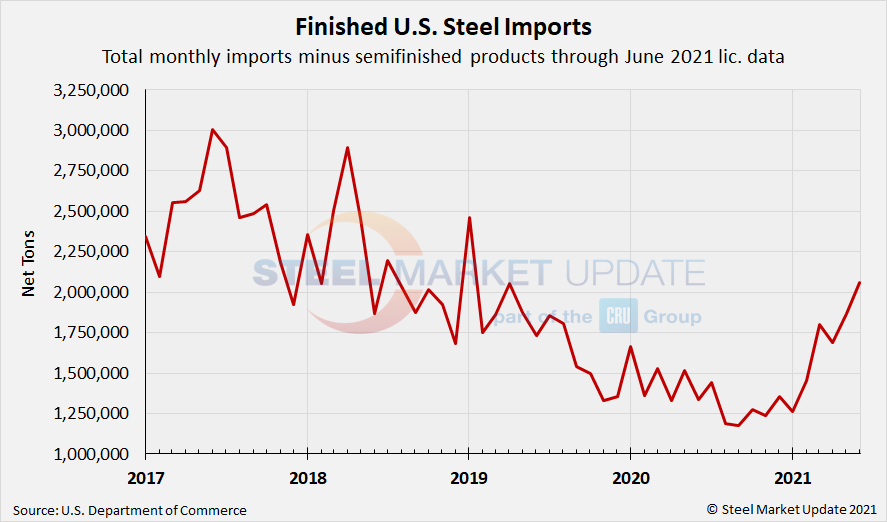

Total finished steel imports were at 1.87 million tons in May, the highest level seen since May 2019. Finished steel import licenses for June are currently at 2.06 million tons.

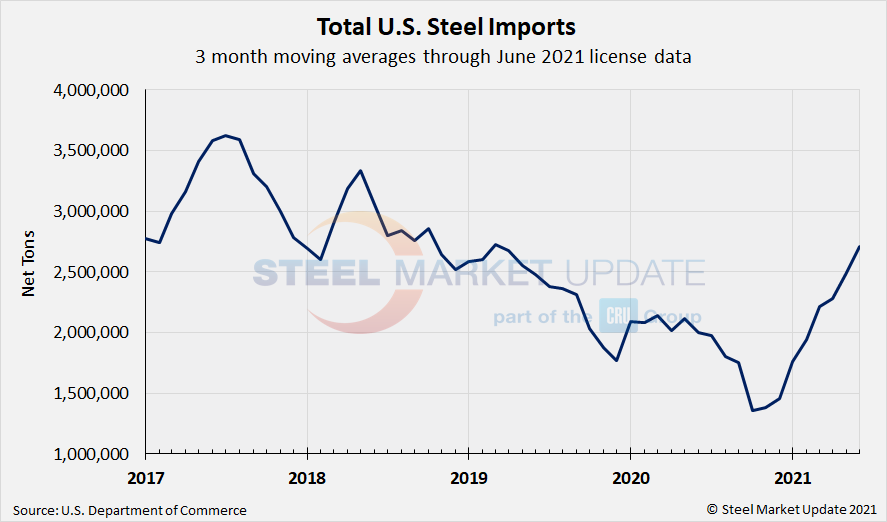

Due to large month-to-month swings in semifinished imports, the chart below shows total monthly imports on a three-month moving average (3MMA) basis in an attempt to more accurately display U.S. steel import trends. The 3MMA through final May import data is 2.49 million tons, up from 2.28 million tons in April and up from 2.21 million tons in March. The lowest 3MMA level in our recent history was October 2020 at 1.36 million tons. The May 3MMA is now the highest seen since May 2019. Looking into the current license data, the June 3MMA would be even higher at 2.71 million tons, which would be the highest level seen since March 2019.

Import licenses collected through the first five days of July total 704,000 tons, with flat rolled imports accounting for 151,000 tons and semifinished (mostly slabs) for 403,000 tons. Roughly projecting the flat rolled licenses through the entire month equates to a 937,000 ton monthly figure, down 9% from June. We will report on updated July license data in the coming weeks.

The table below displays flat rolled product imports as well as other high-volume products, including rebar, tin plate, wire rod, structural pipe and tube, and other long products. We also provide data on categorized imports, divided into semifinished, finished, flat rolled, longs, pipe and tube, and stainless products.

By Brett Linton, Brett@SteelMarketUpdate.com