CRU

April 30, 2021

CRU: Beware the Bubble – This is Not Yet a Commodity Supercycle

Written by Jumana Saleheen

By CRU Chief Economist Jumana Saleheen and CRU Head of Fertilizers Chris Lawson, from CRU’s Steel Monitor

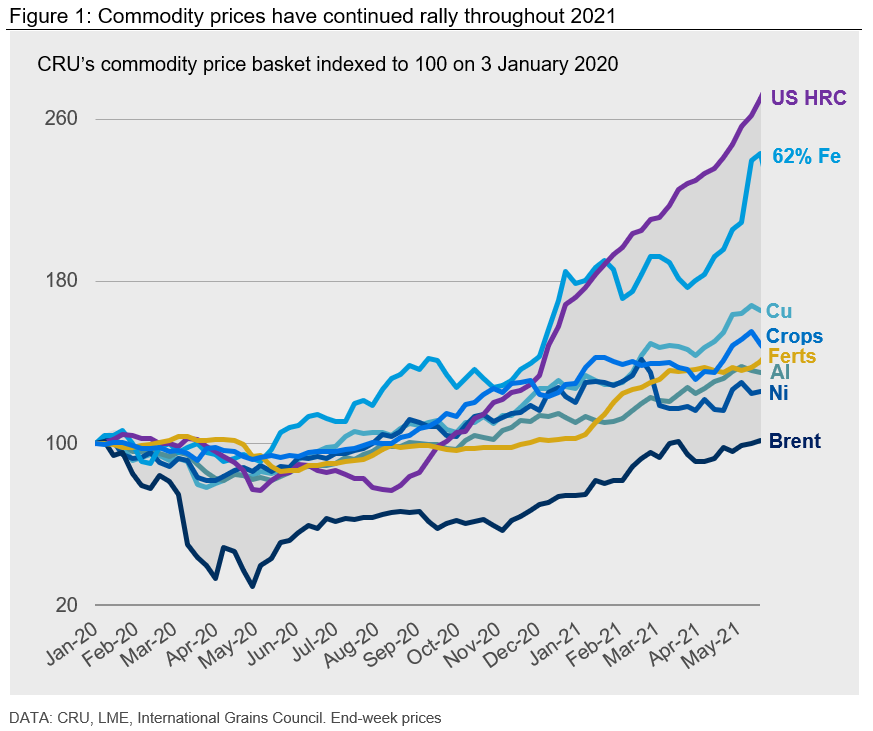

Commodity prices have continued an upwards tear in 2021. Steel and its raw materials have seen the sharpest gains, but less well-known commodities such as fertilizers are also attracting attention. With such steep price rises, calls for a new commodity supercycle are inevitable. Analysts backing a new supercycle are citing support from government stimulus packages, perceived underinvestment in commodity supply and a transition to a brave new “clean and green” world.

In an Insight published earlier this year, CRU concluded that the current rally does not signal a new supercycle. We continue to hold this view. However, there are some upside risks worth greater consideration. This Insight provides updates on inflation, aluminum, base metals, fertilizer and steel markets. Common themes prevail throughout – prices are being supported by tensions across the supply chain (something not isolated to commodity markets), and price corrections are anticipated. But ESG, decarbonization and Chinese supply shifts offer some hope for those betting on a new supercycle.

Inflation Pipeline Heats Up

Two macro factors have supported the commodity price rally: the shape of the recovery has continued to fuel investor fears over inflation; and speculative investment about the future price of green commodities. Our view is that neither of these forces can endure.

First, lockdowns and social distancing restrictions have until recently forced people to spend more time at home and to buy durable goods. This has fueled cost pressures at multiple points in the supply chain, from commodities, to freight, to semifinished and finished goods. Producer price indices (PPIs), which measure the wholesale price of goods as they leave factories, increased sharply in both the U.S. and China this month. The fear is that PPI inflation will give rise to higher consumer price inflation (CPI). These inflation fears have driven investors away from traditional bonds and equities into alternatives such as commodities. However, historically, high PPI inflation has not fed through to strong CPI inflation. High inflation is not a foregone conclusion. Moreover, as vaccination campaigns proceed in advanced economies, we expect consumer demand to rotate away from durable goods towards services. As this happens, cost pressures in industrial supply chains and commodity prices should ease. We continue to believe that fears of a broader surge in inflation are premature, and that we are not heading back to the 1970s.

Second, commodity demand has been fueled by speculative purchases ahead of the UN climate conference, COP26, in November 2021. Some analysts believe climate policy and regulation will give rise to a substantial and prolonged boost in the demand for commodities. While the jury is still out on whether that will happen or not, our view is that climate policies are likely to fall short of the ambition. If true, a reckoning will follow at some point in the future, which will give rise to some correction in commodity prices.

Aluminum Faces Supply Shock But No Supercycle

China has dominated aluminum supply growth in the past decade; that has now changed.

From 2010-2017, China added 90% of global aluminum supply. From 2017-2021, China’s share of global growth will fall to 59%, and that growth faces risks in 2021 H2.

Current profit margins for aluminum smelters in China are at record levels. However, new plants are not ramping up; instead we see curtailments in Inner Mongolia and Yunnan. In Inner Mongolia, this is linked to targets to reduce coal consumption and emissions (aluminum smelters in the province are coal powered). In Yunnan, hydro-powered aluminum smelters have been ordered to curtail after a drought and energy shortages in neighboring provinces.

