Prices

April 20, 2021

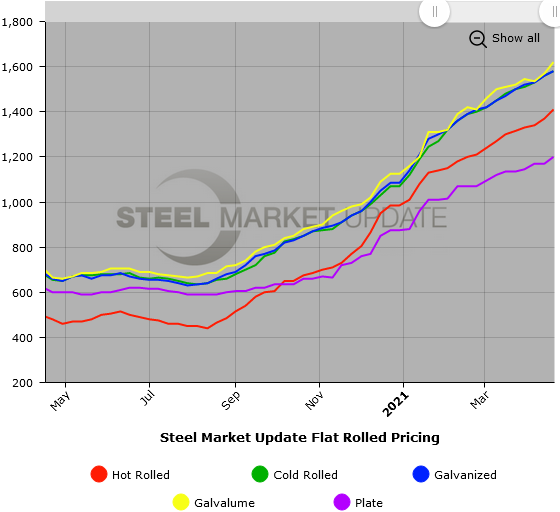

SMU Price Ranges & Indices: Hot Rolled Surges Past $1,400

Written by Brett Linton

The headline price for hot rolled steel crested $1,400 per ton this week, according to Steel Market Update’s latest check of the market, surpassing a mark that few buyers ever expected to see in their careers. SMU pegs the current average hot rolled price at $1,410 per ton, but sources report offers as high as $1,450 or more as service centers and OEMs try to outbid each other for the few spot tons that are available in an incredibly tight market. Overall, flat rolled prices are up by $20-50 per ton over last week.

The same can be said for plate, which is now selling for around $1,200 per ton, far above the previous high-water mark last recorded by SMU of $1,010 in early 2019. Sources tell SMU that the mills might announce another $60 per ton increase on plate before the end of April when they open up the June order book. With little sign that supplies can possibly catch up with the surging demand anytime soon – even with the many tons of imports already on their way to the United States – SMU’s Price Momentum Indicators continue to point toward higher prices over the next 30-60 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,370-$1,450 per net ton ($68.50-$72.50/cwt) with an average of $1,410 per ton ($70.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago, while the upper end increased $50. Our overall average is up $40 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 7-12 weeks

Cold Rolled Coil: SMU price range is $1,540-$1,620 per net ton ($77.00-$81.00/cwt) with an average of $1,580 per ton ($79.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $20 per ton compared to last week. Our overall average is up $20 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 8-14 weeks

Galvanized Coil: SMU price range is $1,540-$1,620 per net ton ($77.00-$81.00/cwt) with an average of $1,580 per ton ($79.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $20 per ton compared to one week ago. Our overall average is up $20 per ton from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,609-$1,689 per ton with an average of $1,649 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 8-15 weeks

Galvalume Coil: SMU price range is $1,600-$1,640 per net ton ($80.00-$82.00/cwt) with an average of $1,620 per ton ($81.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to last week, while the upper end increased $40. Our overall average is up $50 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,891-$1,931 per ton with an average of $1,911 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 10-15 weeks

Plate: SMU price range is $1,150-$1,250 per net ton ($57.50-$62.50/cwt) with an average of $1,200 per ton ($60.00/cwt) FOB mill. The lower end of our range increased $10 per ton compared to one week ago, while the upper end increased $50. Our overall average is up $30 from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 6-10 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.