Prices

March 5, 2021

January Imports at 2.4 Million Tons, February Licenses at 2.0 Million

Written by Brett Linton

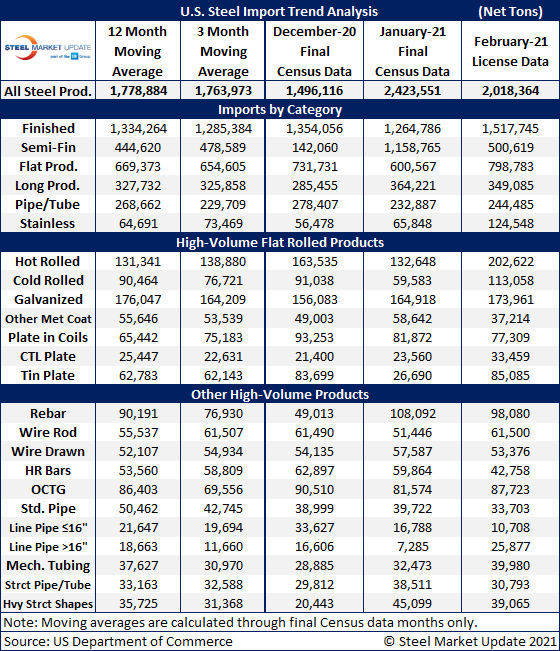

January U.S. steel imports surpassed 2.42 million tons, according to final Census data released last week, up 62% from December due to the quarterly surge in semifinished product imports. Focusing on finished steel imports only, January figures are down from December by 7%.

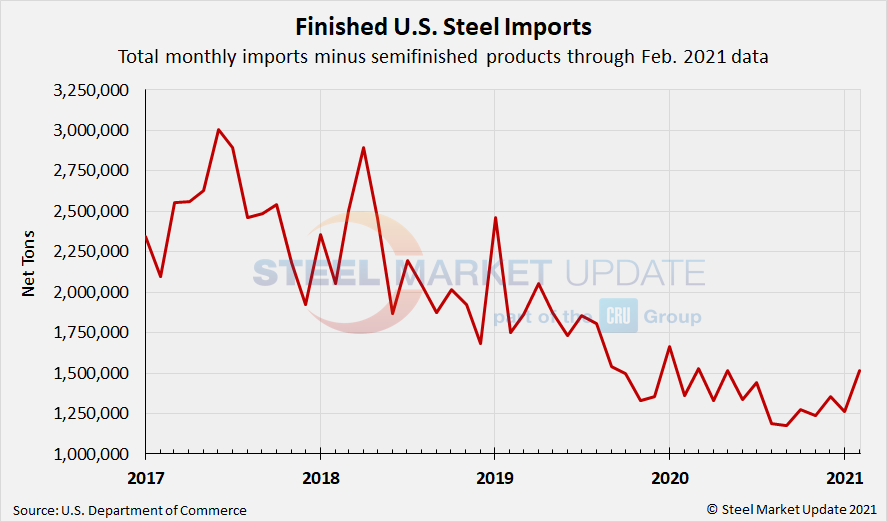

February import licenses are currently at 2.02 million tons through March 5 data, down 17% from January. Recall that the average monthly import level for 2020 was 1.84 million tons, down from 2.32 million tons in 2019 and 2.81 million tons in 2018. Finished steel imports were up to 1.52 million tons in February, up 20% over the month prior and potentially the highest level seen since early-2020.

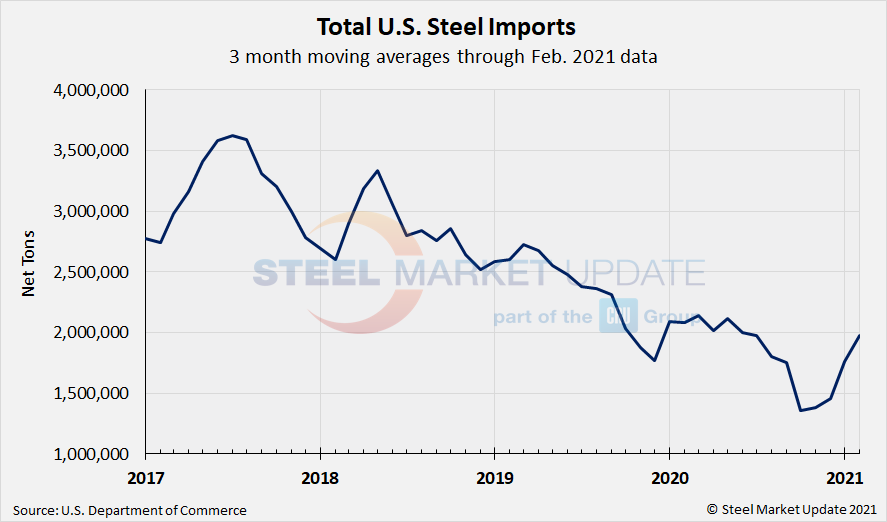

Due to large month-to-month swings in semifinished imports, the chart below shows total monthly imports on a three-month moving average (3MMA) basis in an attempt to more accurately display the U.S. steel import trend. The 3MMA through February license data is 1.98 million tons, up from 1.76 million tons in January and up from 1.46 million tons in December. It appears total steel imports are climbing back towards pre-pandemic levels.

