Prices

February 3, 2021

Raw Materials Prices: Iron Ore, Coking Coal, Pig Iron, Scrap, Zinc

Written by Brett Linton

Among steelmaking raw materials, the prices of iron ore, pig iron and scrap saw large gains in January compared to months prior, up as much as 86 percent year over year. Coking coal prices, which rebounded compared to recent months, were still down 9 percent in January versus prices one year ago. Zinc prices have declined from the high levels seen one month ago, but remain strong compared to the second half of 2019 and most of 2020. Aluminum prices have been hovering around $0.90 per pound since late-November 2020, some of the highest prices seen in recent years.

Table 1 summarizes the price changes of the seven materials considered in this analysis. It reports the month/month, three months/three months and year/year changes as a percentage.

Iron Ore

The Chinese import price of 62% Fe content iron ore fines has been on the rise since May. Figure 1 shows the price of 62% Fe delivered North China since January 2018 at $169.3 as of Jan. 27, up 86 percent over levels one year ago. (Editor’s note: Subsequent to this writing, our sister company CRU reported a sharp decline in iron ore prices in China, which took the 62% Fe fines price down to $152.0 /dmt, a $15.5 /dmt decline w/w as of Feb. 2).

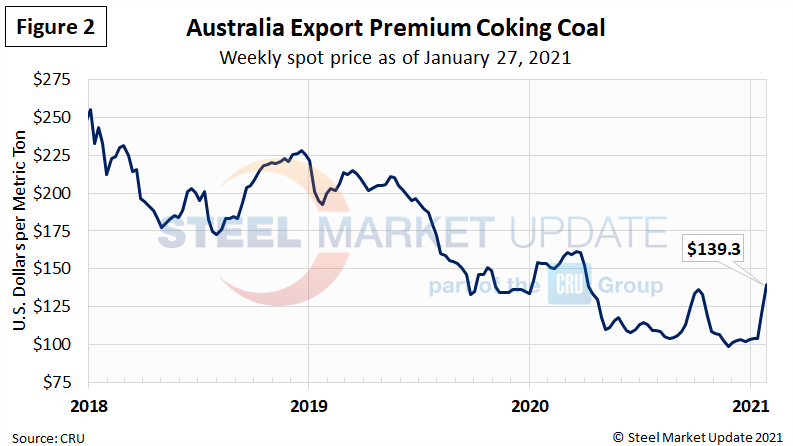

Coking Coal

The price of premium low volatile coking coal FOB east coast of Australia had jumped up in September/October, then declined to a low of $98.5 in late-November. Prices have bounced upwards since then, currently at $139.3 dollars per dry metric ton as of Jan. 27 (Figure 2). The seaborne coking coal price has not been able to fully benefit from the strong demand in China due to import restrictions. Recent coking coal prices remain at the lowest levels seen in SMU’s limited history.

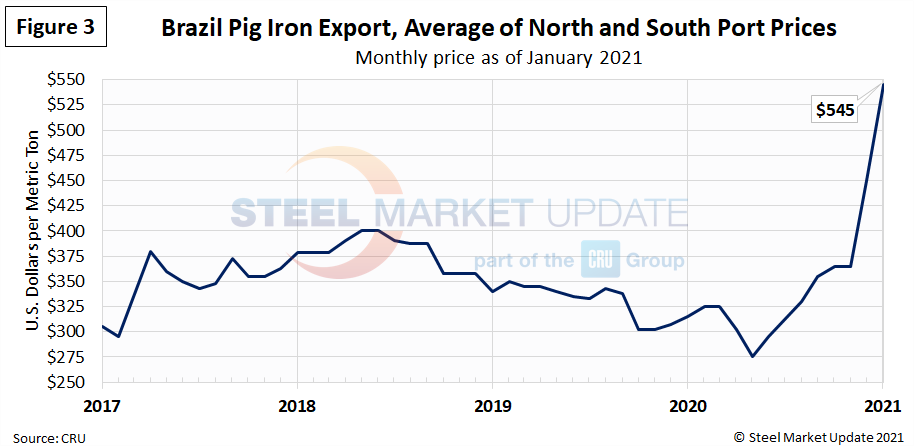

Pig Iron

Most of the pig iron imported to the U.S. currently comes from Russia, Ukraine and Brazil. This report summarizes prices out of Brazil and averages the FOB value from the north and south ports. The latest data through January shows an average pig iron price of $545 per metric ton, up 49.3 percent in just two months, and nearly double the May 2020 low of $275. Pig iron prices had declined since mid-2018, but have risen each month since June 2020 (Figure 3).

