Overseas

February 18, 2021

Cheaper Foreign Steel Continues to Entice U.S. Buyers

Written by Brett Linton

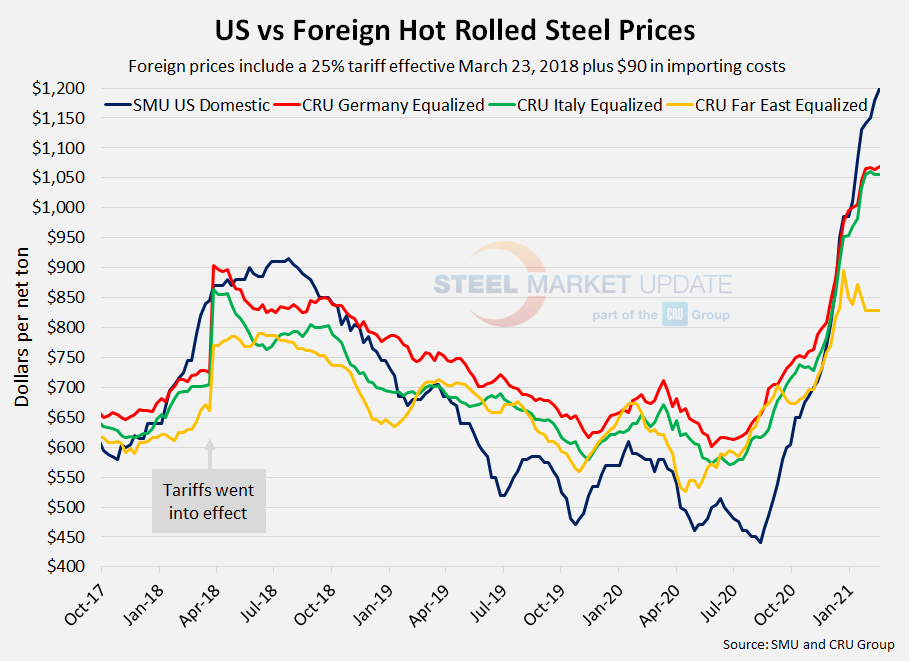

As domestic hot rolled steel prices continue to soar upwards of $1,200 per ton, foreign steel imports continue to tempt U.S. buyers with potential discounts of 10% or more, according to Steel Market Update’s latest foreign versus domestic hot rolled steel price comparison. Foreign HRC prices are theoretically $131-$373 per ton cheaper than domestic steel prices at this time. Recall that domestic mills held record-high price advantages back in August 2020, when foreign steel prices were between $176 and $220 per ton more expensive than domestic steel. This domestic advantage quickly faded in November/December as U.S. prices skyrocketed.

The following calculation is used by Steel Market Update to identify the theoretical spread between foreign hot rolled steel prices (delivered to U.S. ports) and domestic hot rolled coil prices (FOB domestic mills). This is only a “theoretical” calculation as freight costs, trader margin and other costs can fluctuate, ultimately influencing the true market spread. This compares the SMU U.S. hot rolled weekly index to CRU hot rolled weekly indices for Germany, Italy and Far East Asian ports.

![]() SMU includes a 25 percent import tariff effective on foreign prices after March 23, 2018. We then add $90 per ton to the foreign prices in consideration of freight costs, handling, trader margin, etc., to provide an approximate “CIF U.S. ports price” that can be compared against the SMU U.S. hot rolled price. Note that we do not include any antidumping (AD) or countervailing duties (CVD) in this analysis.

SMU includes a 25 percent import tariff effective on foreign prices after March 23, 2018. We then add $90 per ton to the foreign prices in consideration of freight costs, handling, trader margin, etc., to provide an approximate “CIF U.S. ports price” that can be compared against the SMU U.S. hot rolled price. Note that we do not include any antidumping (AD) or countervailing duties (CVD) in this analysis.

