CRU

March 16, 2021

CRU: Record Prices Further Enhance Adoption of CME Group’s HRC Steel Futures Contract

Written by Josh Spoores

By CRU Principal Analyst Josh Spoores, and Gregor Spilker, CME Group

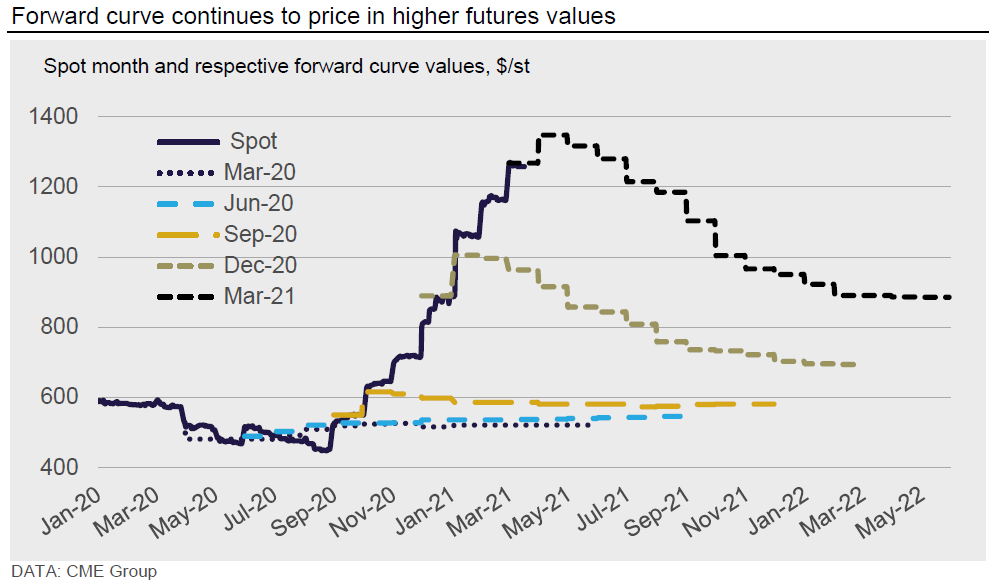

By early 2021 Q2, HRC prices in the U.S. Midwest market had tripled from the trough reached in August 2020. As prices rose from $437 /s.ton to a record high of over $1,300 /s.ton, CME Group’s U.S. Midwest HRC contract settled on CRU surged to record levels of open interest and the contract is seeing continued growth in trading volumes. Spot HRC prices have run ahead of longer dated futures, leading to the market being in deep backwardation.

Supply Chain Whipsawed by COVID-19 Pandemic

As the global response to the pandemic emerged in late 2020 Q1, economic activity fell rapidly as many global markets ordered various shelter-in-place orders with only essential business operations allowed. The subsequent collapse in steel demand meant steel mills were forced to severely curtail output with the majority of cuts coming from blast furnace-based producers, which by their nature have limited flexibility in operating.

As the lockdowns in North America started to ease in mid-May 2020, steel sheet consumption began to rise off the bottom. Yet overall industrial activity was well below pre-pandemic levels and as such, inventories throughout the supply chain were excessive. This allowed mills the option to assess the market risk of restarting production, and most concluded that expensive restarts were not yet prudent.