As requested by SMU members, we have expanded the import table below to include other high-volume products in addition to our normal focus on flat rolled products. We now show a brief history on products such as rebar, tin plate, wire rod, structural pipe and tube, and other long products. We also provide data on categorized imports, divided into semifinished, finished, flat rolled, longs, pipe and tube, and stainless products. We welcome your comments.

Total finished imports in January were down 7% from the prior month at 1.26 million tons, while February licenses were up to 1.52 million tons. If this upwards February license trend continues, it could be the highest monthly finished steel import level seen since January 2020.

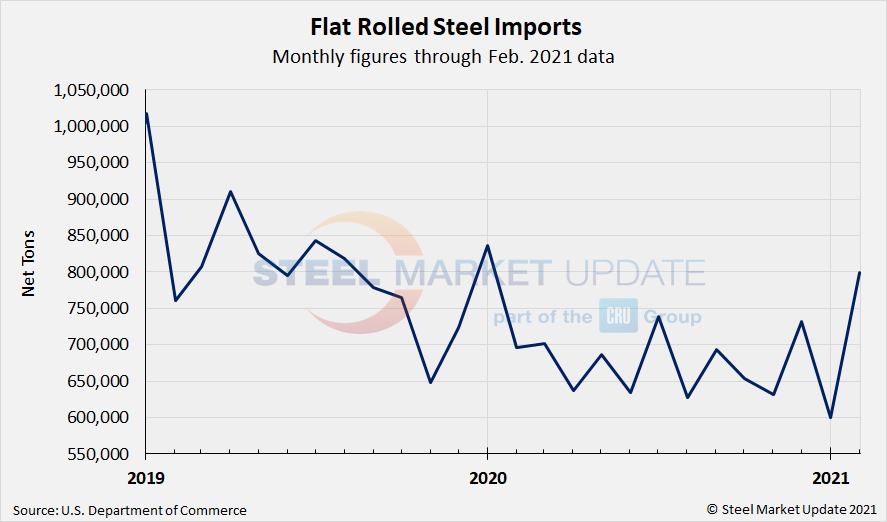

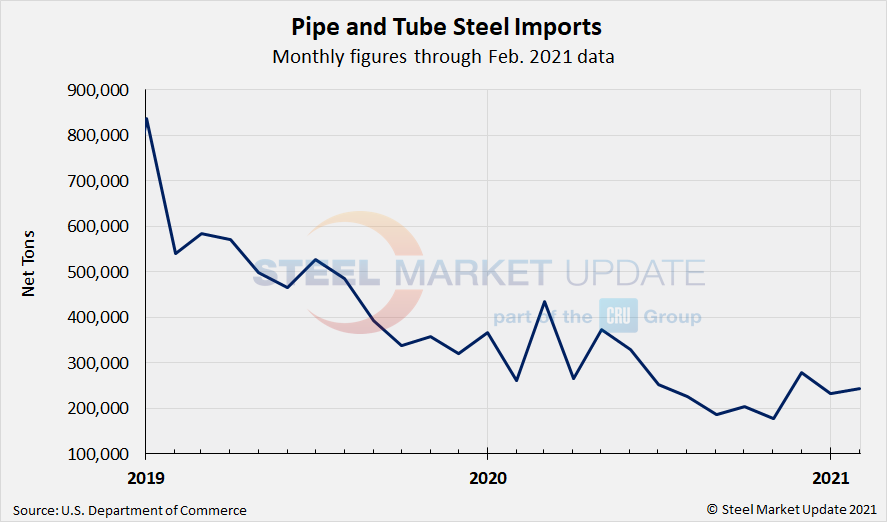

The two charts below show monthly imports grouped by product category: flat rolled imports and pipe and tube imports. Both categories were down from December to January, with flat rolled imports at a multi-year low. February data suggests a 33% spike in flat rolled imports, while imports of pipe and tube products are up just 5% over January.

By Brett Linton, Brett@SteelMarketUpdate.com