Market Data

December 28, 2020

SMU Market Trends: Buyers Finish 2020 in a Positive Position

Written by Tim Triplett

Looking back at the past year, 2020 was not the disaster many in the steel industry had feared. And looking ahead, 2021 appears even more promising, say OEM and service center executives polled by Steel Market Update last week.

Despite an economy that struggled with the COVID pandemic, as well as civil unrest and an acrimonious election, steel prices soared. Two out of three respondents to SMU’s poll said 2020 was comparable, if not better, than 2019 for their business.

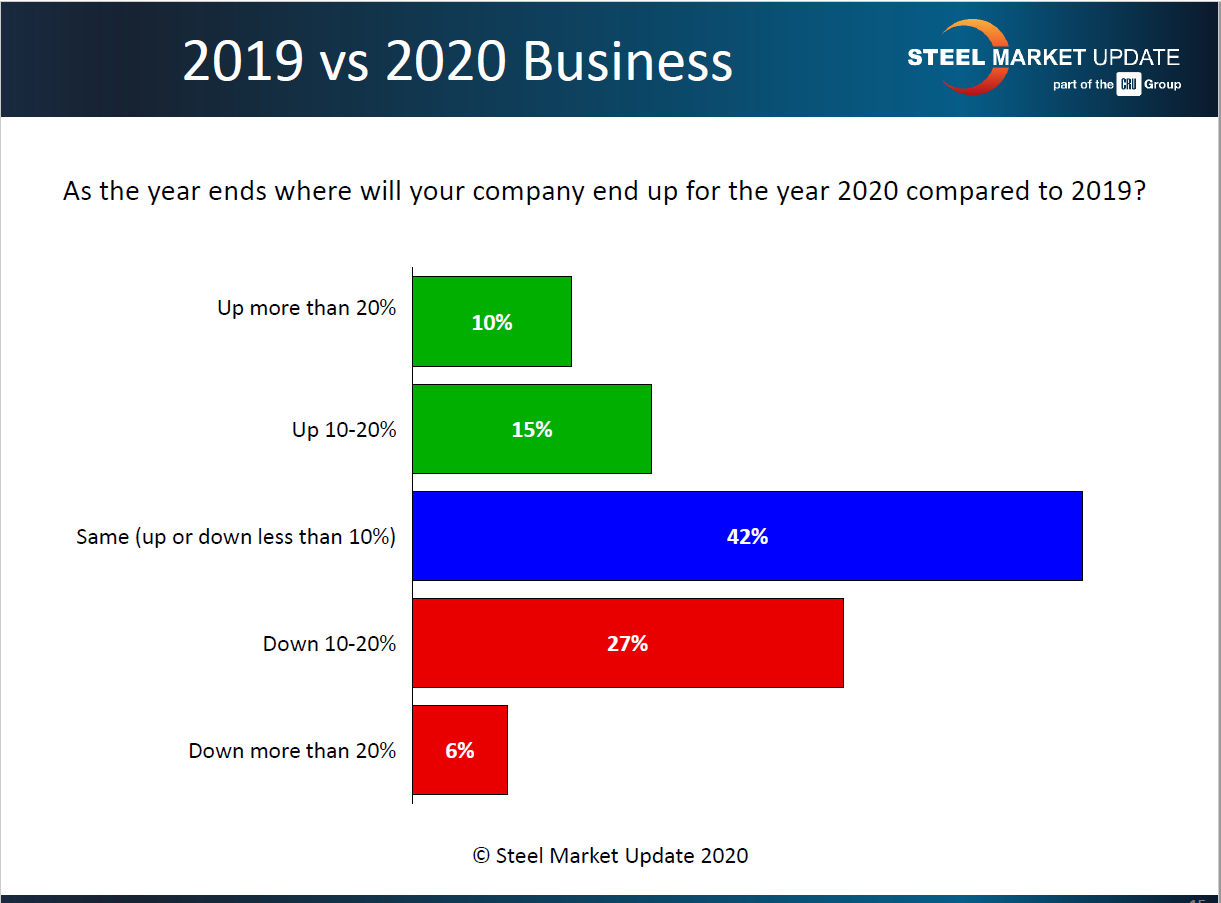

SMU asked: Where will your company end up for the year 2020 compared with 2019?

For the largest group of respondents (42 percent), 2020’s results are not that different from 2019’s, up or down within a 10 percent range—a satisfactory outcome that would have appeared unlikely during the darkest months of the coronavirus. As one executive commented, “Total sales will be very similar in both years, which is amazing considering the drop we saw in March and April.”