Demand Recovery Depletes Inventory

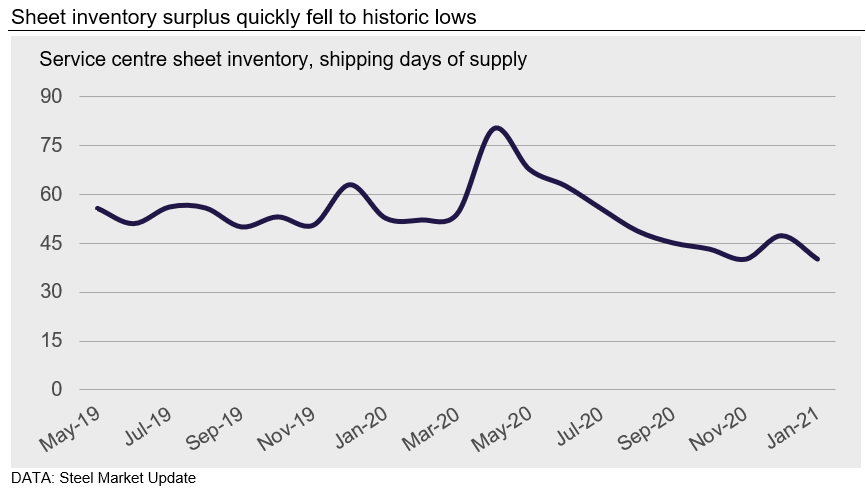

The price of HR (hot-rolled) coil eventually bottomed in mid-August at $437 /s.ton, a 25% drop from the pre-pandemic high of $584 /s.ton. At this time, sheet demand continued to rise from the 2020 Q2 lows, led by a strong rebound in automotive production. Inventories, meanwhile, had started to fall more rapidly. Steel Market Update, part of CRU, tracks inventory at service centers. Based on the daily shipping rate, inventory was 52.9 shipping days of supply in 2020 Q1 and rose to an average of 70.1 in 2020 Q2 before rapidly falling to 48.6 days of supply in August.

Inventories had fallen back as demand increased at a faster rate than the production of steel sheet. And while idled furnaces were coming back online to satisfy this rising demand in 2020 H2, various production disruptions impacted multiple steel mills. These included normal operating and maintenance issues, but also an explosion, a labor strike, COVID-19 outbreaks, and later, a severe winter storm.

Disruptions slowed or paused steel production at multiple facilities, limiting the ability of mills to increase shipments, even though prices by mid-October were nearly 50% higher than the recent low. With production unable to keep up with demand, inventories fell to a low of just 40 shipping days of supply in November 2020 versus 52.9 in 2020 Q1.

On top of limited domestic supply, imports were minimal and not competitive for domestic buyers prior to 2021 Q1. This was because global prices had risen alongside these same post-lockdown fundamentals.

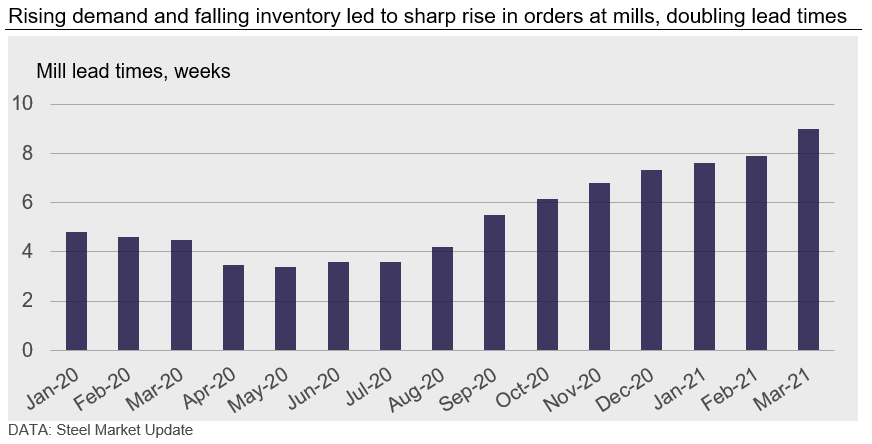

Lead Times Extend

Partly due to disruptions as well as rising underlying demand and the need to build inventory, strong order rates for steel led to rapidly expanding lead times. For HR coil products, lead times were below four weeks in early August 2020, but eventually rose to over nine weeks by early March. The result of expanding lead times was the necessity of buyers to further increase orders at mills, in order to maintain adequate inventory based on lead times. Due to the production disruptions and increased orders, mills were producing at 100% of effective capacity, allowing pricing power to shift firmly toward the mills. Buyers were prepared to pay, quickly revealing the price inelasticity of steel supply, at least in this timeframe.

CME Group’s HRC Futures Flip to Backwardation

Driven by this extreme set of circumstances, U.S. HRC prices have more than tripled since they touched a low of $437/s.ton this past summer. As outright prices strengthened throughout the second half of the year, the term structure also flipped from a contango environment to a market in backwardation—indicating tight supply for prompt delivery and meaning longer lead times as per the above charts. The market is now traded at a record backwardation, with the 12-month forward contract trading more than $300 below spot month.

While the changes in outright prices were spectacular enough in their own right, shifts in the term structure have been no less eye-catching. As of March 17, 2021, the forward curve price indicates further tightness all the way to 2021 Q2, before dropping off precipitously into 2021 Q4 and the next year.