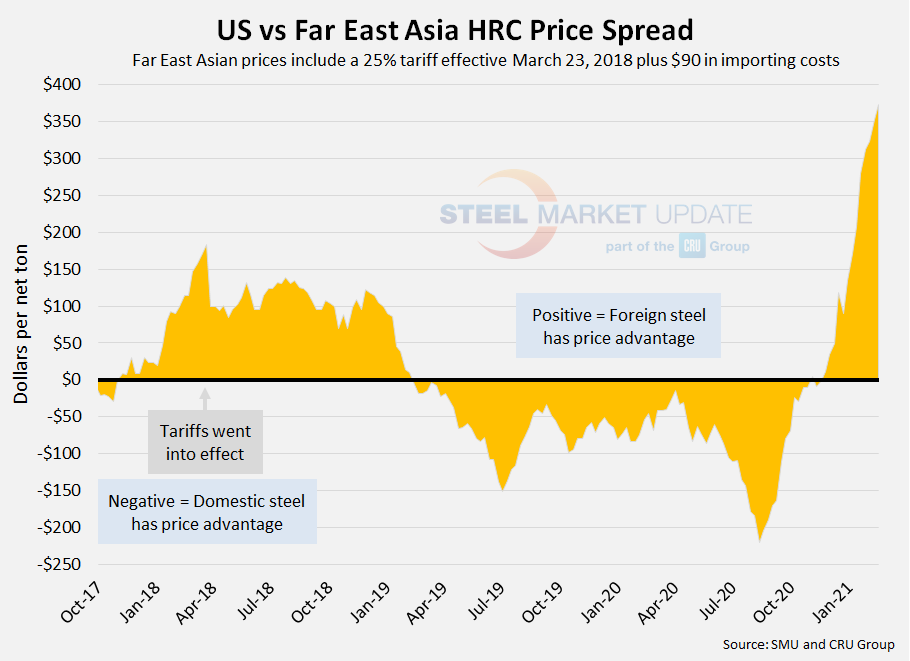

Far East Asian HRC (East and Southeast Ports)

As of Wednesday, Feb. 17, the CRU Far East Asian HRC price was unchanged over last week and the week prior at $590 per net ton ($650 per metric ton). Adding tariffs and import costs, the delivered price of Far East Asian HRC to the U.S. is $828 per ton. The latest SMU hot rolled price average is $1,200 per ton, up $20 over last week and up $50 from two weeks prior. Therefore, U.S.-produced HRC theoretically is now $373 per ton more expensive than imported Far East Asian HRC, up from $323 two weeks ago. Asian imports, which had been more expensive than domestic for over a year and a half, gained their price advantage in November. In mid-August, domestic HRC held a record-high $220 per ton price advantage over Far East Asian HRC.

