Steel Products Prices North America

CRU: U.S. Prices Rise at Fastest 3-Month Rate Ever

Written by Josh Spoores

November 3, 2020

By Principal Consultant Josh Spoores, from CRU’s Steel Sheet Products Monitor

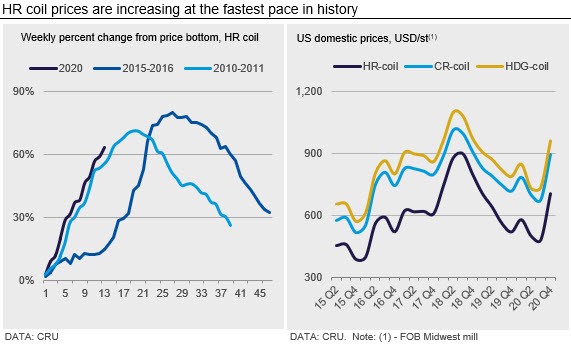

North American sheet prices have continued to surge after bottoming this past August. For HR coil, prices have been assessed at $712 /s.ton. Since Aug. 12, these prices have gained $237 /s.ton, or 63%. This is the fastest percent gain over three months in CRU’s 41 years of steel price assessments.

Sheet prices continue to rise alongside improved underlying demand gains. While the automotive market remains the primary post-lockdown driver of sheet consumption, other markets are also showing YTD increases, based on September data. Residential construction has been strong with new home starts up 5.5% YTD and private residential construction spending is up 7.8% YTD. Appliance sales have followed this uptrend in construction as new orders are up 3.7% YTD, yet new orders for fabricated metal products and machinery are down 5.5 and 4.1 % YTD, respectively.

Based on the weekly AISI report of raw steel production, mill capacity utilization has now surpassed 70%. Yet, for sheet products, mills continue to run near their physical limits. With HR coil prices at $712 /s.ton, mills are now able to achieve historically high gross margins. The only limitation to mill profitability today is the fact that approximately 7 million tons of BF-based production in the U.S. and Canada remains offline, much to the chagrin of key end users.

There were two recent periods where HR coil prices surged nearly as fast as the current rate. These were the post-GFC period of 2010 Q4 through 2011 Q1 and the 2016 period, which came after the 2014-15 OPEC-led oil market crash. In those instances, demand at the mills was driven by increased end demand as well as a need to rebuild inventories. At the start of those price cycles, sheet imports arriving at the U.S. market were below trend and foreign prices were not attractive versus domestic prices. Like now, the end result was increased demand at domestic mills.

However, some market participants are now signaling that foreign steel is becoming more attractive in terms of both prices and lead times, especially for CR and coated sheet. Some buyers have taken a serious look at foreign steel simply as a means to de-risk their supply from domestic producers that are slow to restart capacity. Though global prices have started to increase at a faster rate, buyers may be more concerned about maintaining supply rather than having their supply dependent upon the latest mill production issue.

U.S. West Coast mills, USS-Posco and California Steel Industries, have both closed their January order books after strong sales. Import offers from Vietnam and Korea have been described as comparable to U.S. mills on price and delivery. Demand is continuing to improve in the construction market and companies are reporting increased activity due to virus mitigation efforts, like mobile hospital units and medical equipment.

In Mexico, sheet prices have increased to their highest level since September 2018, with HR coil up by around 6% m/m and CR coil by 4% m/m. The price increase is reflecting better underlying demand, tightness in supply and higher prices in the U.S. market. According to INEG, light vehicle production in Mexico increased by around 9% y/y in October, to 348,000 units. Meanwhile, the construction sector has been supported by infrastructure projects and housing construction, yet it remains far from pre-Covid levels. Like the U.S., production of flat products has been increasing since the June lows, but remains lower y/y.

Outlook: Seasonal Demand Weakness and Rebound in Pandemic to Weigh on Near-Term Price Trend

For the near-term price trend, we expect that domestic prices will peak over the next several weeks. This expectation is based on seasonal demand weakness emerging in some markets while underlying demand gains downshift to a slower speed. Inventory building in various industries may continue to offset some of this coming weakness. Additionally, we expect import arrivals to rise over the next few months.

Lastly, while vaccines continue to make amazing progress, the pandemic is far from over and is, in fact, getting worse. We expect the rebound in economic growth to slow as lockdowns re-emerge, whether they come from government-led directives or simply consumers pulling back as case counts surge. Gains in steel demand are dependent on improved economic and employment activity. Today, Covid-19 remains a downside risk, especially as the political environment is not addressing any new support or stimulus.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com

Josh Spoores

Read more from Josh SpooresLatest in Steel Products Prices North America

Nucor slows HRC price climb with $5/ton increase

After eight weeks of double-digit price increases on hot-rolled (HR) coil, Nucor slowed the price rise this week with an increase of $5 per short ton.

Domestic CRC prices surge ahead of imports

The price spread between stateside-produced CR and imports reached its widest margin in over a year.

Evraz raises plate prices $160/ton

Evraz North America (NA) has followed Nucor and SSAB with a plate price increase of its own: up $160 per short ton (st). The increase was effective immediately for all new orders of carbon, high-strength low-alloy, and normalized and quenched-and-tempered plate products, as well as for hot-rolled coil, the steelmaker said in a letter to […]

Nucor lifts HR coil to $820/ton

Nucor has increased its consumer spot price (CSP) for hot-rolled (HR) coil for a fourth consecutive week.

Nucor pushes HR spot price to $790/ton

Nucor increased its consumer spot price (CSP) for hot-rolled (HR) coil to $790 per short ton (st) on Monday, Feb. 10 – a $15/st bump vs. last week. The Charlotte, N.C.-based company has raised its weekly CSP by $40/st over the past three weeks after maintaining tags at $750/st since Nov. 12, according to SMU’s […]