Market Segment

April 29, 2021

Ternium Sees Strong Market Growth in Mexico

Written by Sandy Williams

Ternium has strong confidence in the growth potential for the Mexican steel industry. Despite a poor performance by the government in helping the economy recover from the impact of the pandemic, CEO Maximo Vedoya expects the industrial base will continue to grow. One of the drivers will be reshoring of the supply base, which will add to steel consumption. Reshoring is happening in the U.S. and Mexico with Mexico having a very strong competitive advantage.

Steel consumption in Mexico, currently at 160 kilograms per inhabitant, is very low but will increase as the country develops, said Vedoya. Mexico has very low debt compared to other countries, which will be beneficial for building and improving infrastructure.

Currently the government is focused on only three projects, “but sometime in the next year or the following, they are going to realize that the needs of infrastructure in Mexico are huge, and they have the means to do it. And so those two things [reshoring and infrastructure] are going to increase steel consumption in Mexico. That’s why we think Mexico is going to grow. Again, it’s not going to be in the near, near future….but in the next two or three years, Mexico has to pass a huge infrastructure bill, as the U.S. is doing.”

New capacity coming online in North America is not expected to be a problem because it will be needed to fulfill increasing steel consumption and deter imports. “If you take the year 2020, imports from finished flat products in the U.S. and Mexico were around 15 million tons. And this is a year which is not a typical year, so you have a lot of room to compete with these imports,” said Vedoya.

“The question is, is the capacity we are building, at least the one that Ternium is building, able to compete with imports? That’s why we are building our capacity with a very competitive cost position. And so, we think that we are more than able to compete.” He added that he doesn’t believe the new capacity will have a huge impact on prices.

Ternium is looking forward to the start-up of its Pesqueria hot strip mill, which will produce its first coil on June 1. “In the shorter term, this state-of-the-art capacity will become very handy at the time of imbalance in the steel market, as it increases our market offering with an expanded product range and enables higher productivity throughout our facilities,” said Vedoya. “As we ramp up this new line, our current expectation is to achieve total incremental shipments in the North American market, the U.S. and Canada of more than 400,000 tons in the second half of this year. But with a longer-term view, I truly believe this will be a significant milestone in Ternium’s life, and it will make us ready for further steps in the country’s development.”

The hot strip mill will require an increase in slab consumption. Currently, Ternium is consuming about 3 million tons of slabs that will bump up to 5 million ton next year following the Pesqueria ramp-up. In the first quarter of 2021, the Brazil facility shipped 700,000 tons to Mexico.

“Ternium Brazil is running almost at 5 million tons,” said Vedoya. “And as you know, we finished our contract with Calvert. So, we don’t have to sell anything to the U.S. beginning in May. So, if you see it that way, we are almost balanced in our slab production and our slab needs. Nevertheless, we are going to buy from third parties because we intend to sell from our slab facility in Brazil, particularly to the local market.”

Selling slab from Brazil to the local customers “is a purely economic analysis” that will avoid issues with freight and weak currencies, said Vedoya. “Instead of them receiving a vessel once a month with a huge transit time, we ship by train every day for these customers, so they pay a premium and you don’t have the freight.”

Plans to decarbonize steelmaking operations around the world are taking hold, said Vedoya. “In China, the government is gradually mandating cuts of steel production with the aim at progressing towards the country’s decarbonization targets. If followed through, this could have a relevant effect in the future of all steel makers, as it could have the potential to solve the country’s chronic steel excess capacity and its detrimental effects in the world steel market.”

Future expansion projects will likely be centered at Pesqueria, said Vedoya. “You know that in 2027 the rule of origins of USMCA change. And, in order to be considered local, you have to have melted and poured in the region for the automotive sector. As we said several times, in 2027 we need to be compliant with USMCA, so one of the options is to invest in Pesqueria.”

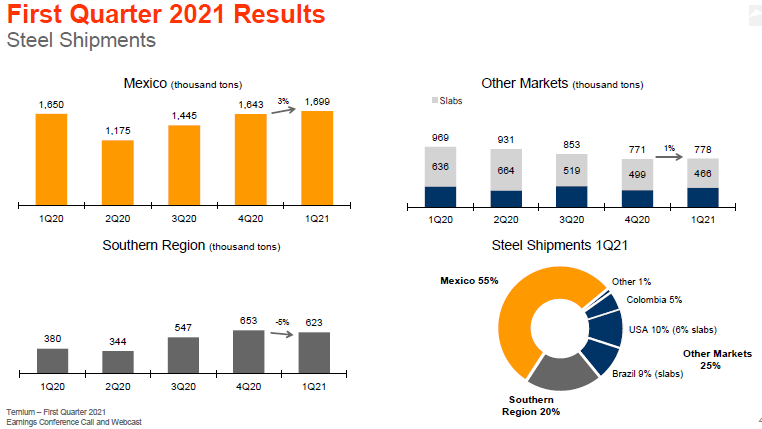

Ternium’s first-quarter net income was $707 million on net sales of $3.249 billion. Sales were up 25% sequentially and 43% year-over-year primarily due to higher steel pricing per ton. Shipments rose 1% to 3 million tons from Q4 with Mexican shipments impacted by extreme weather during Q1, negatively affecting shipments by about 80,000 tons.

Outlook

Looking forward, inventory levels in Mexico are very low. They are expected to normalize in the near future in the commercial market, but will take until the end of the year for industrial customers. Steel prices are expected to remain at current levels for the rest of the quarter and could decrease in the second half as capacity utilization catches up with demand.

Ternium anticipates higher EBITDA and margins in Q2 driven by higher realized steel prices partially offset by higher costs per ton. More than half of the sales in Mexico are under contract, resulting in a lag in realized prices. Prices are also elevated for iron ore, scrap and slab. Export-led customer demand is strong and, if market conditions remain steady, shipments in Mexico are expected to increase.

Ternium’s mills are operating at high capacity including the Ternium slab facility in Rio de Janeiro. The new facility in Columbia is ramping up faster than anticipated, providing approximately 20,000 tons of extra shipments per month in addition to the 10,000 tons of steel that was previously purchased from third parties, the company said.