CRU

March 16, 2021

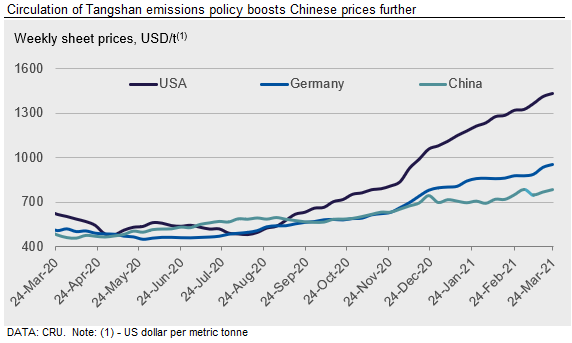

CRU: Tangshan Emission Cut Boosts Chinese Sheet Prices Further

Written by George Pearson

By CRU Analyst George Pearson, from CRU’s Steel Sheet Products Monitor

Details of China’s Tangshan emission control policy that circulated in the last week have provided a further boost to Chinese steel prices but have weighed on prices for iron ore. The high cost of freight is still reducing the competitiveness of sheet imports in every region except for the U.S., where prices are far above the rest of the world. Sheet prices and mill margins are now in uncharted territory, with several regional prices and regional producer margins at the highest level recorded by CRU.

North America

Prices of U.S. sheet products continued to increase over the past week with HR coil reaching a record level of $1,302 /s.ton, an increase of $19 /s.ton w/w. Our volume of submissions increased this week, even though we repeatedly heard that the mills had very few spot tons available, indicating that lead times are in June for any orders other than contractual ones. While imports are arriving, most buyers feel that they are not in quantities great enough to solve the current supply shortage. As new capacity becomes available in Q3 and a larger wave of imports arrives in June-July, consumers are hoping for some relief from increasing sheet prices.

On the U.S. West Coast, California Steel Industries began accepting orders last week for June delivery. Buyers report that CSI has been very good about on-time deliveries while the other domestic mills are delayed on average by three to five weeks. In anticipation of its new mill coming online in June, Ternium has begun offering material for July delivery at prices slightly lower than current domestic pricing.

Europe

In Europe, sheet prices increased by €9-30 /t w/w across all products. German HR coil reached €800 /t and Italian sheet prices have closed some of the gap between north and south, with HR coil rising to €765 /t in our latest assessment. European mills have increased offer prices, with long lead times still reducing pressure to take bookings. Italian service centers have booked import material in the last month to cover future orders but anticipate fewer import bookings in April. ArcelorMittal’s subsidiary AM InvestCo has announced that it will cut Taranto’s production to a minimum output after Italian state-owned company Invitalia failed to meet a payment deadline in an agreement between the two companies. Production at Ilva remains highly politicized and the announcement has been met with some skepticism in the market.

China

Chinese domestic sheet prices went up by RMB30-110 /t over the last week. HR coil prices increased the most due to the Tangshan emission control draft policy being circulated. Sentiment turned bullish as the city asked local mills to cut capacity by 30-50%, depending on the mill, over the course of the next nine months. In an extreme scenario, if this is strictly enforced, we expect a total of 21 Mt of hot metal to be cut from total Chinese supply in 2021. This explains why HR coil prices responded more quickly than CR coil and coated sheet this week, both of which rose by RMB30-40 /t w/w. Although this capacity restriction is still subject to finalization and there are concerns over its enforcement, as we have already heard from sources, we do see this as a major support factor for sheet prices in the short-term when combined with a seasonally strong demand period.

Asia

Sheet prices in South East Asia’s import market continued to rally amid limited supply and rising freight costs. CRU assessed HR coil prices $25 /t higher w/w at $780 /t, CFR Far East Asia. CR coil prices rose by $35 /t to $895 /t, while HDG prices were up by 25 /t w/w to $905 /t.

Last week, several deals of HR coil SAE1006 were concluded at $765-785/t CFR Vietnam, mostly for Indian material. This week, Indian steel mills raised offers to $805/t CFR Vietnam. There were still limited offers for Chinese material because of uncertainty regarding a potential export rebate cut by the Chinese government. The freight rate for China-Vietnam was $25-30 /t this week compared with $23-30 last week. These rates are still around double those in place before Chinese New Year.

In addition, Hoa Phat steel mill also announced HR coil offers to their domestic buyers and the new price was equivalent to $760-765 /t CFR Vietnam, which is a $75/t increase m/m.

India

Indian sheet prices have remained on an upward trajectory, rising INR400-500 ($5-7) /t w/w in the latest reported retail transactions. This is despite easing of the supply disruption caused by labor unrest at a major downstream sheet producer during the first fortnight of March. The latest uptrend in sheet prices is a consequence of a sharp rise in HR coil import prices in the Asian import market. Indian suppliers have reportedly booked HR coil for exports at $750-760 /t FOB (up $15-20 /t w/w) for late April/early May delivery last week. Their export offer prices this week were heard in the range of $770-780 /t FOB, although no bookings were reported at these levels at the time of publishing. Meanwhile, Japanese and South Korean origin HR coil is being offered to Indian buyers at $800-820 /t CFR for May delivery. These higher import offers have led to a rise in domestic steel prices despite modest demand conditions. CRU understands from market sources that Indian steelmakers are likely to announce price increases of around INR1000-2000 ($14-28) /t across sheet products for April delivery.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com