CRU

December 17, 2020

CRU: Scrap Prices Surge on Stronger Steel Markets

Written by Chris Asgill

By CRU Principal Analyst Chris Asgill, from CRU’s Global Steel Trade Service

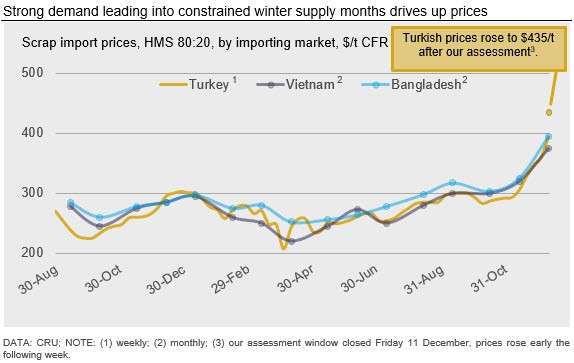

Scrap prices have surged over the past month, with import prices up $50-90 /t m/m. Turkish prices have gained the most significant ground, though were below Asian prices a month ago. At the time of our assessment last week Turkish prices were approaching $400 /t CFR, but prices have moved still higher this week and at the time of writing we heard deals reaching $435 /t CFR.

While a range of factors are driving the increase, ferrous prices, from iron ore to steel, have surged in recent weeks. Steel prices are up sharply as demand continues to recover from the lows of the pandemic, while steelmaking capacity has not restarted at a similar pace. As producers look to restart capacity or ramp up utilization of operating capacity to meet this rise in steel demand, this has driven up demand for inputs such as scrap.

The gains in demand for scrap have come at a time when the market tends to tighten seasonally due to winter weather limiting supply in the Northern Hemisphere. This means that less material is available for export from the key supply markets of the USA, Europe, Japan and Russia. As domestic demand is also now rising in these markets, competition between domestic mills in these markets and mills elsewhere for scrap volumes has become intense.

Gains in iron ore prices cannot go unmentioned, with prices for this material tipping $160 /t CFR China for 62% Fe ore late last week. This has been primarily driven by strong demand from China and elsewhere, with added boosters over recent weeks from several supply-side issues. Steel margins have nevertheless increased rapidly amid strong demand, in turn enabling steel producers to pay more for scrap to secure supply.

Outlook: Winter Supply Constraints and Strong Demand Will Support Further Price Gains

Domestic scrap prices are expected to continue rising in January. Winter weather will impede supply in the Northern Hemisphere as it does each year. Additionally, demand this year is on a stronger upward path than is typical given the recovery from the lows of the pandemic. Consequently, while there have already been significant gains in December, the stage is set for another round of increases next month. That said, we do not expect prices to rise at the same pace, rather increasing in the more modest range of around $40 /t m/m for domestic prices in export markets. Import prices are expected to extend higher again as competition for material with domestic mills and high freight costs remain in place; both Asian and Turkish scrap import prices are expected to rise to around $460 /t CFR in January.

What comes after this is a point for discussion: do steel and scrap markets continue on what could be viewed as an inexorable rise or does a crash follow imminently? One thing is for certain, a drop in prices will come; it always does. The size of the drop will depend on how overbought steel and scrap prices get. The timing will be driven by a combination of the sustainability of the current demand recovery and the pace at which steelmakers are willing and able to restart or bring capacity online. The demand recovery seems reasonably resilient, though steel margins currently on offer indicate that steelmakers will hasten any possible increases in production. This suggests that if the price fall is not in February, it will follow shortly thereafter. This interplay for demand and supply, be it for steel or scrap, is the core reason why price rallies of this magnitude never last for long.

While seasonality has to a degree been thrown out of the window this year, seasonal factors cannot be ignored. Scrap prices in all the key markets we assess have fallen m/m in virtually every February since 2009, with only three exceptions: 2010, 2013 and 2019. In 2010, domestic prices for exporters rose, while import prices fell. Then, China was a large importer of scrap and volumes were falling back, while scrap demand in Turkey and Asia was easing. In 2013, it was the opposite as key domestic markets were weaker (n.b. except for Japan), while demand was picking up for importers. In 2019, all prices rose strongly following the tragic tailings dam incident in Brazil. Demand is rising in all markets currently, so there is support on this side, though prices at current levels will also stimulate a lot of scrap supply. The one wildcard for ongoing upward price momentum in 2021 Q1 and Q2 may be how quickly and extensively China allows scrap imports again.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com