For about 25 percent of the service centers and OEMs responding to SMU’s poll, 2020 was actually a growth year, up 10 to more than 20 percent. Only about one-third expected to end the year behind 2019. As several noted, sales volumes may have been down, but profits were up due to the high steel prices.

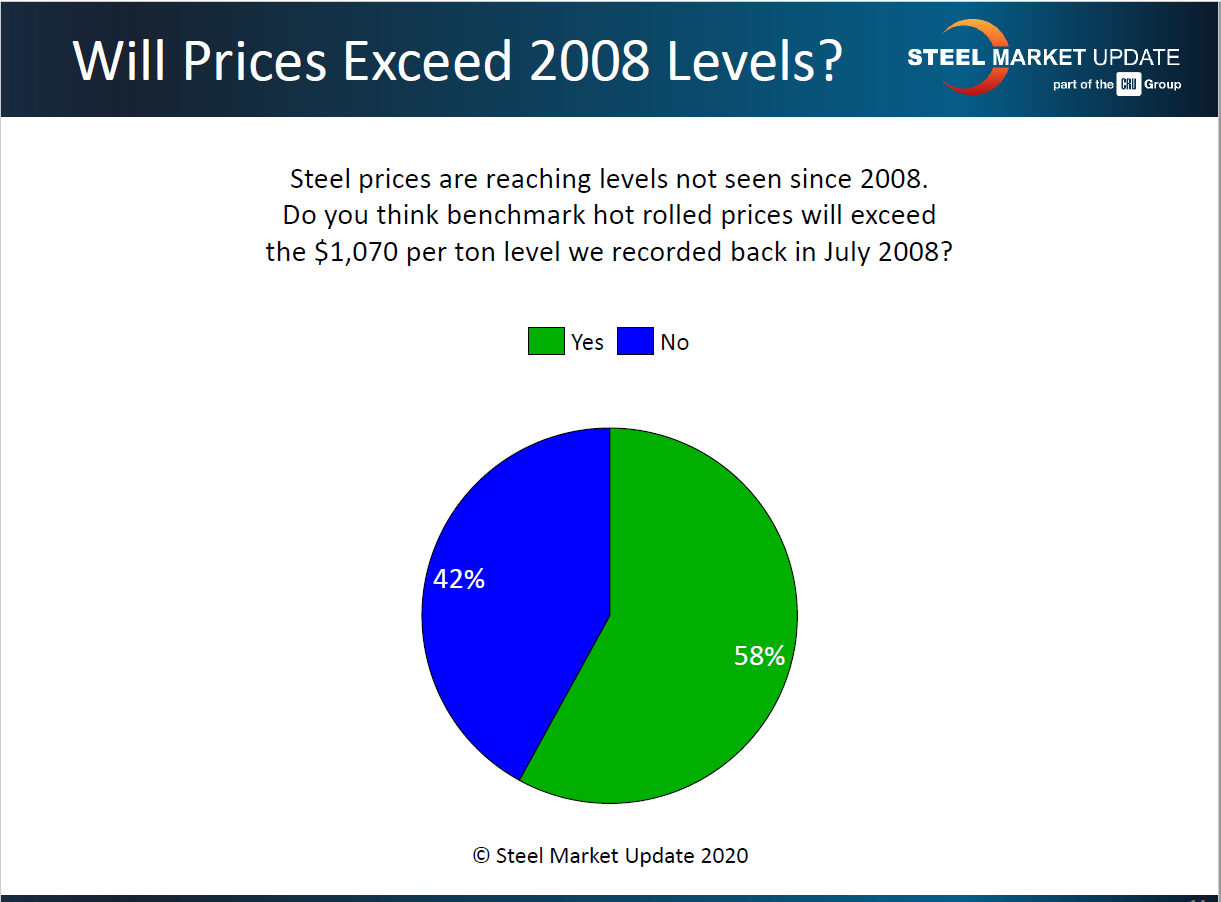

Steel Price Prediction

Steel prices have been on a sharp upward trajectory, more than doubling since August as demand has continued to exceed supplies. The majority of steel buyers (58 percent) responding to SMU’s questionnaire believe benchmark hot rolled prices, now near $1,000 a ton, will exceed the $1,070 level recorded back in July 2008.

“Lots of drivers are pointing toward upward mobility in price—demand is outpacing supply, raw material costs and global prices are up, imports are low. HR could top $1,100,” said one service center exec. “Supply is limited. Spot lead time (if any tons are available) is out to March or April,” said another respondent. “All bets are off now. Raw materials (iron ore and scrap) are spiking. We will soon see new records. What goes up will eventually come down, but later than sooner next year,” predicted a third buyer.