Scrap

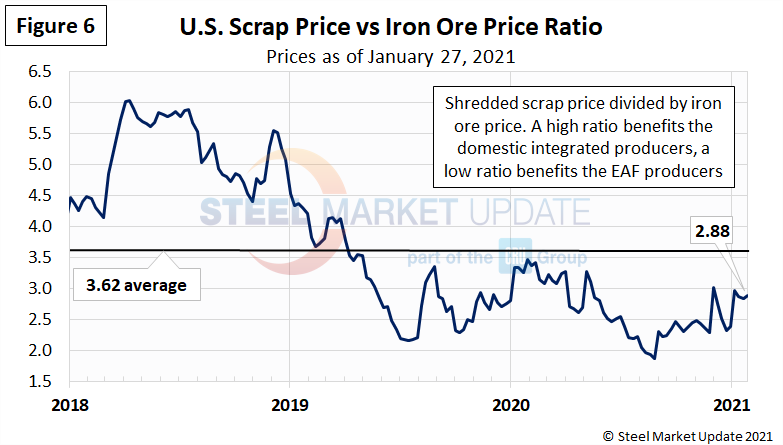

Hot rolled steel prices fluctuate up and down with the price the mills must pay for their raw materials. Changes in the relationship between scrap and iron ore prices offer insights into the competitiveness of integrated mills, whose primary feedstock is iron ore, versus the minimills, whose primary feedstock is scrap. Figure 4 shows the spread between shredded and busheling, both priced in dollars per gross ton in the Great Lakes region. January scrap prices increased 25 percent from December, were up 71 percent over October, and rose over 55-60 percent compared to this time January 2020. Scrap prices are expected to level off or decline somewhat in February.

Figure 5 shows the recent spread between the price of iron ore, at $169.3 per dry metric ton, and shredded scrap at $487.5 per gross ton.

To compare the two, Steel Market Update divides the shredded scrap price by the iron ore price to calculate a ratio (Figure 6). A high ratio favors the integrated/BF producers, a lower ratio favors the minimill/EAF producers. As the 2.88 ratio shows, minimills continue to hold a more competitive cost advantage. This ratio hit an all-time low of 1.86 in late-August 2020 (in our 12+ year limited data history).

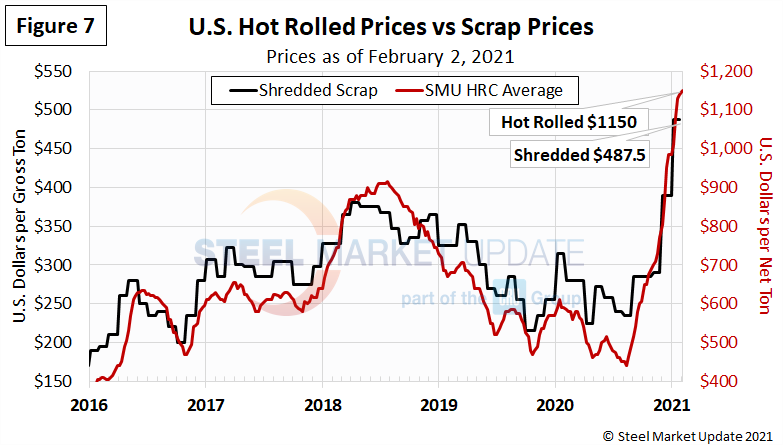

Figure 7 shows how the price of hot rolled steel generally tracks with the price of shredded scrap. Shred rose by approximately $100 from December to January, while hot rolled prices have risen $165 per ton since late-December.

Zinc and Aluminum

Zinc, used to make galvanized and other products, had steadily risen since March 2020, reaching an 18-month high on Jan. 7 (Figure 8). The LME cash price per pound of zinc as of Feb. 3 was $1.1529, up 40 percent from the mid-March low of $0.8236. The price of zinc factors into the coating extras charged by the mills for galvanized products. Many mills revised their coating extras upwards in December to reflect the higher zinc price. Aluminum prices, which factor into the price of Galvalume, have been trending upwards over the last few months. Note that aluminum prices often have large swings and return to typical levels within a few days, as seen in the graphic below. The LME cash price per pound of aluminum was $0.8906 as of Feb. 2, and has been hovering around $0.90 since late-November 2020.