As a result of government mandated restrictions on supply, China will import nearly 2.3 Mt of primary aluminum in 2020 and 2021. Those imports will pull stocks in the rest of the world down by 30 days of consumption. Restrictions on supply in China are impacting the global market.

The world has become accustomed to China adding vast amounts of aluminum supply – that dynamic has definitively changed. Aluminum demand is booming, but this is the main reason that prices are rallying.

Base Metals Ride the Economic Recovery

Base metal prices continue to be powered by the broader economic recovery and global government fiscal/central bank commitments. Talk surrounding a renewed supercycle have intensified.

The fundamentals of copper, cobalt, lithium, and nickel look positive; namely growing demand driven by the greening of the economy will lead to a significant supply gap opening-up from the mid-2020s, providing strong price support. Yet, it is still too early to call this the beginnings of a supercycle. For other metals, such as zinc and lead, the opportunities that green technologies offer seem to be more limited.

The shift to EVs and renewables is coming, but there are risks, and the pace and the way these markets evolve over time is by no means certain. Risks include the extent that China meets its needs from scrap, materials such as copper see substitution, and thrifting of metal units.

On the supply side of the market, environmental, social and governance (ESG) concerns bring both opportunities and threats. Ignoring these issues is no longer an option for producers. Future access to finance and a continued social license to operate will be contingent on building and maintaining a solid ESG record.

What is clear is that ESG will create winners and losers, and leaders and laggards, in the base metals sector. Strategic thinking and bold decision making could help lower costs and enable the industry to operate in a more sustainable and inclusive manner. However, bringing on new projects will be more challenging than in the past.

The base metals industry will need to see huge scale investment from miners, OEMs and from the downstream sector to hit their ESG goals. However, while there needs to be a shift of focus, sustained shortfalls of metal and a prolonged period of market tightness is a risk and not a certainty.

Ample Capacity Will Burst the Fertilizer Bubble – But the Green Ammonia Revolution is Gaining Pace

Fertilizer prices have continued their upwards trajectory. Although feedstock costs have increased, producer margins have been robust and investor interest is returning. But capacity is ample, and more is being built across the nitrogen, phosphate and potash segments. High crop prices are expected to continue well into 2022, but we anticipate oversupply to pull fertilizer prices lower by the turn of this year.

In our supercycle matrix analysis earlier this year, we assessed the likelihood of a new fertilizer price supercycle as low. We noted some potential “demand disruptors,” particularly in the nitrogen industry, with proposals for ammonia use as a fuel and hydrogen carrier gaining traction. Since our initial Insight, the interest and investment in this segment has been astonishing, with new projects and partnerships announced almost daily. If the use of ammonia as a fuel and hydrogen carrier does expand, the potential for a fertilizer price supercycle will be much higher than our current expectations. But this segment is still in its infancy – the technology to produce and consume green ammonia is still in development. We estimate there will not be any significant demand impact until much later in the decade.

Steel Profitability Skyrockets, But the S&D Squeeze Will Be Short-lived

Steel’s price performance over recent months has been astonishing. Despite raw material prices also shifting higher, steel mill profitability around the world is skyrocketing.

But does this translate to a supercycle? Many of the drivers of the current rally are temporary in nature, including supply chain restocking, a mismatch of supply and demand recoveries and a stimulus-aided boom in consumer durable goods purchases. While we retain our view that this is not a steel supercycle, the arguments to the upside are finding more weight.

In our prior Insight, we noted that the energy transition is steel-intensive, but that it also comes with offsets because both fossil fuels and renewables are important sources of steel demand. Given the continued build in societal pressure to decarbonize, there is upside risk to steel demand from a faster than expected transition. For example, the timing of demand changes may be different as the world may need to install renewables before halting oil and gas investment, adding upside to steel demand and prices.

A further risk concerns Chinese steel supply. The Chinese government has set a near-term target to engineer a y/y fall in crude steel output in 2021 and has longer-term goals to reduce pollution and CO2 intensity. It is designing short-term policy measures to achieve this, including changing tax regimes on exports and imports. Longer term, a scenario in which the Chinese steel sector withdraws from the world export market and moves to importing has the potential to greatly alter world trade flows. Although outside of our base case forecast, if this eventuates, it will create periodic global supply constraints. Even so, we expect these would not last long enough to drive a new supercycle. Heightened mill profitability over an extended period would attract new supply to the market, including Chinese-owned supply located outside China.

Still No Supercycle, But the Upside Risks Have Gained Weight

The common theme throughout the aluminum, base metals, fertilizer and steel markets is that tensions across supply chains are creating a commodity price bubble. The bursting of this bubble is likely to be staggered and will be dependent on the length and severity of the inflation surge. While this is no supercycle, some of the supercycle criteria highlighted in our original Insight (namely demand disruptors and capacity constraints) may be shifting to be more supportive. Furthermore, policy measures are evolving on an almost daily basis, and changes in China have the potential to alter trade flows – an upside for the shorter-term business cycle. For a supercycle to be triggered, climate policy actions must meet ambitions – this will hopefully become clearer over the next year, and sooner or later this dilemma must be solved.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com