CRU

March 11, 2021

CRU: Metallics Prices Rebound as Markets Tighten

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley from CRU’s Steel Metallics Monitor

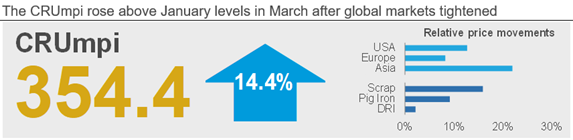

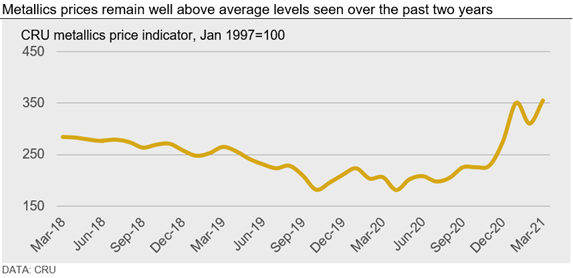

The CRU metallics price indicator (CRUmpi) rose by 14.4% m/m in March to 354.4, bouncing back above levels seen in January. China’s return to the steel market following New Year holiday celebrations there helped lift steel and scrap prices in Asia, while seasonally constrained supply in Europe and the U.S. during a time of high demand also resulted in a rise in metallics prices. We see some downside price risks building for April, but do not expect prices to undergo substantial downside pressure.

A variety of supply-side factors combined for March trading to limit the availability of metallics across the globe. At the same time, steel demand remained strong and metallics consumption rates high, leading to notable market tightness and, consequently, higher prices. Indeed, March market dynamics looked very similar to those back in January, and price levels either neared or exceeded levels set during the first month of the year. In Asia, Chinese demand returned in force following the Chinese New Year holiday, boosting scrap demand and prices. This higher demand in Asia caused Turkish steel export (and scrap import) prices to rise, pulling more material from the U.S. and European markets where supply availability was already seasonally limited.

Government-led pandemic controls in China led to more workers staying in their areas of work instead of returning to their hometowns, allowing steelmaking and manufacturing activity to return more quickly than in prior years. While this increased demand, scrap collection companies in the country generally did not bring workers back until after the Lantern Festival on Feb. 26, meaning that scrap supply availability was low compared to demand.

In other areas of Asia, prices also rose after electricity rates in Japan normalized and allowed steelmaking activity to resume in the Kanto region, increasing scrap prices thereby 42% m/m. This demand increase meant lower availability for southeast Asian importers. In Vietnam, prices rose by $84 /t m/m as importers there turned to Australian and U.S. exporters for material amid strong interest from Chinese buyers for billet. Importers in Bangladesh also focused on securing U.S. and European material.

China’s return to the steel market also impacted demand for Turkish steel exports. While there were small, intermittent increases in Turkish scrap import prices in early February, by the time March arrived prices were up by $58 /t m/m for HMS 1/2 80:20 CFR Turkey. This increase was substantial enough to even attract Russian scrap exporters, who had been dissuaded from sending material abroad in February due to the imposition of a new export tariff. With material leaving the country and stocks dwindling, Russian mills were also forced to increase scrap bids.

The pull from Turkey also helped create market tightness in Europe, boosting obsolete scrap prices there back to January levels. Moreover, domestic demand on the continent rose during the second half of February as wire rod and rebar mills in Germany began receiving more orders. Even though prime grade availability was hampered by lower manufacturing activity during the lockdowns, the E8 price premium to shredded scrap has not increased.

Conversely, U.S. prime grade prices increased by more than obsolete grades as a semiconductor shortage began to curtail automotive output. Given high steel prices and demand, mills were forced to compete more aggressively for prime material, but a cold snap throughout most of the country also limited obsolete grade availability.

Higher scrap prices and steel output, in combination with increasing iron ore and freight costs, caused ore-based metallic prices to rise as well. While Europe and the U.S. were the most active in the pig iron market, Chinese HBI buyers are now also seeking material.

Outlook: Prices to Face Some Downside Pressure in April

Chinese steel demand looks to be stable in the coming weeks, although the market is approaching peak buying season for long products. We expect this to help keep other steel markets strong and scrap demand high. That said, scrap is becoming seasonally easier to collect in many markets and collection is highly incentivized at current price levels. As such, we do expect to see some downside pressure on obsolete grade pricing in April, although any downside pressure on prime grades is likely to be more limited.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com