CRU

January 8, 2021

CRU: U.S. Mills Earning Massive Margins in Historically Strong Bull Market

Written by Josh Spoores

By CRU Principal Analyst Josh Spoores, from CRU’s Steel Sheet Products Monitor

Sheet prices in the U.S. Midwest market have not only continued to rise, but the m/m gains have come so fast that our second Wednesday price assessment completely skipped the $900 /s.ton level. Our Jan. 12 price assessment for HR coil is $1,044 /s.ton, a m/m increase of $199 /s.ton. HR coil prices have now risen by $607 /s.ton since the recent low in August, a gain of 139%.

Due to these higher prices and our own forecast of integrated steelmaking costs from our Steel Cost Review, domestic steel mills are earning historically high margins. For 2021 Q1, integrated mill margins on HR coil are estimated at $450 /s.ton, which is slightly higher than margins earned from May through July 2008. Further, in just this one quarter, mills will earn nearly two years’ worth of margins from the 2010-2017 period.

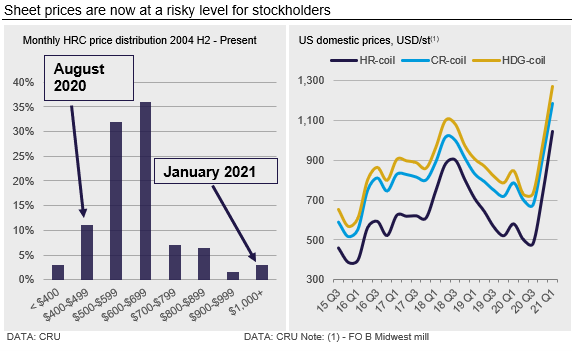

Margins are at historically high levels because prices are at a historical extreme. Our second Wednesday price assessment for HR coil is the price that we have assessed now for 41 years. The accompanying chart displays the distribution of this price from July 2004 onwards in nominal terms.

When looking at the distribution of nominal monthly prices since 2004, we see just how unprecedented prices at their current level are (see chart). Over the past 200 months, 68% of the time, HR coil has been between $500 and $699 /s.ton. Prices over $1,000 represent only 3% of the price assessments. In 2008, HR coil prices were higher than $1,000 /s.ton for five months. In 2021, our Jan. 12 price assessment is the first time in nearly 13 years that our monthly HR coil price assessment is back above $1,000 /s.ton.

U.S. West Coast buyers continue to see growth in customer demand, although not at a level commensurate with increasing mill prices. As the mills continue to tightly control their order entry, some buyers have been forced to fill inventory shortages with material from other service centers. There is hope that when California Steel Industries opens its April book next week, it will have more volume to offer since the resolution of the Brazilian slab quota issue.

Mexican sheet prices have increased this month to reach the highest level seen since we started our coverage in August 2017. Mexican HR coil spot prices increased by around 30% m/m and CR coil prices are up by 25% m/m. The increase was supported by higher prices in the U.S. Midwest market and tight supply in the spot market in Mexico. Local mills are focused on deliveries of contracted material keeping some distributors short of material. Production is expected to increase with the resumption of an idled BF at AHMSA, which is expected to occur before the end of 2021 Q1. A new strategic plan for AHMSA is soon to be announced following the closure of the deal with Villacero, and considering the good demand conditions and prices, market participants believe the plan will include the resumption of the BF and production optimization.

Outlook: Beware the Mean Reversion

The 2008-09 price cycle was unique, yet so is the current cycle as buying activity at the mills remains higher than available supply. Due to this, HR coil prices have risen at the fastest pace in history from this past August through November before making an even sharper move higher.

As the monthly price distribution chart shows, prices at this level will not last and a correction is coming. We expect prices to fall back and are looking for evidence to understand when this correction may take place. We do see evidence of supply availability increasing, yet still high demand from buyers has continued to support prices. We do suspect that some portion of mill orders represents orders for inventory rather than immediate needs. Adding to this, we have buyers telling us of increased import orders as well. Though the volume of inventory orders and imports may be low, when viewed in combination with increased availability of supply at the mills, it will inevitably lead to a price peak. We continue to expect a peak in 2021 Q1 when lead times are in 2021 Q2. The availability of supply at mills will increase due to a combination of new and restarted production and a slower, yet still positive demand rebound. One risk remains any further disruption from Covid-19, though this may be both an upside as well as downside risk.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com