Market Data

January 21, 2021

Steel Mill Negotiations: Mills Still in Control

Written by Tim Triplett

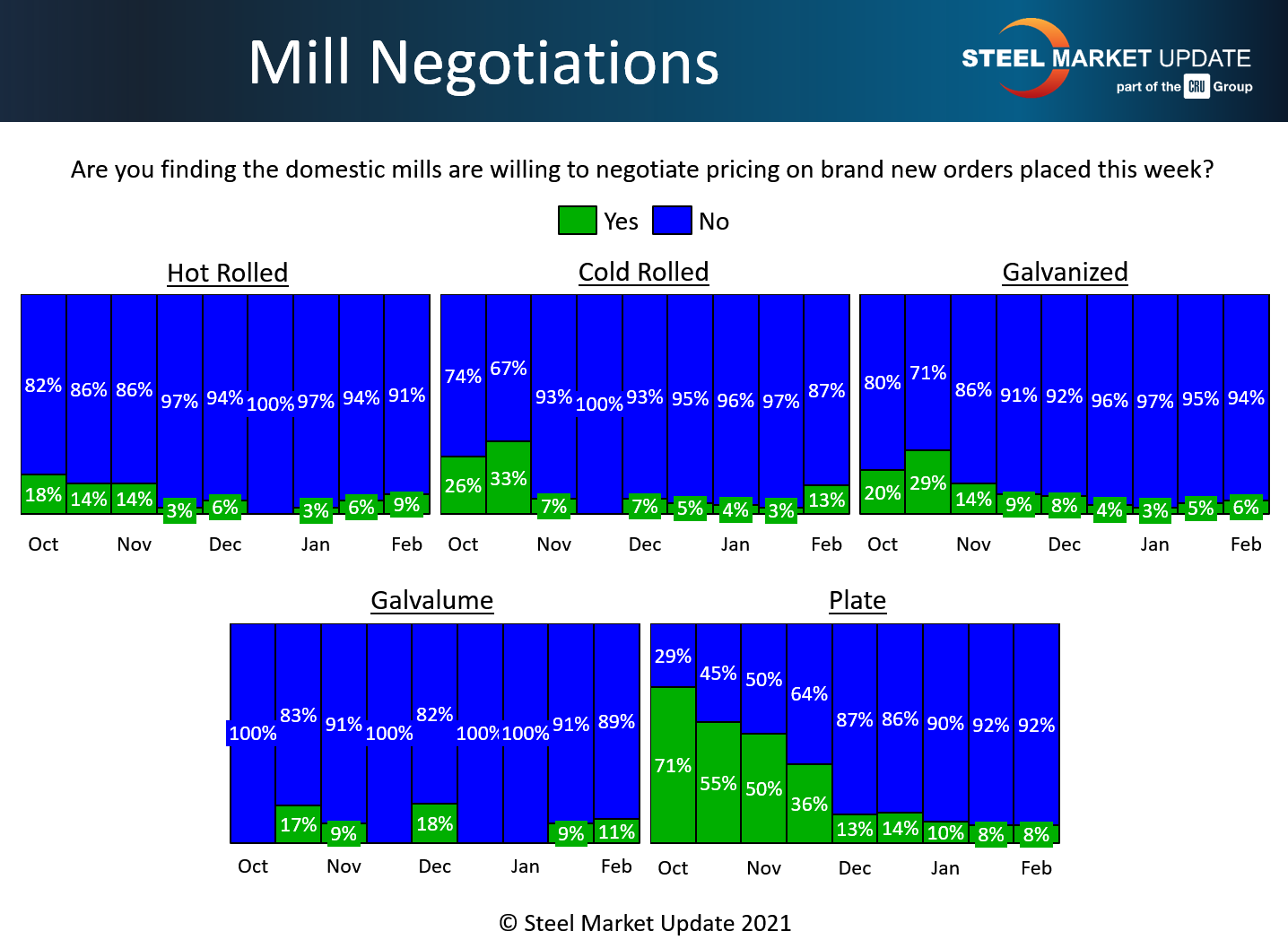

With one month of the new year in the record books, steel demand continues to outpace supplies, leaving the mills in a dominant negotiating position. Roughly nine out of 10 buyers responding to Steel Market Update’s questionnaire this week reported that their mill reps are unwilling to talk price on virtually all flat rolled and plate steel products.

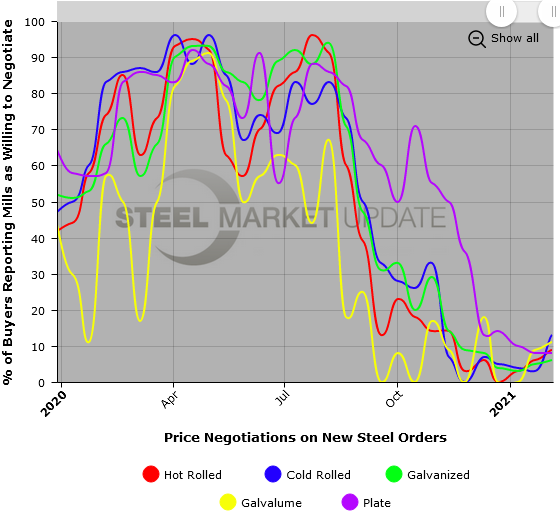

Steel has been a seller’s market for nearly six months, dating all the way back to September based on SMU’s data, and there are no signs yet of that changing. “I believe we are 20-30 days away from mills beginning to negotiate,” commented one manufacturing executive.

SMU’s latest check of the market puts the average hot-rolled coil price at $1,150 per ton ($57.50/cwt)–up $10 per ton from last week and marking a new all-time high for U.S. HRC prices for the fourth consecutive week. Leading analysts predict a correction is imminent in the weeks ahead as added mill capacity and the arrival of imports increases supplies enough to ease the pressure on availability. Until that happens, the mills will continue to control price negotiations.

Note: These negotiations are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. To see an interactive history of our Negotiations data, visit our website here.

By Tim Triplett, Tim@SteelMarketUpdate.com