Prices

February 16, 2021

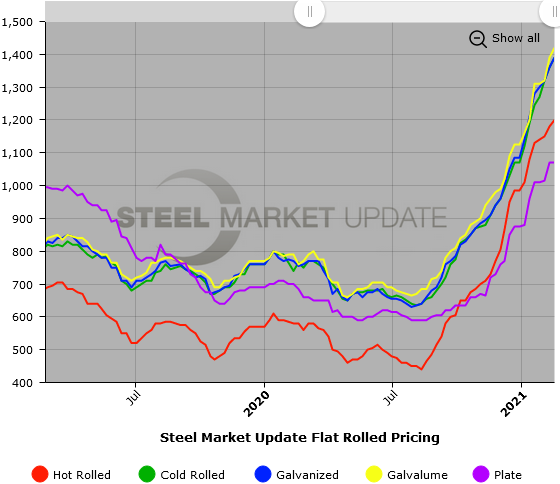

SMU Price Ranges & Indices: New High Mark for HR at $1,200

Written by Brett Linton

Speculation that hot rolled steel prices could reach $1,200 per ton drew scoffs from some quarters just two months ago, yet here we are. Steel Market Update’s check of the market this week shows the average HR price up a further $20 per ton to yet another record high. The HR price surpassed the former high recorded by SMU ($1,070 in mid-2008) in the second week of January and has added $130 to the average price tag for a ton of steel since then. How much higher can it go? “Until people stop buying,” commented one respondent to SMU’s survey this week. “This is a unique market and the combination of factors are making for a perfect storm.” Nothing perfect about the stormy winter weather that is delaying steel shipments all across the country, only adding to the tight supplies and difficulty buyers face getting their hands on steel. Prices for other flat rolled products jumped by around $30 per ton this week as well. And steel prices could keep rising until new mill capacity comes online – something that won’t happen until this summer – or until imports reach a critical mass. SMU’s Price Momentum Indicators continue to point toward higher prices in the short term. But buyer beware: That momentum could shift rapidly now that HR has hit what many observers believed would be the market’s peak.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,150-$1,250 per net ton ($57.50-$62.50/cwt) with an average of $1,200 per ton ($60.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to one week ago, while the upper end increased $50. Our overall average is up $20 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 6-12 weeks

Cold Rolled Coil: SMU price range is $1,340-$1,440 per net ton ($67.00-$72.00/cwt) with an average of $1,390 per ton ($69.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $40. Our overall average is up $30 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 7-13 weeks

Galvanized Coil: SMU price range is $1,340-$1,440 per net ton ($67.00-$72.00/cwt) with an average of $1,390 per ton ($69.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $40. Our overall average is up $30 from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,409-$1,509 per ton with an average of $1,459 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 8-14 weeks

Galvalume Coil: SMU price range is $1,370-$1,470 per net ton ($68.50-$73.50/cwt) with an average of $1,420 per ton ($71.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to one week ago, while the upper end increased $50. Our overall average is up $30 from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,661-$1,761 per ton with an average of $1,711 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-14 weeks

Plate: SMU price range is $1,020-$1,120 per net ton ($51.00-$56.00/cwt) with an average of $1,070 per ton ($53.50/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged compared to last week. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 5-10 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.