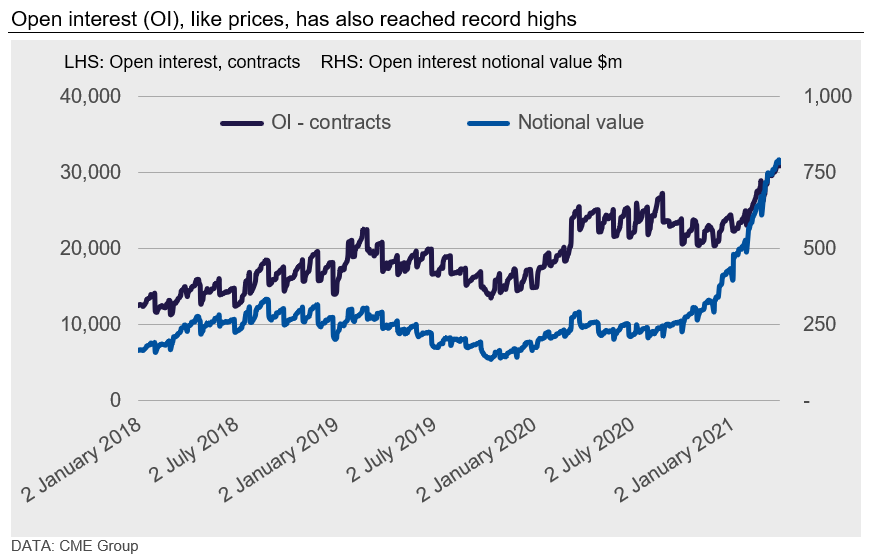

As of late March 2021, open interest (OI) in U.S. HRC stands above 30,000 contracts (600,000 short tons) for the first time ever. This is nearly double the amount of OI versus early 2020 and new records continue to be set in early April. Measured in notional value terms, the increase in OI is even more dramatic: It was around $200m in January 2020, and now stands at just shy of $800m (as of March 31, 2021; notional value was measured using the prevailing spot month price). Trading activity in 2020 was also record breaking, with total traded volume in U.S. Midwest HRC increasing to 221,756 contracts, +26% year on year. This is equivalent to a daily turnover of 877 contracts, or 17,540 short tons of steel traded on the Exchange every 24 hours.

The CFTC Commitment of Traders (“COT”) report tracks the net positioning of “Managed Money”—the category that includes commodity trading advisors, fund managers, etc. Starting from a net short positioning during the first phase of lockdowns in late 2020 Q1, those accounts increased their positions to record levels of net length by 2020 Q3, in time to capture the price rally in Midwest steel prices. By November, however, positioning had switched into net short. As of the latest CFTC COT report (March 30, 2021), Managed Money accounts have a net short position in U.S. HRC of 10,402 contracts—also a record, but on the short side this time.

HRC Commitment of Traders Report—Managed Money Switches to Record Net Short

HRC Price Volatility Will Remain, Which Will Continue to Support the Use of Steel Futures

The HRC futures market is in heavy backwardation. Faced with strong volatility in outright prices and along the forward curve, market participants have relied on CME Group’s liquidity to manage their risk and capture trading opportunities—this shows in record trading volume (+26% year on year) and the build-up in open interest to above 30,000 contracts.

With HRC prices at record levels and more than double the 2004-2019 average of $620, there is serious risk in the market for any participants with price exposure. In addition, the forward curve shows large value differentials between nearby and deferred delivery months. While global prices and costs are high, domestic prices are unsustainable at their current level. We believe the primary catalyst for prices to reverse will be a dramatic increase in available supply. This supply increase has already started to come about with increased domestic production, rising import arrivals and soon, a substantial increase in supply from new steel mills starting up this summer. While end demand growth will remain strong, the startup of 7 Mt of new supply this summer and an additional 4 Mt in 2021 Q4 will likely overwhelm demand and drive prices back down towards more sustainable levels.

As supply chains recover from pandemic disruption and new supply comes online, HRC prices will likely revert from a supply-deficit price back towards a cost-plus mechanism. And while prices may continue to find some support from high raw materials costs and global prices, this will largely be transitory.

From our view, many market participants have embraced the CME Group’s CRU-settled HRC steel futures contract, as evidenced by the record level of volume and open interest. We expect price volatility to remain a constant in the U.S. Midwest HRC market and as such, we anticipate further participation in futures, which will help market participants to better manage their price risk exposure.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com