Prices

January 12, 2021

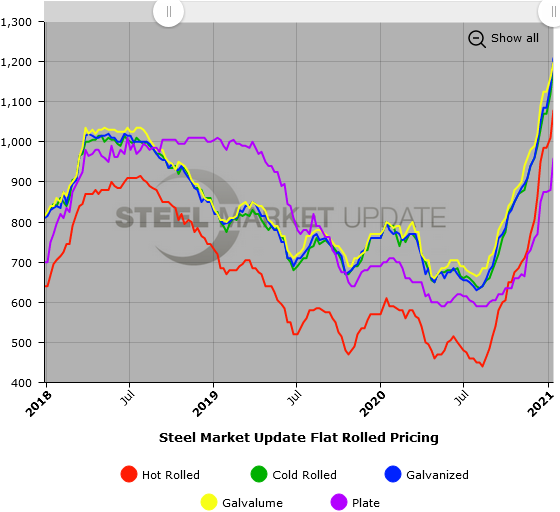

SMU Price Ranges & Indices: Hot Rolled Hits a New High

Written by Brett Linton

The benchmark price for hot rolled steel reached a new record high of $1,080 per ton this week, according to Steel Market Update’s latest check of the market, surpassing the previous high of $1,070 per ton recorded by SMU in 2008. Prices for flat rolled and plate steel products jumped by another $40-80 per ton in the past week as steel demand continued to outstrip supplies and spot market tons remained scarce. Steel prices are difficult to assess given the tight market conditions with relatively few non-contract transactions taking place. Consider that it won’t be until sometime later this year that mills bring new steelmaking capacity online. Imports remain limited by strong markets overseas and restrictive tariffs in the U.S. And demand is fairly robust despite the pandemic’s effects on the economy. Without an increase in production/imports or a decrease in consumption to bring supply and demand more in balance, prices could rise even further in the coming weeks. Steel Market Update’s Price Momentum Indicators remain pointed toward higher steel prices in the next 30-60 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,030-$1,130 per net ton ($51.50-$56.50/cwt) with an average of $1,080 per ton ($54.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $40 per ton compared to one week ago, while the upper end increased $100. Our overall average is up $70 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 6-10 weeks

Cold Rolled Coil: SMU price range is $1,140-$1,240 per net ton ($57.00-$62.00/cwt) with an average of $1,190 per ton ($59.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to last week, while the upper end increased $80. Our overall average is up $70 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 7-12 weeks

Galvanized Coil: SMU price range is $1,180-$1,240 per net ton ($59.00-$62.00/cwt) with an average of $1,210 per ton ($60.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $80 per ton compared to one week ago, while the upper end increased $60. Our overall average is up $70 from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,249-$1,309 per ton with an average of $1,279 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 8-13 weeks

Galvalume Coil: SMU price range is $1,180-$1,220 per net ton ($59.00-$61.00/cwt) with an average of $1,200 per ton ($60.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to last week, while the upper end increased $20. Our overall average is up $40 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,471-$1,511 per ton with an average of $1,491 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-12 weeks

Plate: SMU price range is $900-$1,020 per net ton ($45.00-$51.00/cwt) with an average of $960 per ton ($48.00/cwt) FOB delivered to the customer’s facility. The lower end of our range increased $50 per ton compared to one week ago, while the upper end increased $110. Our overall average is up $80 from last week. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 6-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.