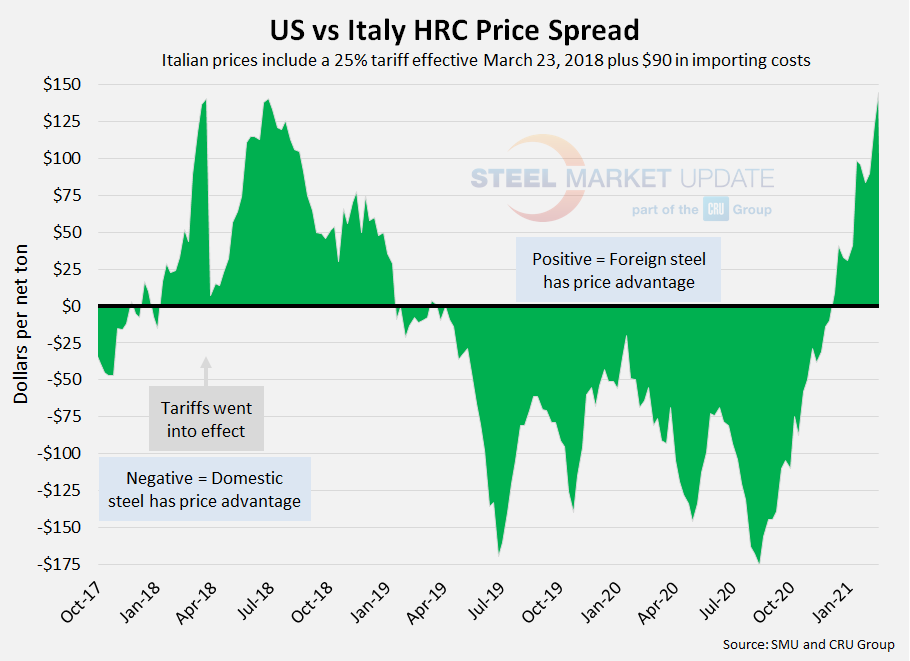

Italian HRC

CRU published Italian HRC prices at $772 per net ton ($851 per metric ton), down $1 from last week and down $4 from two weeks ago. After adding tariffs and import costs, the delivered price of Italian HRC is approximately $1,055 per ton. Accordingly, domestic HRC is theoretically $145 per ton more expensive than imported Italian HRC, up from $90 two weeks ago. Prior to December, U.S. prices had held the price advantage for over a year and a half. This price differential has been shrinking since mid-August, when domestic HRC held a record high $176 per ton price advantage over Italian imports.

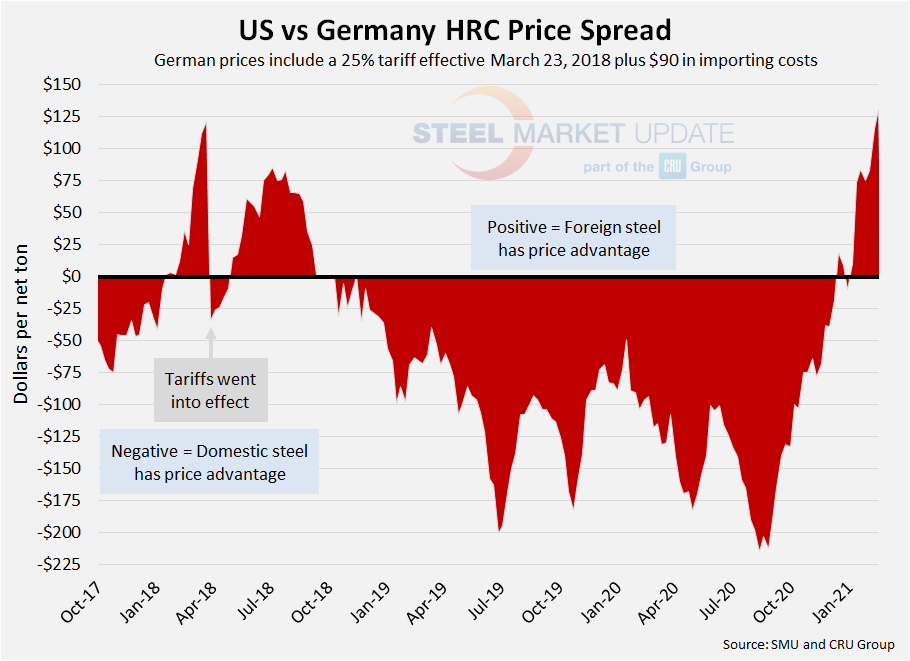

German HRC

The latest CRU German HRC price is $783 per net ton ($863 per metric ton), up $4 from the previous week and up $1 from two weeks prior. Adding tariffs and import costs, that puts the German price at $1,069 per ton delivered to the U.S. Therefore, domestically sourced HRC is theoretically $131 per ton more expensive than imported German HRC, up from $83 two weeks ago. Prior to December, U.S. prices had held the competitive price advantage for over two years. This price differential has been shrinking since mid-August, when domestic HRC held a record high $215 per ton price advantage over German imports.

The graph below compares all four price indices and highlights the effective date of the tariffs. Foreign prices are referred to as “equalized,” meaning they have been adjusted to include tariffs and importing costs for a like-for-like comparison against the U.S. price.

Note: Freight is an important part of the final determination on whether to import foreign steel or buy from a domestic mill supplier. Domestic prices are referenced as FOB the producing mill, while foreign prices are FOB the Port (Houston, NOLA, Savannah, Los Angeles, Camden, etc.). Inland freight, from either a domestic mill or from the port, can dramatically impact the competitiveness of both domestic and foreign steel. When considering lead times, a buyer must take into consideration the momentum of pricing both domestically and in the world markets. In most circumstances (but not all), domestic steel will deliver faster than foreign steel ordered on the same day.

By Brett Linton, Brett@SteelMarkeUpdate.com