Nevertheless, a significant percentage foresee an end to the uptrend. As one exec commented: “Demand is slowing and the mills will start eating into their backlogs in the next 30-45 days.”

Forecast for 2021?

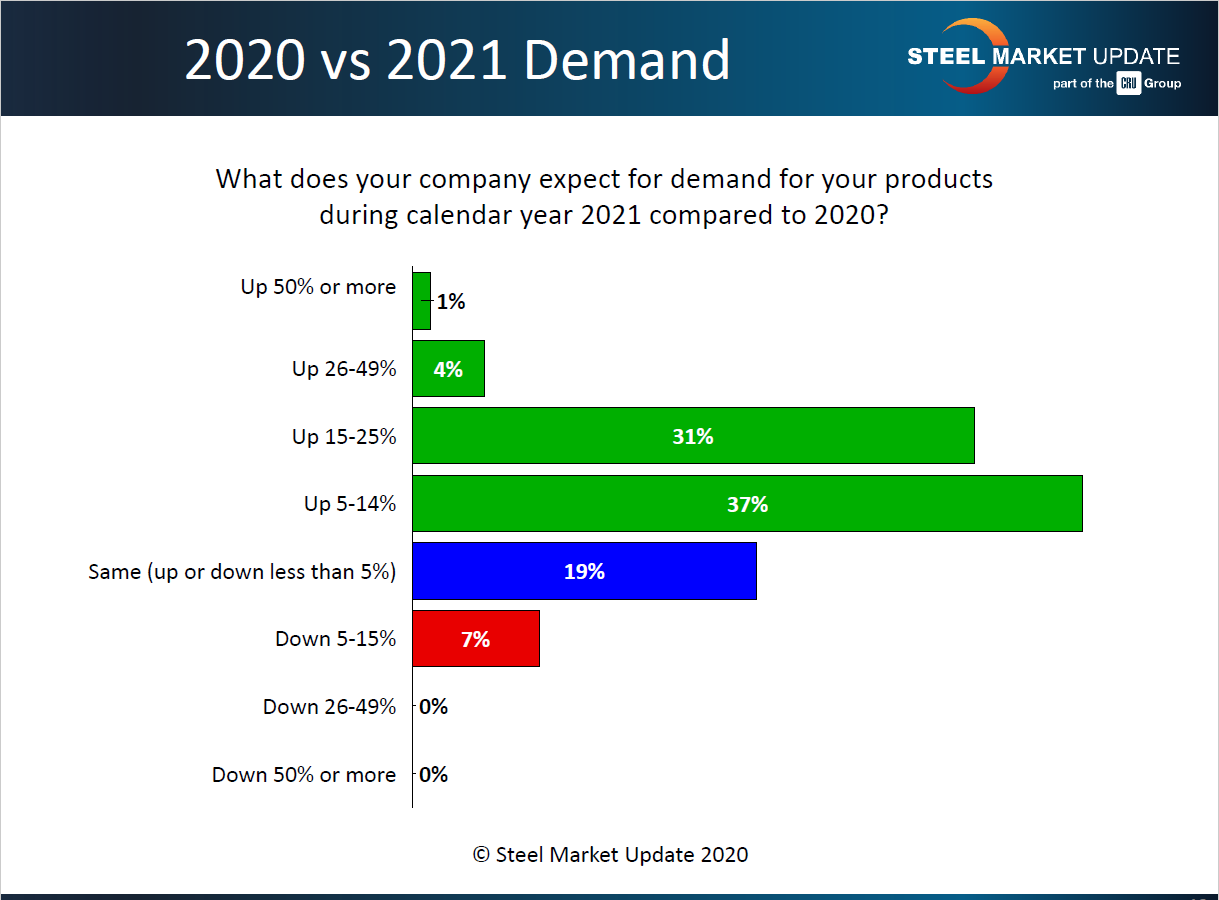

SMU also asked: What does your company expect for demand in 2021 versus 2020?

Looking ahead to 2021, roughly three-fourths of buyers forecast that demand will improve by a weighted average of around 17 percent. Of the other 26 percent who expect demand to be the same or lower, the downturn is expected to average less than 5 percent.

“I think demand will be up. It may be the roaring 20’s all over again,” commented one exec. “It’s hard to predict with the year-over-year comps exploding in the second half this year,” noted one servicd center. “I’m concerned with the industrial/commercial/institutional/government sectors of construction being down. But our OEM business continues to look strong,” said another.